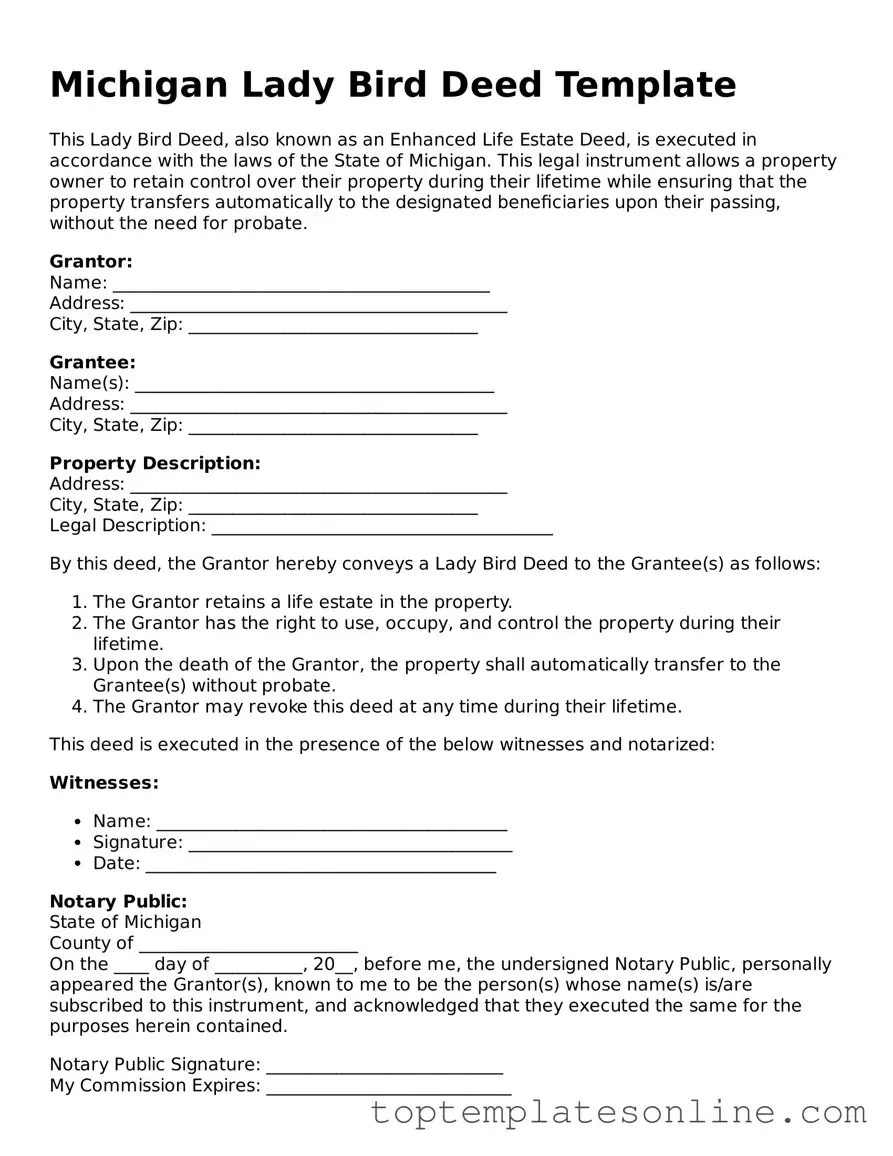

Blank Lady Bird Deed Template for Michigan State

In the realm of estate planning, the Michigan Lady Bird Deed has gained attention for its unique ability to facilitate the transfer of property while providing significant benefits to property owners and their heirs. This specific type of deed allows individuals to retain control over their property during their lifetime, ensuring they can continue to live in and manage their home. When the property owner passes away, the deed automatically transfers ownership to the designated beneficiaries without the need for probate, streamlining the process and reducing potential costs. Furthermore, the Lady Bird Deed offers protection against creditors, as the property is not considered part of the deceased's estate. This form is particularly advantageous for those looking to maintain their property’s value while simplifying the transfer process for their loved ones. As a result, understanding the intricacies of the Michigan Lady Bird Deed is essential for anyone considering estate planning options that prioritize both personal control and a smooth transition of assets.

Some Other State-specific Lady Bird Deed Templates

What Is a Lady Bird Deed in Nc - The owner can sell or mortgage the property without restrictions placed by the deed.

When engaging in various activities or agreements, securing a Hold Harmless Agreement is essential for minimizing legal exposure. This form not only clarifies responsibilities but also ensures that parties can operate confidently, free from the burden of liability for unforeseen incidents. For more detailed information on this important document, you can visit newyorkform.com/free-hold-harmless-agreement-template, which provides valuable resources and templates.

Printable Life Estate Deed Form - This form may help expedite access to real estate for beneficiaries without legal obstacles.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. The legal description should be clear and precise. Using vague terms or incorrect addresses can lead to confusion and complications in the future.

-

Not Including All Necessary Parties: It's essential to ensure that all relevant parties are included in the deed. If there are multiple owners or beneficiaries, omitting anyone can create disputes later on. Each person's name should be listed correctly to avoid any legal issues.

-

Improper Execution: The Lady Bird Deed must be signed and dated correctly. Failing to have the necessary witnesses or notary can invalidate the deed. It’s crucial to follow Michigan’s requirements for execution to ensure the deed is legally binding.

-

Neglecting to Record the Deed: After filling out the form, some individuals forget to file the deed with the appropriate county register of deeds. Recording the deed is a vital step that protects the interests of the beneficiaries and ensures the transfer is recognized legally.

Guide to Writing Michigan Lady Bird Deed

Once you have the Michigan Lady Bird Deed form ready, it’s important to fill it out accurately to ensure that it serves its intended purpose. Follow these steps carefully to complete the form.

- Begin by entering the name of the property owner(s) in the designated section. Make sure to include full legal names as they appear on the property title.

- Next, provide the address of the property. This should include the street number, street name, city, state, and ZIP code.

- In the next section, list the name(s) of the intended beneficiary(ies). These are the individuals who will receive the property upon the owner's passing.

- Specify the relationship of the beneficiary(ies) to the property owner(s). This can include terms like spouse, child, or friend.

- Fill in any additional information requested, such as the percentage of ownership if there are multiple beneficiaries.

- Review the form for accuracy. Double-check all names, addresses, and relationships to ensure everything is correct.

- Sign and date the form in the appropriate areas. The signature should match the name provided at the top of the form.

- Have the form notarized. This step is crucial for the document to be legally binding.

- Finally, file the completed deed with the county register of deeds where the property is located. Keep a copy for your records.

Documents used along the form

The Michigan Lady Bird Deed is a unique legal instrument that allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. When using this deed, several other forms and documents may be necessary to ensure a smooth transfer of property and to address related legal matters. Below is a list of commonly associated documents.

- Warranty Deed: This document guarantees that the grantor has clear title to the property and can legally transfer it. It offers protection to the grantee against any future claims on the property.

- Quit Claim Deed: This form is used to transfer ownership without any guarantees about the title. It is often used between family members or in divorce settlements.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal or financial matters. It can be useful for managing property or executing the Lady Bird Deed if the owner is unable to do so.

- Address NYCERS Form: This document is crucial for members of the New York City Employees Retirement System to keep their address updated, ensuring they receive vital communications and benefits. For detailed guidance, you can refer to the NY Templates.

- Affidavit of Heirship: This document establishes the heirs of a deceased person. It can help clarify ownership and facilitate the transfer of property after someone's passing.

- Trust Agreement: If the property is part of a trust, this document outlines the terms of the trust and how the property should be managed and distributed.

- Estate Planning Documents: These include wills and living trusts that outline how a person's assets should be distributed upon their death. They work in conjunction with the Lady Bird Deed to ensure that property is handled according to the owner's wishes.

- Property Tax Exemption Form: In Michigan, certain property transfers may qualify for tax exemptions. This form helps ensure that beneficiaries can take advantage of any available tax benefits.

Using these documents in conjunction with the Michigan Lady Bird Deed can help facilitate a seamless transfer of property and clarify ownership rights. It is advisable to consult with a legal professional to ensure all necessary forms are completed accurately and filed appropriately.