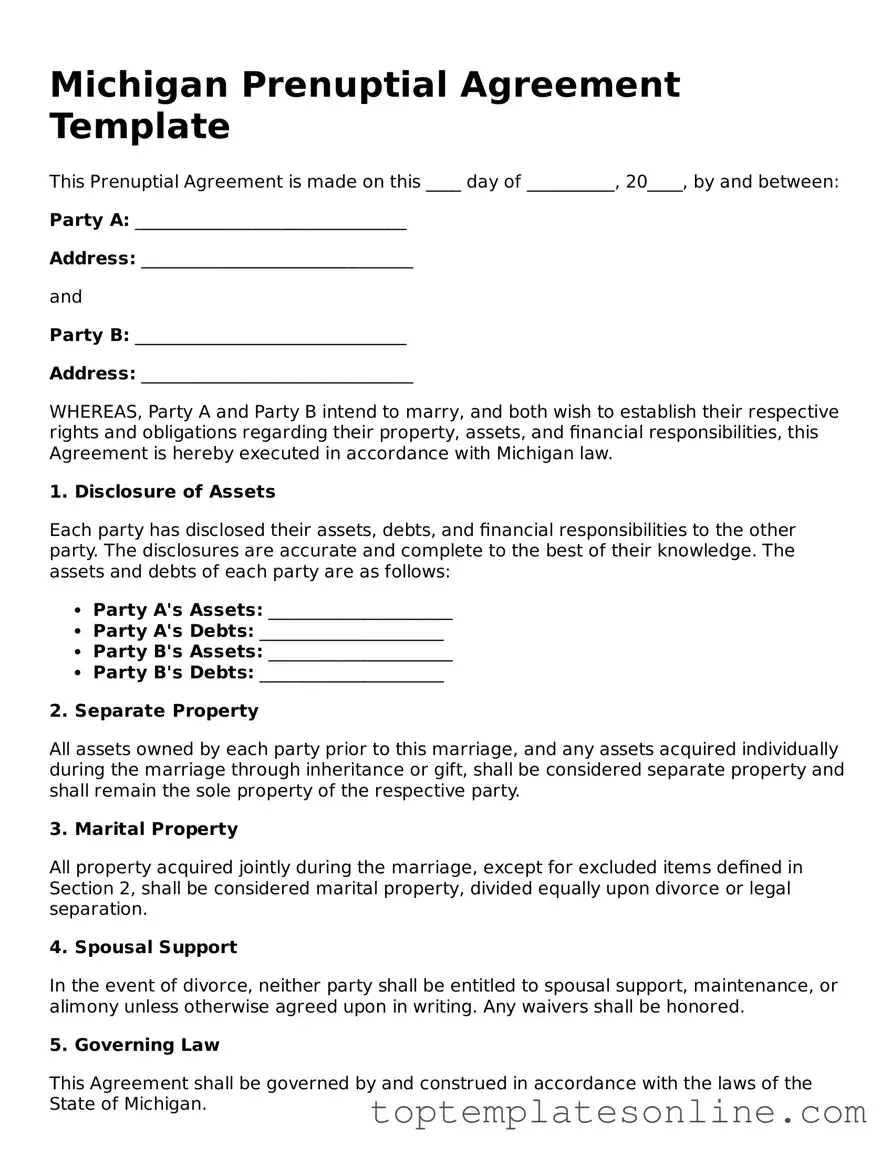

Blank Prenuptial Agreement Template for Michigan State

When couples in Michigan consider marriage, they often think about the future and the potential complexities that can arise from the union. A Michigan Prenuptial Agreement serves as a proactive tool, allowing partners to outline their financial rights and responsibilities before tying the knot. This agreement can address various aspects, including the division of property, spousal support, and the management of debts. By establishing clear terms, couples can mitigate misunderstandings and conflicts that may arise during the marriage or in the unfortunate event of a divorce. The form itself requires careful consideration, as it must be executed voluntarily and with full disclosure of assets to ensure its enforceability. Ultimately, a well-crafted prenuptial agreement not only protects individual interests but also fosters open communication between partners, reinforcing the foundation of trust essential for a successful marriage.

Some Other State-specific Prenuptial Agreement Templates

New York Prenuptial Contract - Couples have the freedom to determine the terms of their financial arrangement, rather than leaving it up to the state.

For those looking to understand the intricacies of a mobile home transaction, grasping the details of the Mobile Home Bill of Sale is crucial. This form can serve as a vital resource, ensuring that buyers and sellers alike are well-informed of their rights and responsibilities. For further assistance, you can explore more about this in the context of a "detailed Mobile Home Bill of Sale" at https://nypdfforms.com/mobile-home-bill-of-sale-form/.

North Carolina Prenuptial Contract - Can clarify the management of joint bank accounts and expenses.

New Jersey Prenuptial Contract - This agreement can also dictate how to handle shared responsibilities, like mortgage or rent payments.

Ohio Prenuptial Contract - It can stipulate how financial decisions will be made within the marriage.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary personal information. This includes full names, addresses, and dates of birth. Omitting even a small detail can lead to complications later.

-

Not Disclosing Assets: Transparency is crucial in a prenuptial agreement. Some individuals may underestimate the importance of fully disclosing their assets and debts. Not doing so can result in the agreement being challenged in the future.

-

Ignoring State Laws: Each state has its own requirements for prenuptial agreements. Failing to understand Michigan’s specific laws can lead to an unenforceable agreement. It’s essential to be aware of what is legally required.

-

Not Seeking Legal Advice: Many couples attempt to navigate the process without professional guidance. While it may seem straightforward, having an attorney review the agreement can help ensure that it is fair and comprehensive.

Guide to Writing Michigan Prenuptial Agreement

Completing the Michigan Prenuptial Agreement form is a straightforward process that requires careful attention to detail. Each party must provide accurate information about their assets, liabilities, and other relevant details. Following these steps will ensure that the form is filled out correctly.

- Begin by obtaining the Michigan Prenuptial Agreement form. This can typically be found online or at a local legal office.

- At the top of the form, enter the full names of both parties. Include the date of the agreement.

- Next, provide the current addresses for both parties. This helps establish residency.

- List all assets owned by each party. Include real estate, bank accounts, investments, and personal property.

- Document any debts or liabilities for each party. This may include loans, credit card debt, or mortgages.

- Detail how you wish to handle property acquired during the marriage. Specify whether it will remain separate or become marital property.

- Include any additional terms or conditions you want to address in the agreement. This may involve spousal support or inheritance rights.

- Both parties should review the completed form for accuracy and completeness. Make any necessary corrections.

- Sign the document in the presence of a notary public. This step is crucial for the agreement's validity.

- Each party should keep a copy of the signed agreement for their records.

Documents used along the form

A prenuptial agreement is an important document for couples planning to marry. It helps clarify financial matters and protect individual assets. Along with the Michigan Prenuptial Agreement form, several other documents may be useful in the process of preparing for marriage. Here are some of those forms and documents:

- Financial Disclosure Statement: This document outlines each partner's assets, debts, income, and expenses. It ensures transparency and helps both parties understand their financial situation before marriage.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It addresses financial matters and asset division in case of divorce or separation.

- Separation Agreement: This document is used when a couple decides to separate. It outlines the terms of the separation, including asset division, child custody, and support obligations.

- Will: A will specifies how a person's assets will be distributed after their death. It is important to have a will in place, especially when entering into a marriage.

- Address NYCERS form: This document enables members to update their address information with the New York City Employees Retirement System (NYCERS), ensuring they receive important communications and benefits at their correct address. For further details, refer to NY Templates.

- Power of Attorney: This document allows one partner to make financial or medical decisions on behalf of the other if they become incapacitated. It is crucial for ensuring that both partners' wishes are respected.

- Living Trust: A living trust can help manage assets during a person's lifetime and ensure a smooth transfer of assets after death. It can also provide privacy and avoid probate.

- Child Custody Agreement: If children are involved, this document outlines custody arrangements and parenting responsibilities. It helps clarify each parent's role and ensures the child's best interests are prioritized.

- Child Support Agreement: This document specifies the financial support one parent will provide for their child. It ensures that both parents contribute to the child's upbringing.

- Debt Agreement: This document outlines how debts will be managed and shared during the marriage. It helps prevent misunderstandings and disputes regarding financial responsibilities.

Having these documents in place can provide peace of mind for both partners. They help establish clear expectations and protect individual interests, ultimately fostering a healthier relationship as you embark on this new journey together.