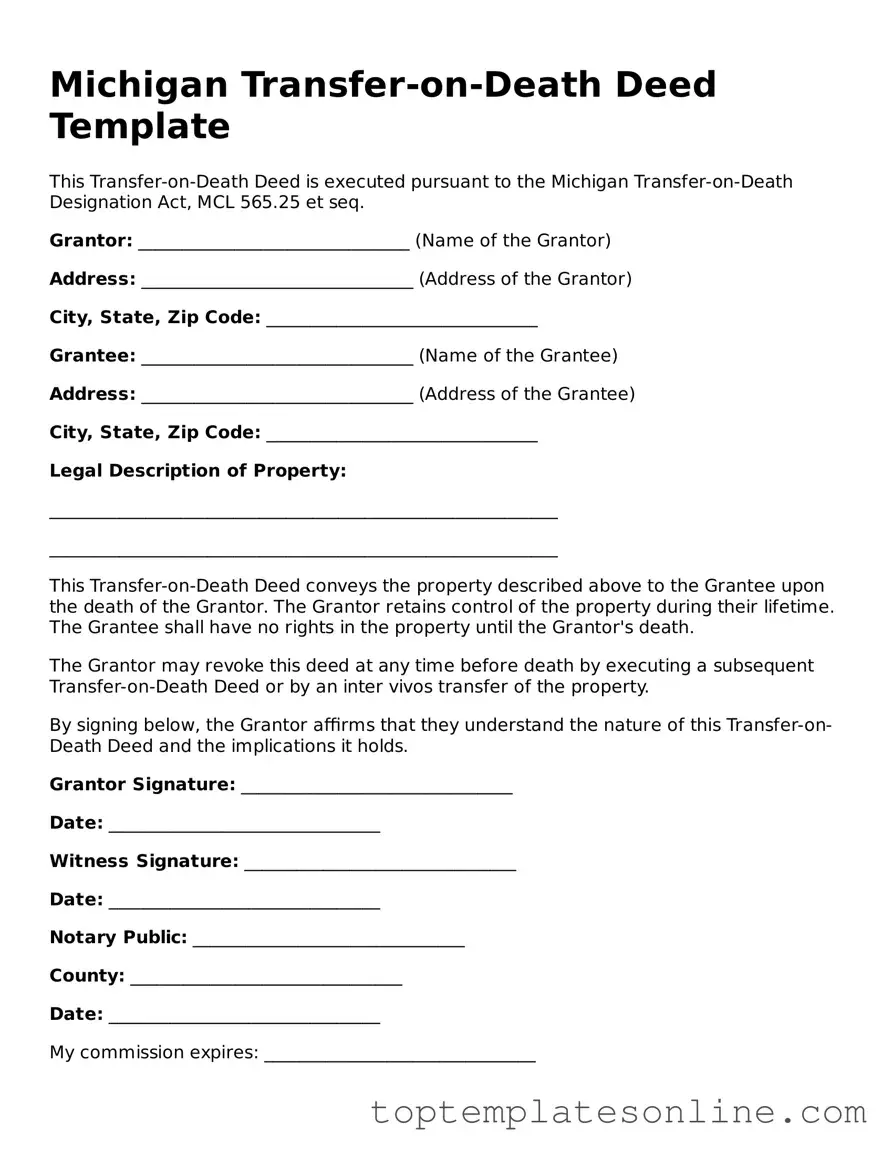

Blank Transfer-on-Death Deed Template for Michigan State

The Michigan Transfer-on-Death Deed (TOD) form provides a straightforward mechanism for property owners to transfer real estate to designated beneficiaries upon their death, bypassing the probate process. This legal tool allows individuals to maintain full control over their property during their lifetime, ensuring that their wishes are honored without the complications that often accompany traditional estate planning methods. By filling out this form, property owners can designate one or more beneficiaries who will automatically inherit the property upon the owner's passing. The TOD deed must be executed and recorded with the appropriate county register of deeds to be valid. It is important to note that the transfer only takes effect after the death of the property owner, and any changes to the deed can be made at any time prior to that event. This form is particularly beneficial for those looking to simplify the transfer of property and reduce potential legal disputes among heirs. Understanding the requirements and implications of the Michigan Transfer-on-Death Deed is essential for anyone considering this option for their estate planning needs.

Some Other State-specific Transfer-on-Death Deed Templates

Transfer on Death Designation Affidavit - The use of a Transfer-on-Death Deed can simplify estate planning, especially for single property owners.

How to Gift Land to Family Member - Setting up a Transfer-on-Death Deed typically involves filling out a standard form and having it recorded in the local land records office.

For those looking to protect sensitive information, understanding the importance of a Non-disclosure Agreement can be invaluable in any business environment. The essential elements of a Non-disclosure Agreement help ensure that proprietary data is safeguarded and legally binding.

Problems With Transfer on Death Deeds - Ensure your Transfer-on-Death Deed complies with local regulations for optimal effect.

Where Can I Get a Tod Form - Consider using this deed to keep family properties intact and easily transferred.

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a complete and accurate description of the property. This can lead to confusion or disputes about which property is intended to be transferred.

-

Missing Signatures: The deed requires signatures from all property owners. Omitting a signature can invalidate the deed, preventing the intended transfer from occurring.

-

Not Notarizing the Document: A Transfer-on-Death Deed must be notarized to be valid. Skipping this step can render the deed unenforceable.

-

Failing to Record the Deed: After completing the deed, it must be recorded with the appropriate county register of deeds. Neglecting this step means the transfer may not be recognized upon the owner’s death.

-

Inaccurate Beneficiary Information: Providing incorrect details about the beneficiary, such as name or relationship, can lead to complications. Ensure that all information is precise and clear.

-

Not Considering Future Changes: Some individuals do not think about the implications of changing beneficiaries. It’s important to understand how future life events may affect the deed.

-

Ignoring State Laws: Each state has specific requirements regarding Transfer-on-Death Deeds. Failing to adhere to Michigan’s laws can result in an ineffective deed.

-

Not Seeking Legal Advice: Some people attempt to fill out the form without consulting a legal professional. This can lead to mistakes that could have been avoided with proper guidance.

Guide to Writing Michigan Transfer-on-Death Deed

After obtaining the Michigan Transfer-on-Death Deed form, you will need to provide specific information about the property and the beneficiaries. This form allows you to designate who will receive your property upon your passing without going through probate. Follow these steps to complete the form accurately.

- Begin by entering the name of the property owner in the designated section. Ensure that the name matches the name on the property title.

- Provide the address of the property. Include the street address, city, state, and zip code.

- Next, identify the beneficiaries. List the full names of the individuals or entities you wish to inherit the property. You may designate multiple beneficiaries.

- Specify the percentage of the property each beneficiary will receive. If you have multiple beneficiaries, ensure the total percentages add up to 100%.

- Include the legal description of the property. This can typically be found on the property deed. It may include details like lot number, subdivision name, and county.

- Sign and date the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- After notarization, file the completed form with the county register of deeds where the property is located. This step is crucial for the deed to be legally effective.

Upon completing these steps, the form will be officially recorded. This action ensures that your wishes regarding the property transfer are documented and will be honored after your death.

Documents used along the form

The Michigan Transfer-on-Death Deed is a useful tool for transferring property upon death without going through probate. However, there are several other forms and documents that may be needed in conjunction with this deed to ensure a smooth transfer of assets. Here’s a brief overview of these important documents.

- Will: A legal document that outlines how a person wishes their assets to be distributed after their death. It can provide guidance on matters not covered by the Transfer-on-Death Deed.

- Durable Power of Attorney: This document allows someone to make financial decisions on your behalf if you become incapacitated. It’s important to have this in place to manage your affairs smoothly.

- Dirt Bike Bill of Sale: This form is essential for recording the sale and transfer of ownership of a dirt bike in New York, providing important information for both buyer and seller. For more details, you can refer to NY Templates.

- Living Trust: A trust created during a person's lifetime that can hold assets. It allows for easier transfer of property upon death and can help avoid probate.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance and retirement plans. They specify who will receive the assets directly, bypassing probate.

- Affidavit of Heirship: This document can help establish the identity of heirs when someone dies without a will. It may be necessary to clarify ownership of property.

- Property Deed: The official document that records the ownership of real estate. It is essential to ensure that the property is correctly titled in the name of the new owner after the transfer.

Understanding these documents can help you navigate the complexities of property transfer and ensure your wishes are honored. Always consider consulting a legal expert to assist with these forms and to provide personalized advice based on your situation.