Blank Quitclaim Deed Template for Michigan State

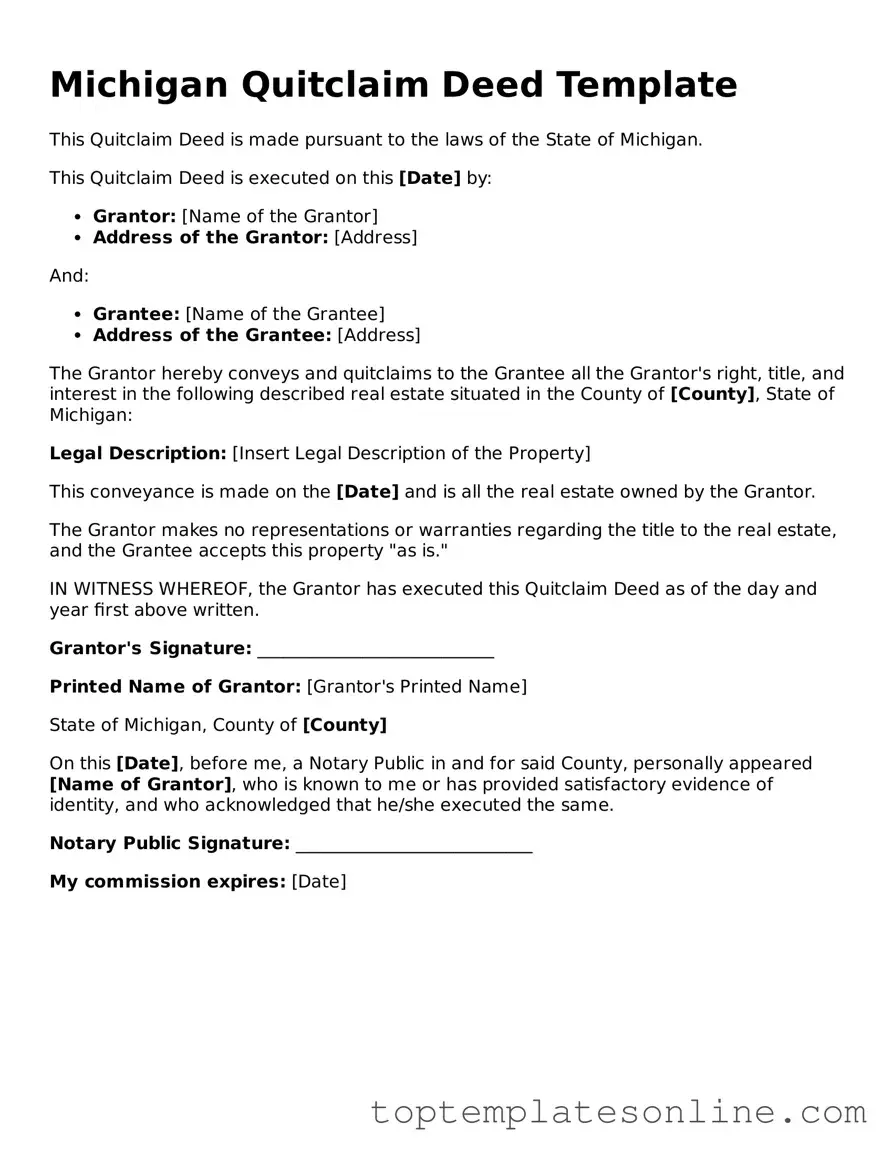

The Michigan Quitclaim Deed form serves as a vital instrument in real estate transactions, particularly for individuals seeking to transfer property ownership without the complexities often associated with traditional deeds. This form allows the granter—the individual relinquishing their interest in the property—to convey any rights they may have to the grantee, or the recipient of the property. Unlike warranty deeds, which provide assurances about the title's validity, a quitclaim deed offers no such guarantees, making it essential for both parties to understand the implications of this transfer. The form typically requires basic information, including the names of both the granter and grantee, a legal description of the property, and the date of the transaction. Additionally, it may necessitate notarization to ensure its legal validity. While often used among family members or in situations where trust exists between parties, the Michigan Quitclaim Deed can also facilitate the quick transfer of property in various legal contexts, such as divorce settlements or estate planning. Understanding the nuances of this form is crucial for anyone involved in property transactions in Michigan, as it impacts ownership rights and future claims on the property.

Some Other State-specific Quitclaim Deed Templates

Warranty Deed - It’s important to have the document properly notarized to ensure its validity.

For those looking to engage in such a transaction, having access to a reliable resource can be invaluable; for instance, you can obtain a template from NY Templates to ensure your Boat Bill of Sale is properly prepared and fulfills all legal requirements.

Quitclaim Deed Ohio - The seller in a Quitclaim Deed is known as the grantor.

Common mistakes

-

Incorrect Grantee Information: One common mistake is providing inaccurate or incomplete details about the grantee. Ensure that the name is spelled correctly and that the address is current. Missing or incorrect information can lead to future disputes or difficulties in property transfer.

-

Failure to Notarize: A Quitclaim Deed must be notarized to be legally binding. Skipping this step can render the document invalid. Always ensure that the signature is witnessed by a notary public to avoid complications.

-

Omitting Legal Descriptions: The legal description of the property is crucial. Some individuals neglect to include this information or provide vague descriptions. A precise legal description helps to clearly identify the property being transferred, preventing future misunderstandings.

-

Incorrectly Filling Out the Date: The date of execution must be accurate. Errors in dating can create confusion about when the transfer took place, potentially affecting the rights of the parties involved.

-

Not Recording the Deed: After completing the Quitclaim Deed, it should be recorded with the county register of deeds. Failing to do so means the transfer may not be recognized publicly, which can lead to issues with ownership claims later on.

-

Ignoring Tax Implications: Some people overlook the tax consequences of transferring property. It’s important to consult with a tax professional to understand any potential liabilities or exemptions that may apply to the transaction.

Guide to Writing Michigan Quitclaim Deed

Once you have the Michigan Quitclaim Deed form in hand, you can begin the process of transferring property ownership. This form requires specific information about the property, the grantor, and the grantee. Follow these steps carefully to ensure that the form is filled out correctly.

- Obtain the Form: Start by downloading the Michigan Quitclaim Deed form from a reliable source or visit your local county clerk’s office to get a physical copy.

- Identify the Grantor: In the first section, clearly write the name of the person or entity transferring the property. Include their address for clarity.

- Identify the Grantee: Next, enter the name of the person or entity receiving the property. Make sure to include their address as well.

- Describe the Property: Provide a detailed description of the property being transferred. Include the property address and any legal description required, such as lot number or parcel number.

- Consideration: Indicate the amount of money or other consideration exchanged for the property. If it’s a gift, you can write "love and affection" or a similar phrase.

- Sign the Document: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name provided earlier.

- Notarization: Have the notary public complete their section, verifying the identity of the grantor and witnessing the signature.

- File the Deed: Once completed, take the signed and notarized deed to your local county clerk’s office for recording. There may be a filing fee, so check beforehand.

After filing, the deed will become part of the public record. You will receive a copy for your records, confirming the change in ownership. Keep this document in a safe place for future reference.

Documents used along the form

The Michigan Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. While the Quitclaim Deed serves its purpose effectively, several other forms and documents are often utilized in conjunction with it to ensure a smooth transaction. Below is a list of these related documents, each accompanied by a brief description.

- Property Transfer Affidavit: This document is required by the Michigan Department of Treasury to report the transfer of property. It includes information about the property and the parties involved, and it helps in assessing property taxes.

- Title Insurance Policy: This document protects the buyer from potential issues related to the title of the property, such as liens or disputes over ownership. It provides financial security in the event of title defects.

- Warranty Deed: Unlike a Quitclaim Deed, a Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. This document provides more protection for the buyer.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller, including the purchase price, contingencies, and closing date. It serves as a foundational document for the transaction.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document details all financial transactions involved in the closing of the property sale, including fees, commissions, and adjustments.

- Affidavit of Identity: This document is often used to verify the identity of the parties involved in the transaction. It helps prevent fraud and ensures that the correct individuals are signing the deed.

- Motorcycle Bill of Sale Form: To ensure a legal transfer of ownership, use our comprehensive Motorcycle Bill of Sale documentation to protect your interests during the transaction.

- Power of Attorney: If one party cannot be present to sign the Quitclaim Deed, a Power of Attorney allows another individual to act on their behalf, ensuring the transaction can proceed smoothly.

- Notice of Intent to Foreclose: In cases where the property is being transferred due to foreclosure, this document informs parties of the intent to foreclose and outlines the necessary steps and timelines involved.

- Tax Exemption Affidavit: If applicable, this document is submitted to claim any tax exemptions on the property. It provides necessary information to local tax authorities for assessment purposes.

Utilizing these documents alongside the Michigan Quitclaim Deed can facilitate a more efficient and secure property transfer process. Each form plays a distinct role in ensuring that all legal and financial aspects of the transaction are properly addressed.