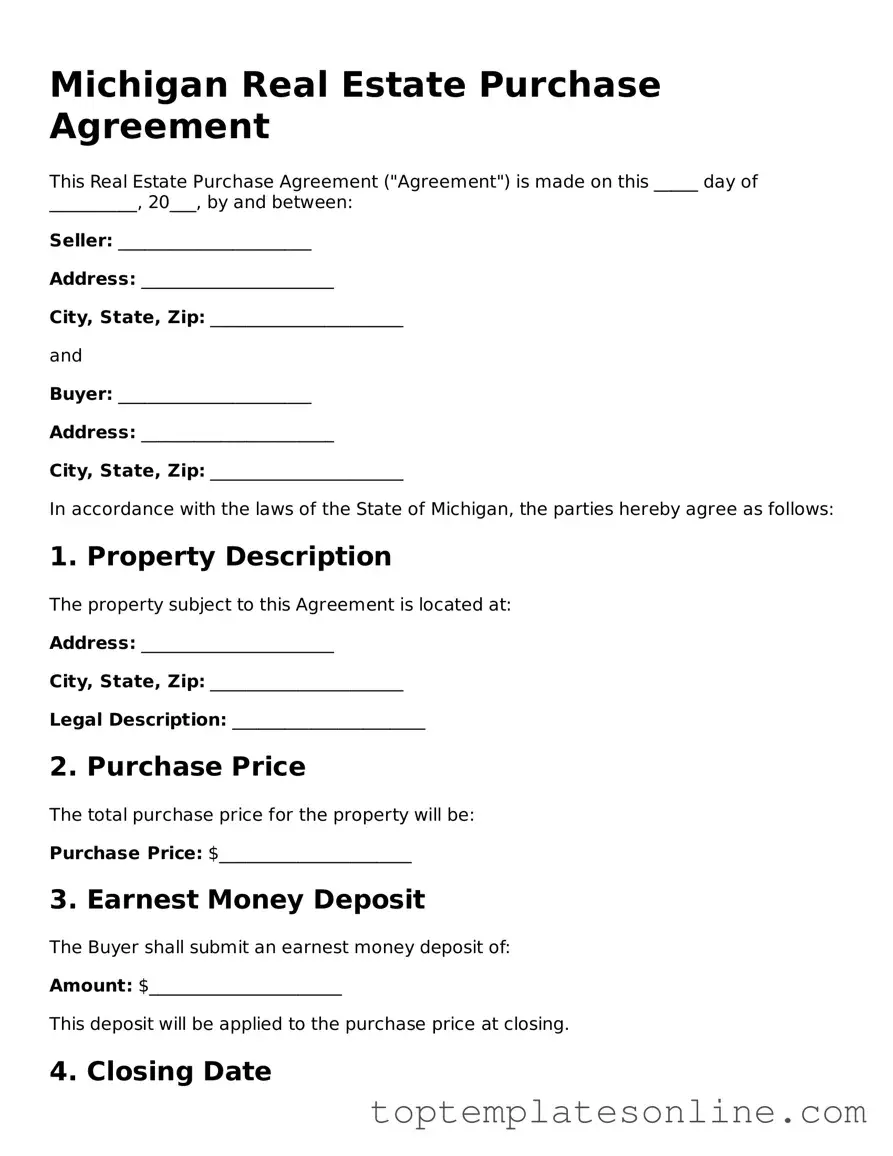

Blank Real Estate Purchase Agreement Template for Michigan State

The Michigan Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling property in Michigan. This form outlines the terms and conditions agreed upon by both the buyer and the seller, ensuring clarity and protection for all parties involved. Key aspects of the agreement include the purchase price, financing details, and the closing date, which are essential for setting expectations. Additionally, the form addresses contingencies, such as home inspections and financing approval, which can significantly impact the transaction. Other important elements include the legal description of the property, disclosures regarding the condition of the property, and any included fixtures or personal property. By detailing these components, the Michigan Real Estate Purchase Agreement facilitates a smoother transaction process while safeguarding the interests of both the buyer and the seller.

Some Other State-specific Real Estate Purchase Agreement Templates

Purchasing Agreements - The parties may negotiate if the transaction involves multiple properties.

Before signing the Florida Residential Lease Agreement, it is crucial for both landlords and tenants to familiarize themselves with the essential components of the document, as it ensures that key terms and responsibilities are clearly outlined; for further insights and templates, you may refer to Florida Forms.

North Carolina Association of Realtors - This document serves as a binding contract between buyer and seller.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details in the form. This includes missing names, addresses, or contact information for both the buyer and the seller. Incomplete information can lead to delays and misunderstandings.

-

Incorrect Property Description: A common mistake is not accurately describing the property being purchased. This may involve omitting important details such as the property address, parcel number, or legal description. An incorrect property description can create legal issues later on.

-

Failure to Specify Terms: Buyers and sellers sometimes neglect to clearly outline the terms of the sale. This includes the purchase price, deposit amount, and financing arrangements. Without clear terms, both parties may face confusion or disputes during the transaction.

-

Ignoring Contingencies: Some individuals overlook the importance of including contingencies in the agreement. Common contingencies may involve financing, inspections, or the sale of another property. Failing to include these can put the buyer or seller at risk.

Guide to Writing Michigan Real Estate Purchase Agreement

After completing the Michigan Real Estate Purchase Agreement form, you will have a clear understanding of the terms and conditions of the property transaction. This agreement outlines the rights and responsibilities of both the buyer and the seller. Follow the steps below to ensure that you fill out the form accurately and completely.

- Obtain the Form: Acquire the Michigan Real Estate Purchase Agreement form from a reliable source, such as a real estate office or online legal document provider.

- Fill in Buyer Information: Enter the full name, address, and contact information of the buyer(s) in the designated section.

- Fill in Seller Information: Provide the full name, address, and contact information of the seller(s) in the appropriate area.

- Property Description: Clearly describe the property being sold, including the address and any legal descriptions necessary.

- Purchase Price: State the agreed-upon purchase price for the property in the designated field.

- Deposit Information: Specify the amount of earnest money deposit and the method of payment.

- Closing Date: Indicate the proposed closing date for the transaction.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as financing or inspections.

- Signatures: Ensure that all parties involved sign and date the agreement at the bottom of the form.

Documents used along the form

When buying or selling property in Michigan, several forms and documents complement the Real Estate Purchase Agreement. These documents help clarify the transaction and protect the interests of both parties involved. Here’s a list of commonly used forms:

- Seller's Disclosure Statement: This document requires the seller to disclose known issues with the property, such as structural problems or past repairs. It helps buyers make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about potential lead-based paint hazards. It is a federal requirement to ensure safety.

- Property Inspection Report: After a home inspection, this report outlines the condition of the property. It can reveal necessary repairs and maintenance issues.

- Appraisal Report: An appraisal determines the property's market value. Lenders often require this document to ensure the loan amount aligns with the property's worth.

- Title Commitment: This document outlines the terms of the title insurance policy. It confirms that the seller has the right to sell the property and identifies any liens or encumbrances.

- Closing Statement: Also known as a HUD-1 statement, this document details all financial transactions involved in the closing process, including fees and credits.

- Affidavit of Title: The seller signs this document to affirm their ownership of the property and confirm there are no undisclosed liens or claims against it.

- Articles of Incorporation: This document is essential for establishing a corporation in New York, as it outlines the necessary details for registration. It includes information such as the corporation's name, office address, and purpose. For a comprehensive template, you can refer to newyorkform.com/free-articles-of-incorporation-template/.

- Purchase Agreement Addendum: This is an additional document that modifies or adds terms to the original purchase agreement, addressing specific conditions or contingencies.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be valid.

Each of these documents plays a crucial role in ensuring a smooth real estate transaction. Understanding them can help buyers and sellers navigate the process with confidence.