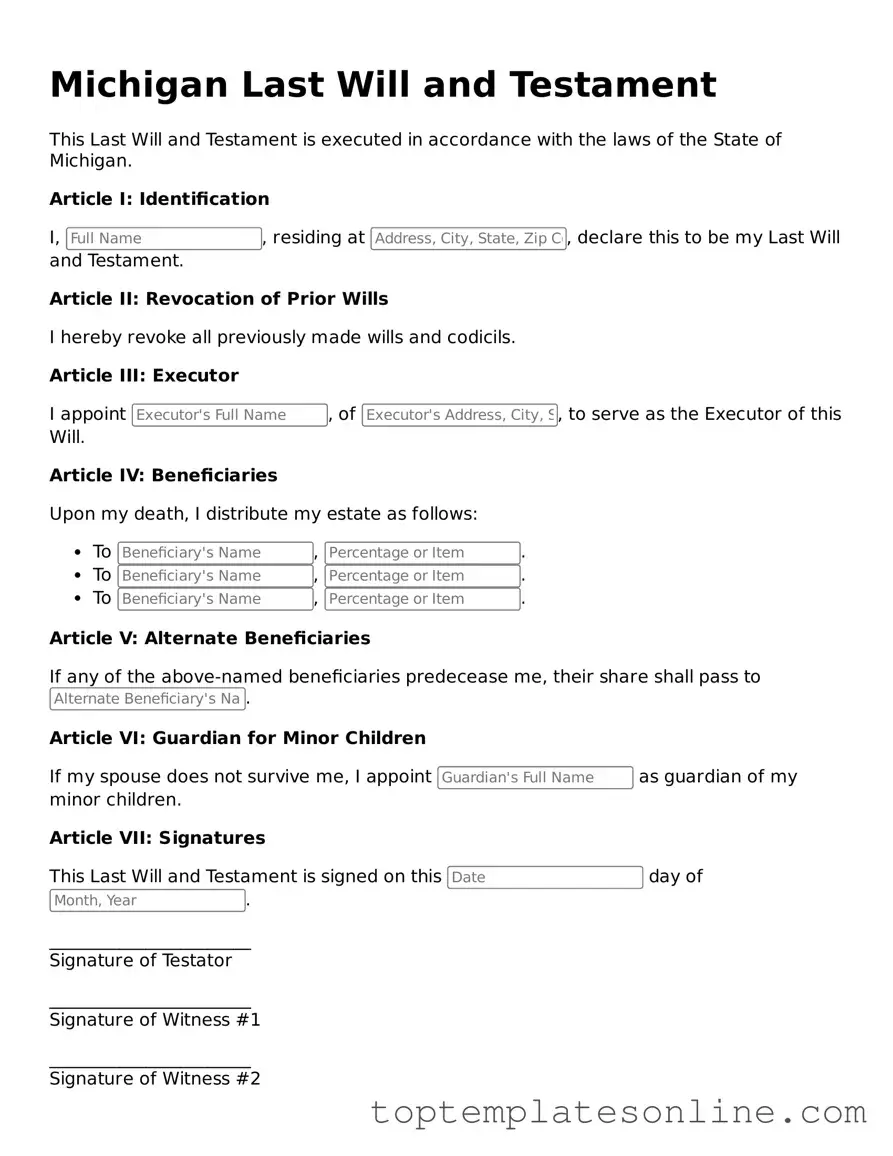

Blank Last Will and Testament Template for Michigan State

Creating a Last Will and Testament is a vital step in ensuring that your wishes are honored after your passing. In Michigan, this legal document serves several important functions. It allows individuals to specify how their assets will be distributed among beneficiaries, appoint guardians for minor children, and name an executor to manage the estate. The form must be completed with attention to detail, as it requires the testator's signature, the date, and the signatures of at least two witnesses. These witnesses must not be beneficiaries, ensuring that the process remains fair and transparent. Additionally, a Michigan Last Will and Testament can be revoked or amended at any time, providing flexibility as life circumstances change. Understanding these key aspects can help individuals navigate the process with confidence and peace of mind.

Some Other State-specific Last Will and Testament Templates

Last Will and Testament Template New York Pdf - Can alleviate the emotional burden on family members by providing clear guidance for the future.

When entering into various agreements, it is crucial to understand the implications of a Hold Harmless Agreement, which serves as a safeguard for parties involved by eliminating potential legal liabilities associated with specific risks. For those interested in crafting such a document, a valuable resource can be found at https://newyorkform.com/free-hold-harmless-agreement-template/, ensuring that all necessary details are addressed effectively.

Will Template Georgia - May outline preferences for trusts if complete asset management is desired.

Common mistakes

-

Not Clearly Identifying the Testator: One common mistake is failing to clearly state who is creating the will. The document should start with the full name and address of the person making the will, known as the testator.

-

Inadequate Witness Signatures: Michigan law requires that a will be signed in the presence of at least two witnesses. People often overlook this requirement, which can lead to the will being deemed invalid.

-

Not Revoking Previous Wills: If someone creates a new will but does not revoke any previous ones, confusion may arise. It’s important to clearly state that the new will revokes all prior wills.

-

Vague Language: Ambiguity can lead to disputes among heirs. Using clear and specific language about assets and beneficiaries is crucial to avoid misinterpretation.

-

Failing to Update the Will: Life changes, such as marriage, divorce, or the birth of children, should prompt a review and potential update of the will. Many forget this important step.

-

Not Including a Residual Clause: A residual clause addresses what happens to any assets not specifically mentioned in the will. Omitting this can leave assets in limbo.

-

Overlooking Digital Assets: In today’s digital age, people often forget to include digital assets like online accounts or cryptocurrencies. These should be addressed in the will to ensure proper distribution.

-

Not Storing the Will Properly: After completing the will, it’s essential to store it in a safe place. Many people leave it in a location that is not easily accessible, which can complicate matters after their passing.

Guide to Writing Michigan Last Will and Testament

Once you have the Michigan Last Will and Testament form in hand, you’re ready to fill it out. This document is essential for outlining your wishes regarding your assets and beneficiaries. Taking your time with each section will ensure clarity and precision.

- Begin by entering your full name at the top of the form. Make sure it matches your legal name.

- Next, provide your current address. This helps to establish your residency.

- State your date of birth. This information is important for identifying you.

- Designate an executor. This person will be responsible for carrying out the terms of your will. Include their full name and address.

- List your beneficiaries. These are the individuals or organizations who will receive your assets. Include their names and relationships to you.

- Detail your assets. Clearly describe what you own, including property, bank accounts, and personal items. Specify who receives each asset.

- Include any special instructions. If there are particular wishes regarding your funeral or the care of dependents, write them down.

- Sign and date the document. Your signature indicates that you understand and agree to the contents of the will.

- Have the document witnessed. Michigan law requires at least two witnesses. They should sign the will in your presence.

- Consider having the will notarized. While not required, this can add an extra layer of authenticity.

After completing these steps, store your will in a safe place. Inform your executor and trusted family members about its location. This ensures that your wishes are honored when the time comes.

Documents used along the form

The Michigan Last Will and Testament is a crucial document for outlining an individual's wishes regarding the distribution of their assets after death. However, several other documents complement this form to ensure a comprehensive estate plan. Below is a list of five additional forms and documents that are often used alongside the Last Will and Testament in Michigan.

- Durable Power of Attorney: This document allows an individual to designate someone else to make financial and legal decisions on their behalf if they become incapacitated.

- Healthcare Power of Attorney: This form grants a trusted person the authority to make medical decisions for an individual if they are unable to do so themselves.

- Living Will: A living will outlines an individual’s preferences regarding medical treatment and end-of-life care, specifically in situations where they cannot communicate their wishes.

- Revocable Trust: This trust allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death, avoiding probate.

- ATV Bill of Sale: A crucial document for transferring ownership of an all-terrain vehicle, including buyer and seller information, vehicle description, and sale price. For a template, visit NY Templates.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, require specific beneficiary designations to ensure they are passed directly to the named individuals without going through probate.

Utilizing these documents in conjunction with the Michigan Last Will and Testament can provide clarity and security regarding an individual's wishes and ensure that their estate is managed according to their preferences.