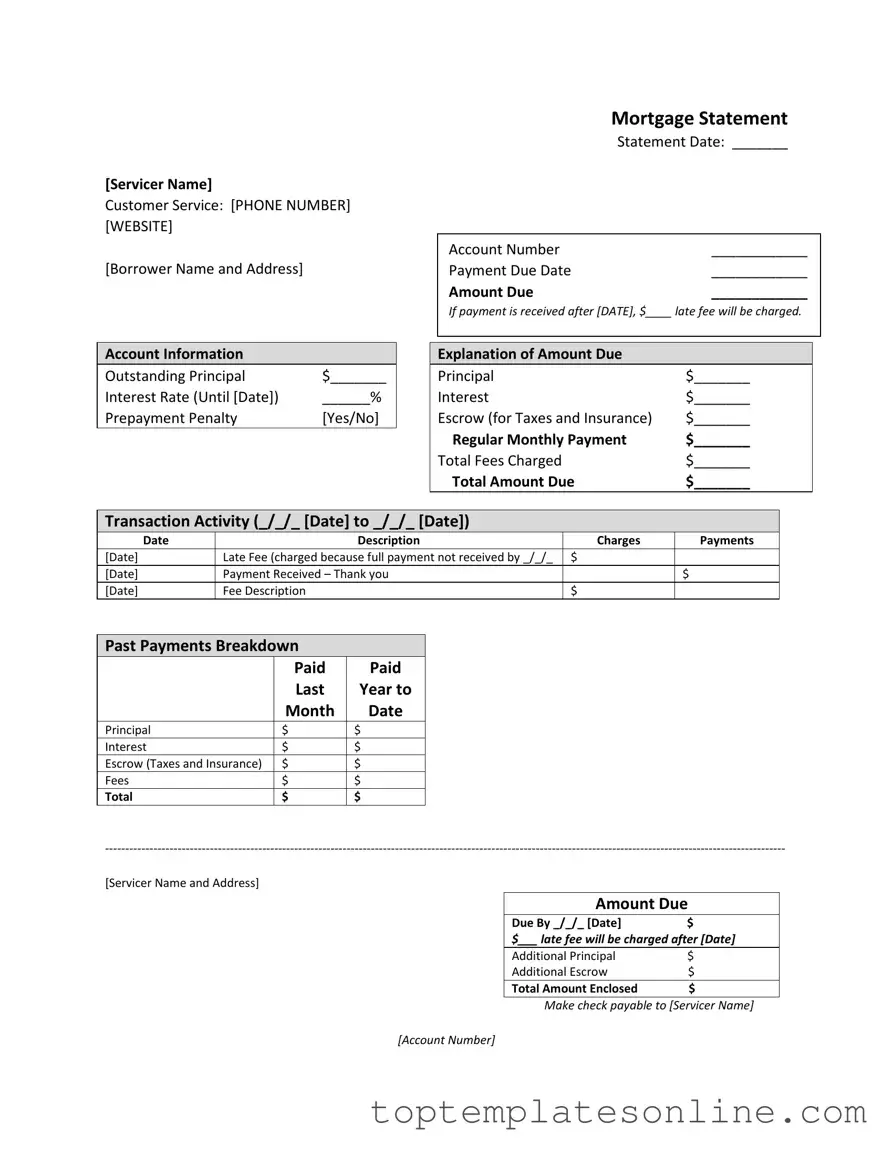

Fillable Mortgage Statement Form

The Mortgage Statement form is a crucial document for homeowners, providing a comprehensive overview of their mortgage account. It includes essential details such as the servicer's contact information, borrower’s name and address, and the statement date. Key figures are highlighted, including the account number, payment due date, and total amount due. Homeowners will find a breakdown of the outstanding principal, interest rate, and any applicable prepayment penalties. The form also details the explanation of the amount due, which encompasses principal, interest, escrow for taxes and insurance, and any fees charged. Transaction activity is recorded, showing recent charges and payments, including any late fees incurred. Importantly, the statement addresses partial payments, indicating that these do not apply directly to the mortgage but are held separately until the full payment is made. Additionally, it includes a delinquency notice for those who may be behind on payments, outlining the risks of foreclosure. For those facing financial difficulties, the form provides information on mortgage counseling or assistance, ensuring that homeowners have access to resources that can help them navigate their situation.

Common PDF Templates

What Is a Bol - The document also acts as a contract between the shipper and the carrier, detailing terms of transportation.

How Long Does College Credits Last - Record keeping of this form is crucial for the university's compliance and your benefit.

When creating a legal safeguard for your financial and legal matters, understanding the Durable Power of Attorney is crucial. This document empowers an agent to act on your behalf, ensuring your interests are maintained even during times of incapacity. For further insights and templates, you can refer to NY Templates that provide helpful resources for drafting your own New York Durable Power of Attorney.

Clock in Clock Out Sheet - Follow company guidelines when completing your time card.

Common mistakes

-

Failing to provide the Servicer Name and Customer Service Phone Number accurately. This information is crucial for any follow-up or inquiries.

-

Leaving the Statement Date blank. This date helps track the timeline of payments and account status.

-

Not including the Account Number. This number is essential for identifying the correct mortgage account.

-

Missing the Payment Due Date. It is important to know when the payment is due to avoid late fees.

-

Incorrectly calculating the Amount Due. Double-check the figures to ensure accuracy and avoid potential issues.

-

Overlooking the section regarding Late Fees. Be aware of any fees that may apply if payments are not made on time.

-

Not detailing the Outstanding Principal and Interest Rate correctly. This information is vital for understanding the loan's current status.

-

Neglecting to check the Transaction Activity section for accuracy. This section provides a history of payments and charges that can affect the account.

-

Failing to read the Important Messages section thoroughly. This section contains crucial information about partial payments and potential consequences of delinquency.

Guide to Writing Mortgage Statement

Completing the Mortgage Statement form requires careful attention to detail. This form is essential for managing your mortgage account effectively. Follow these steps to ensure you fill it out correctly.

- Gather your information: Collect your servicer's name, customer service phone number, website, and your personal details such as your name and address.

- Fill in the statement date: Write the date of the mortgage statement in the designated space.

- Enter your account number: Locate your account number and write it down where indicated.

- Complete the payment due date: Fill in the date your next payment is due.

- Specify the amount due: Enter the total amount you owe for that payment period.

- Note the late fee: If applicable, write the amount of the late fee that will be charged if payment is made after the specified date.

- Account information: Fill in the outstanding principal, interest rate, and whether there is a prepayment penalty.

- Break down the amount due: Specify the amounts for principal, interest, escrow, regular monthly payment, total fees charged, and total amount due.

- Transaction activity: Record the date range for transaction activity and list any charges or payments made during that time.

- Past payments breakdown: Provide details of payments made last year, including principal, interest, escrow, and fees.

- Final amount due: Write the total amount due and the date by which it must be paid to avoid late fees.

- Make your payment: If you are enclosing a check, ensure it is made payable to the servicer's name and includes your account number.

After filling out the form, review your entries for accuracy. Make sure all amounts are correct and that you have included any necessary documentation. This will help avoid any issues with your mortgage account.

Documents used along the form

When dealing with a mortgage, there are several important documents that complement the Mortgage Statement form. Each of these documents serves a unique purpose and helps provide a clearer picture of your mortgage situation. Here’s a brief overview of some of the key forms you might encounter.

- Loan Agreement: This document outlines the terms of your mortgage, including the loan amount, interest rate, repayment schedule, and any fees. It’s the official contract between you and the lender.

- Operating Agreement: To establish a clear organizational framework, it is advisable to consult the comprehensive Operating Agreement form for LLC management in New York.

- Payment History: This record shows all your past payments, including dates and amounts. It helps you track your payment behavior over time and can be useful for resolving disputes.

- Escrow Account Statement: If your mortgage includes an escrow account for taxes and insurance, this statement details the amounts collected and disbursed from that account. It ensures you know how your funds are being managed.

- Notice of Default: This document is sent if you fall behind on your payments. It informs you of your delinquency and outlines the steps you need to take to avoid foreclosure.

- Loan Modification Agreement: If you’ve negotiated changes to your loan terms, this agreement reflects those modifications. It’s crucial to keep this document on hand for your records.

- Annual Escrow Analysis: This report is typically provided once a year and reviews your escrow account. It compares what you paid into the account versus what was actually needed for taxes and insurance.

- Foreclosure Notice: If you are at risk of losing your home, this notice will inform you of the foreclosure process. It’s important to understand your rights and options at this stage.

Each of these documents plays a vital role in managing your mortgage and understanding your financial obligations. Keeping them organized and accessible can help you navigate your mortgage journey more effectively.