Blank Tractor Bill of Sale Template for Michigan State

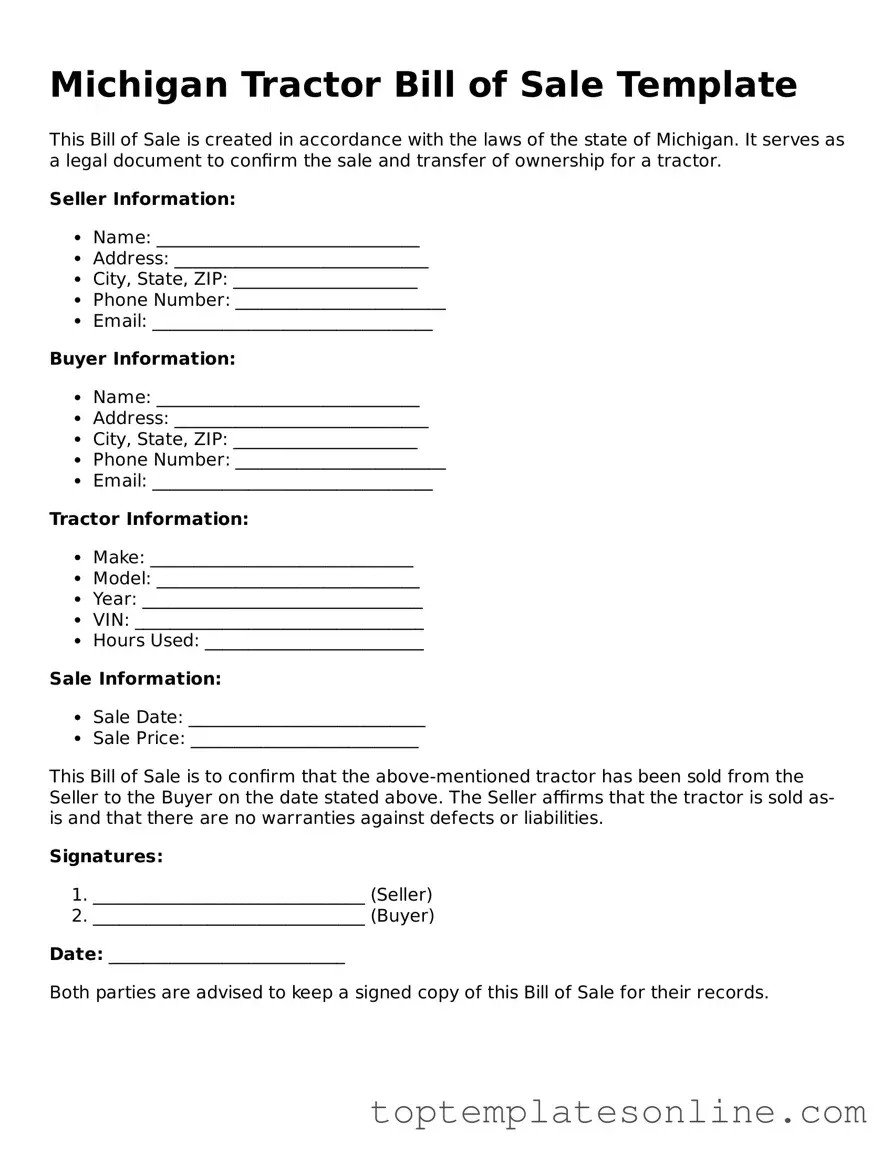

When it comes to buying or selling a tractor in Michigan, having a clear and concise bill of sale is essential. This document serves as a legal record of the transaction, ensuring that both the buyer and seller are protected. The Michigan Tractor Bill of Sale form includes important details such as the names and addresses of both parties, a thorough description of the tractor, including its make, model, and identification number, and the agreed-upon purchase price. Additionally, it outlines any terms and conditions relevant to the sale, such as warranties or guarantees, which can prevent misunderstandings later on. By completing this form, both parties can confirm their agreement and avoid potential disputes, making it a crucial step in the process of transferring ownership. Understanding the significance of this document not only facilitates a smoother transaction but also provides peace of mind for everyone involved.

Some Other State-specific Tractor Bill of Sale Templates

Can You Hand Write a Bill of Sale - A duplicate can be retained by both buyer and seller for their records.

Farm Equipment Bill of Sale - This form can also help track tractor changes in ownership for tax assessments.

When considering a Power of Attorney, it is crucial to understand the implications of this legal document, which allows the principal to appoint an agent to make decisions on their behalf, covering essential areas such as financial matters and healthcare. For additional resources on creating these legal documents, you can refer to Florida Forms, which provide valuable templates and information to ensure your choices are well-documented and respected.

Farm Equipment Bill of Sale - Helps buyers verify the legitimacy of the tractor's ownership history.

Common mistakes

-

Inaccurate Vehicle Information: One common mistake is failing to provide the correct details about the tractor. This includes the make, model, year, and Vehicle Identification Number (VIN). Any discrepancies can lead to complications during registration.

-

Omitting Seller and Buyer Information: Both the seller and buyer must provide their full names and addresses. Missing or incorrect information can create confusion and may affect the legal transfer of ownership.

-

Not Including Sale Price: The sale price should be clearly stated on the form. Leaving this section blank or entering an incorrect amount can lead to issues with taxes and registration.

-

Failing to Sign the Document: A signature is essential for the validity of the bill of sale. Without the signatures of both parties, the document may not be recognized as a legitimate transfer of ownership.

-

Ignoring Date of Sale: The date when the sale occurs is crucial. Not including this date can create ambiguity regarding when ownership was transferred, which may affect liability and insurance coverage.

-

Not Keeping Copies: After completing the form, it is vital to retain copies for both the seller and buyer. Failing to do so may lead to disputes or difficulties in proving ownership later on.

-

Neglecting to Check Local Regulations: Each state may have specific requirements regarding the bill of sale. Ignoring these regulations can result in the document being deemed invalid or insufficient for legal purposes.

Guide to Writing Michigan Tractor Bill of Sale

Completing the Michigan Tractor Bill of Sale form is essential for a smooth transaction between the buyer and seller. This form provides proof of the sale and helps protect both parties. Follow these steps to ensure you fill it out correctly.

- Obtain the Michigan Tractor Bill of Sale form. You can find it online or at a local office supply store.

- Enter the date of the sale at the top of the form.

- Fill in the seller's name and address. Make sure to provide accurate contact information.

- Enter the buyer's name and address. Again, accuracy is key for future reference.

- Describe the tractor being sold. Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the tractor. Be clear and specific about the amount.

- Include any additional terms or conditions of the sale, if applicable.

- Both the seller and buyer should sign and date the form at the designated areas.

- Make copies of the completed form for both parties for their records.

Once you have filled out the form, ensure both parties keep their copies for future reference. This documentation is important for any potential disputes or for registering the tractor with the state.

Documents used along the form

When purchasing or selling a tractor in Michigan, several other forms and documents may be necessary to ensure a smooth transaction. These documents can help clarify ownership, provide proof of payment, and facilitate registration. Below is a list of forms commonly used alongside the Michigan Tractor Bill of Sale.

- Title Transfer Document: This form is essential for transferring ownership of the tractor from the seller to the buyer. It includes details about the vehicle, such as the VIN and the names of both parties.

- Affidavit of Ownership: If the seller cannot provide a title, this document serves as a sworn statement asserting that the seller is the rightful owner of the tractor.

- Vehicle Registration Application: After the sale, the buyer must complete this application to register the tractor with the Michigan Secretary of State. It includes information about the buyer and the vehicle.

- Sales Tax Form: This form is used to report the sales tax due on the purchase. It helps ensure that the buyer pays the appropriate taxes when registering the tractor.

- Payment Receipt: A receipt serves as proof of payment for the tractor. It should include the purchase amount, date, and signatures from both parties.

- Inspection Report: If applicable, this document details the condition of the tractor at the time of sale. It can help protect both parties in case of disputes regarding the tractor's condition.

- Lease Agreement: It is important to have a solid lease agreement to ensure all terms are clear and to protect both the tenant and the landlord. For more information on lease agreements, visit https://newyorkform.com/free-lease-agreement-template.

- Insurance Information: Buyers may need to provide proof of insurance before registering the tractor. This document confirms that the buyer has obtained the necessary coverage.

Having these documents prepared and organized can facilitate a smoother transaction when dealing with the Michigan Tractor Bill of Sale. Ensure that all parties understand their responsibilities and keep copies of all forms for their records.