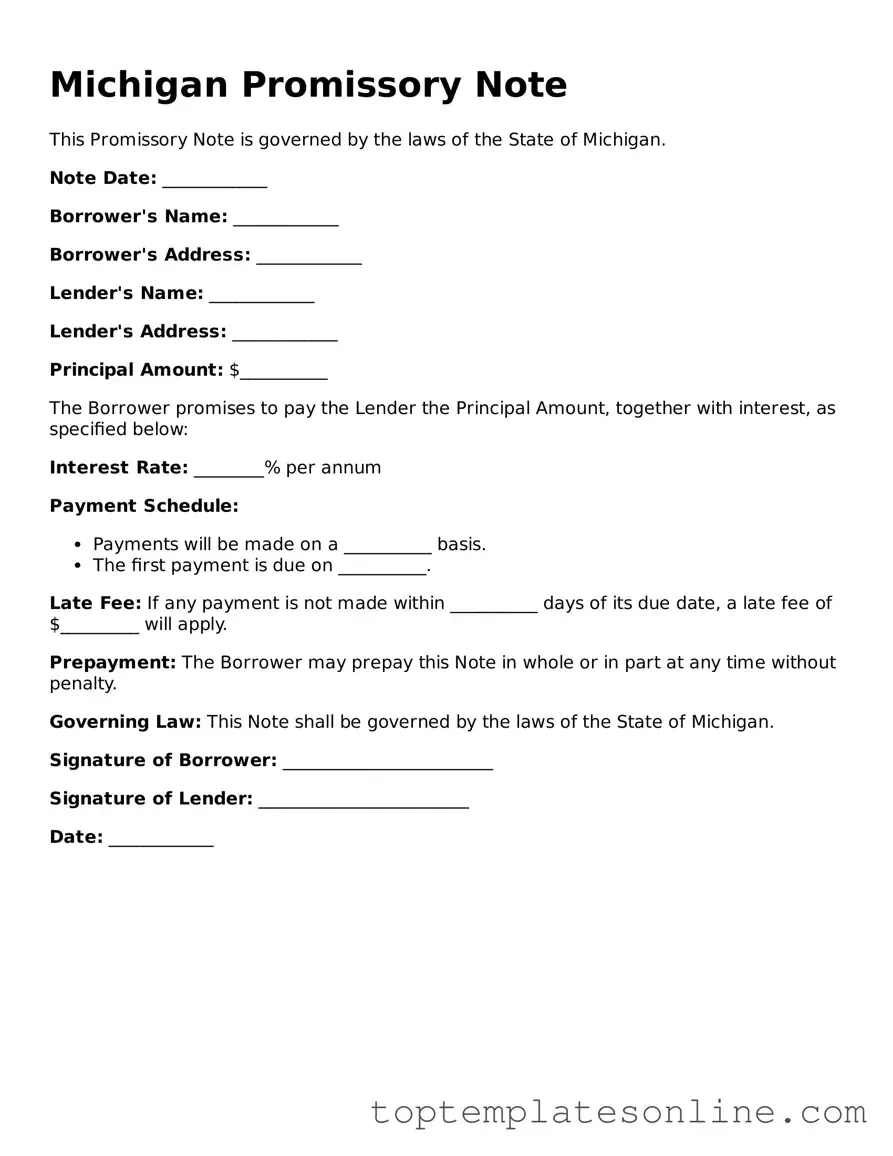

Blank Promissory Note Template for Michigan State

When it comes to securing loans or establishing a clear agreement between a borrower and a lender, the Michigan Promissory Note form plays a crucial role. This straightforward document outlines the borrower's promise to repay a specified amount of money, often detailing the terms of repayment, interest rates, and any associated fees. It serves as a legal instrument that not only fosters trust between parties but also provides clarity on the obligations involved. The form typically includes essential elements such as the names and addresses of both the borrower and lender, the principal amount borrowed, and the repayment schedule. Additionally, it may address what happens in the event of default, ensuring that both parties understand their rights and responsibilities. By using this form, individuals and businesses can navigate the lending process with confidence, knowing that they have a solid framework in place to protect their interests.

Some Other State-specific Promissory Note Templates

Promissory Note for Personal Loan - This form can help build trust by formalizing the terms of a loan agreement.

Having a comprehensive understanding of the Power of Attorney form is essential for anyone looking to manage their affairs effectively. This critical document ensures that a trusted individual can make decisions on your behalf when you are unable to do so, encompassing various aspects from financial management to healthcare options. For those interested in the specifics of creating a Power of Attorney in New York, you can find helpful resources at newyorkform.com/free-power-of-attorney-template/.

Ohio Promissory Note Requirements - A properly drafted promissory note can facilitate smoother negotiations.

Common mistakes

Filling out a Michigan Promissory Note form can seem straightforward, but many people stumble on common pitfalls. Here’s a list of mistakes to watch out for:

- Not including all parties' information: Ensure that the names and addresses of both the borrower and lender are clearly stated. Missing this can lead to confusion later.

- Incorrect loan amount: Double-check that the loan amount is accurate. A simple typo can create significant issues down the line.

- Missing date: Always include the date when the note is signed. This establishes a timeline for repayment and can affect legal standing.

- Omitting repayment terms: Clearly outline the repayment schedule. Whether it’s monthly, quarterly, or another frequency, clarity is key.

- Ignoring interest rates: If there’s an interest rate, it must be specified. Failing to do so can lead to misunderstandings about the total repayment amount.

- Not considering default terms: It’s essential to include what happens in case of default. This protects both parties and clarifies expectations.

- Neglecting to sign: A signature is crucial. Without it, the document may not hold up in court, rendering it ineffective.

- Forgetting witnesses or notarization: Depending on the situation, having a witness or getting the document notarized can add an extra layer of security.

By avoiding these mistakes, you can create a solid Promissory Note that serves its purpose effectively. Taking the time to review your document can save you from potential headaches in the future.

Guide to Writing Michigan Promissory Note

Once you have the Michigan Promissory Note form in hand, it's time to fill it out accurately. This document will require specific information about the borrower, the lender, and the terms of the loan. Completing this form correctly ensures that all parties are clear on their obligations and rights.

- Obtain the form: Download the Michigan Promissory Note form from a reliable source or obtain a physical copy.

- Fill in the date: At the top of the form, write the date on which the note is being executed.

- Identify the lender: Clearly write the full name and address of the lender. This is the individual or entity providing the loan.

- Identify the borrower: Enter the full name and address of the borrower. This is the individual or entity receiving the loan.

- Loan amount: Specify the total amount of money being loaned. This should be written in both numbers and words for clarity.

- Interest rate: Indicate the interest rate applicable to the loan. This should also be clearly stated in percentage form.

- Payment terms: Describe how and when the borrower will make payments. Include details such as the frequency of payments (monthly, quarterly, etc.) and the due dates.

- Maturity date: Specify the date by which the loan must be fully repaid.

- Signatures: Both the lender and the borrower must sign the document. Ensure that each party also prints their name beneath their signature.

- Witness or notarization: Depending on your needs, consider having the document witnessed or notarized for added validity.

After filling out the form, keep copies for your records. Ensure that both parties receive a signed copy for their files. This will help avoid any misunderstandings in the future.

Documents used along the form

When dealing with a Michigan Promissory Note, it is essential to have a clear understanding of other related documents that may be necessary for a complete transaction. Below is a list of commonly used forms and documents that accompany the Promissory Note. Each document serves a specific purpose and helps ensure that all parties are protected and informed.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and any fees associated with the loan.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used and the rights of the lender in case of default.

- Dirt Bike Bill of Sale: This essential form is used in New York to record the sale and transfer of ownership of a dirt bike, providing vital information for both buyer and seller to ensure compliance with state regulations. For further details, you can refer to NY Templates.

- Disclosure Statement: This document provides borrowers with important information about the loan, including total costs, interest rates, and any potential penalties for late payments.

- Personal Guarantee: If the borrower is a business entity, a personal guarantee from an individual may be required to ensure repayment, holding the individual personally liable.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components, helping borrowers understand their payment obligations over time.

- Payment Receipt: This document serves as proof of payment when the borrower makes a payment toward the loan, ensuring accurate record-keeping for both parties.

- Default Notice: If a borrower fails to meet their obligations, this notice informs them of the default and outlines the potential consequences, including legal action.

Understanding these documents is crucial for a smooth lending process. Ensure that all forms are completed accurately and retained for future reference. This diligence protects both the lender and borrower in any financial transaction.