Blank Operating Agreement Template for Michigan State

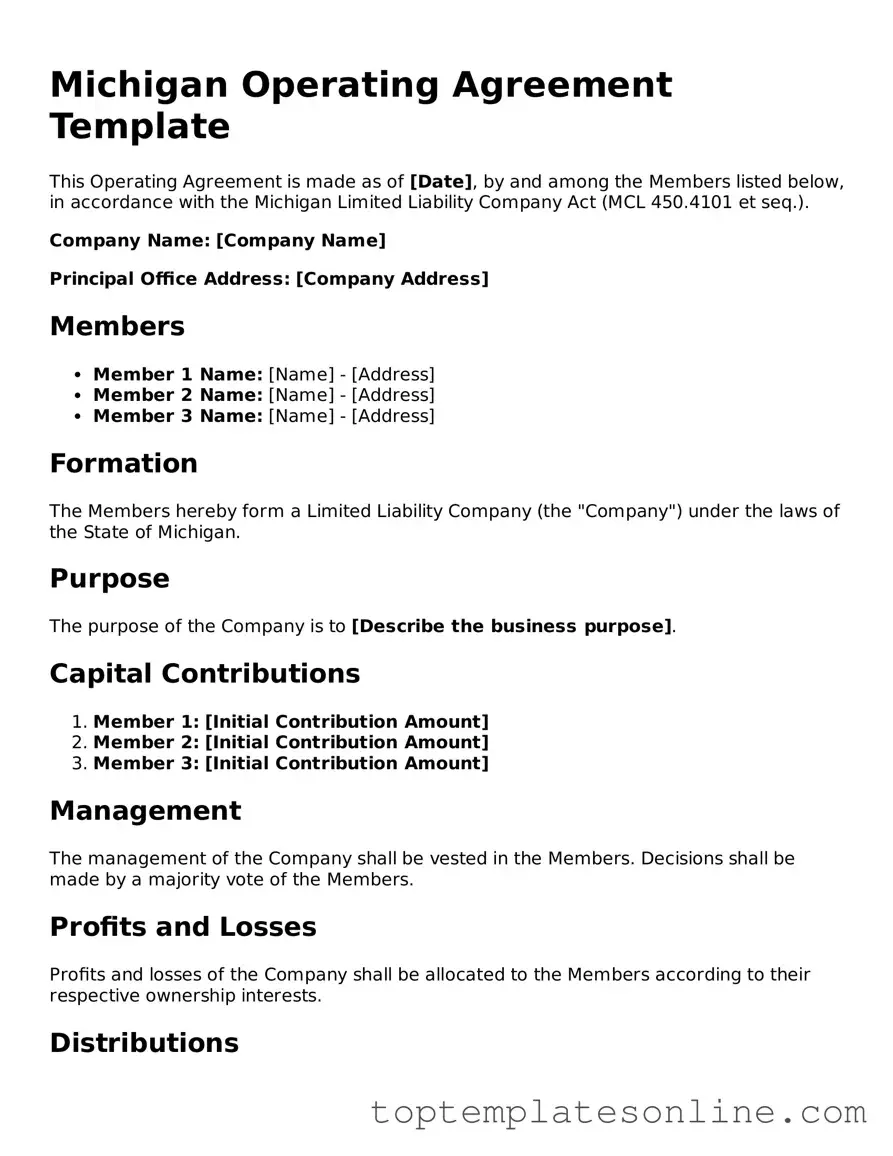

When forming a Limited Liability Company (LLC) in Michigan, one of the key documents you will encounter is the Michigan Operating Agreement form. This essential document serves as the backbone of your LLC, outlining the internal structure and operational procedures of the business. It details the roles and responsibilities of members, the distribution of profits and losses, and the decision-making processes that will govern the company. Additionally, the Operating Agreement addresses important matters such as how new members can be added, the process for resolving disputes, and what happens in the event of a member’s departure or the dissolution of the LLC. By establishing clear guidelines, this agreement helps to prevent misunderstandings and conflicts among members, ensuring that everyone is on the same page regarding the company’s operations. Furthermore, while Michigan law does not require an Operating Agreement for LLCs, having one in place is highly recommended as it provides legal protection and enhances the credibility of your business. Understanding the nuances of this form can help you navigate the complexities of running an LLC, setting the stage for a successful venture.

Some Other State-specific Operating Agreement Templates

Texas Llc Filing Fee - The Operating Agreement serves as a guideline for daily operations.

The comprehensive guide to the Motor Vehicle Bill of Sale simplifies the process for buyers and sellers by providing necessary details for a successful transaction.

Ohio Llc Operating Agreement Template - This document can help in laying out the business’s mission and values.

New Jersey Operating Agreement - It can serve as a foundational document for business succession planning.

Common mistakes

-

Not specifying the members: One common mistake is failing to list all members of the LLC. Every individual or entity involved should be clearly identified.

-

Ignoring the management structure: Some people overlook the importance of defining whether the LLC will be member-managed or manager-managed. This decision impacts daily operations.

-

Inadequate capital contributions: Members often forget to detail their initial capital contributions. Clearly stating these amounts helps avoid future disputes.

-

Vague profit distribution: Not specifying how profits and losses will be shared can lead to confusion. Clear guidelines are essential for transparency.

-

Failing to include decision-making processes: Omitting the procedures for making major decisions can result in conflicts. It’s important to outline how decisions will be reached.

-

Neglecting to address amendments: Some operating agreements lack provisions for future amendments. Including a process for changes ensures adaptability.

-

Not considering dissolution procedures: Many overlook the need to outline how the LLC can be dissolved. Clear procedures provide a roadmap for winding down the business.

-

Using unclear language: Ambiguous terms can lead to misinterpretations. It’s crucial to use straightforward language that all members understand.

-

Failing to sign and date the agreement: Lastly, neglecting to have all members sign and date the agreement can render it unenforceable. Ensure that all parties acknowledge their agreement.

Guide to Writing Michigan Operating Agreement

Once you have gathered all necessary information, you can begin filling out the Michigan Operating Agreement form. This document is essential for outlining the management structure and operational procedures of your business. Follow these steps carefully to ensure that all required information is accurately captured.

- Title the Document: At the top of the form, clearly label it as the "Operating Agreement" for your LLC.

- Provide the Name of the LLC: Enter the full legal name of your Limited Liability Company as registered with the state.

- List the Principal Office Address: Write the complete address where the main business operations will take place.

- Identify Members: List the names and addresses of all members involved in the LLC. Include their roles and ownership percentages.

- Outline Management Structure: Specify whether the LLC will be managed by its members or by appointed managers. Provide the names of any appointed managers if applicable.

- Detail Voting Rights: Describe the voting rights of each member. Indicate how decisions will be made and what constitutes a quorum.

- Include Financial Contributions: Document the initial capital contributions of each member, including any cash, property, or services.

- Set Profit and Loss Distribution: State how profits and losses will be allocated among members. This may be in proportion to ownership percentages or another agreed-upon method.

- Establish Rules for Meetings: Outline the frequency and procedures for member meetings, including notice requirements and record-keeping.

- Sign and Date the Agreement: Ensure that all members sign and date the agreement to indicate their consent and understanding of the terms.

After completing the form, review it for accuracy and completeness. Once you are satisfied, consider keeping a copy for your records and providing a copy to each member. This agreement will serve as a foundational document for your LLC's operations.

Documents used along the form

The Michigan Operating Agreement is a crucial document for LLCs, outlining the management structure and operational procedures of the business. Alongside this agreement, several other forms and documents are often utilized to ensure compliance with state regulations and to facilitate smooth business operations. Below is a list of common documents that may accompany the Michigan Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes essential information such as the LLC's name, address, and the names of its members.

- Member Consent Form: This form is used to document the agreement of all members regarding significant decisions or actions taken by the LLC, ensuring that everyone is on the same page.

- Operating Procedures: This document outlines specific procedures for the day-to-day operations of the LLC, detailing roles and responsibilities of members and managers.

- Tax Identification Number (TIN) Application: Also known as Form SS-4, this application is submitted to the IRS to obtain a TIN, which is necessary for tax purposes and opening a business bank account.

- Annual Report: Many states, including Michigan, require LLCs to file an annual report. This document updates the state on the LLC's status, members, and any changes in business operations.

- Bylaws: While not always required, bylaws serve as internal rules for the LLC, covering aspects such as meetings, voting rights, and procedures for adding new members.

- ATV Bill of Sale: This legal document records the transfer of ownership of an all-terrain vehicle (ATV), providing important details about the transaction, including buyer and seller information, vehicle description, and sale price. For further assistance, you can refer to NY Templates.

- Membership Certificates: These certificates are issued to members as proof of their ownership interest in the LLC. They can help clarify ownership stakes and rights within the company.

Utilizing these forms and documents in conjunction with the Michigan Operating Agreement can help establish a solid foundation for your LLC. This comprehensive approach ensures that all members are informed and that the business operates smoothly and in compliance with state laws.