Fillable Netspend Dispute Form

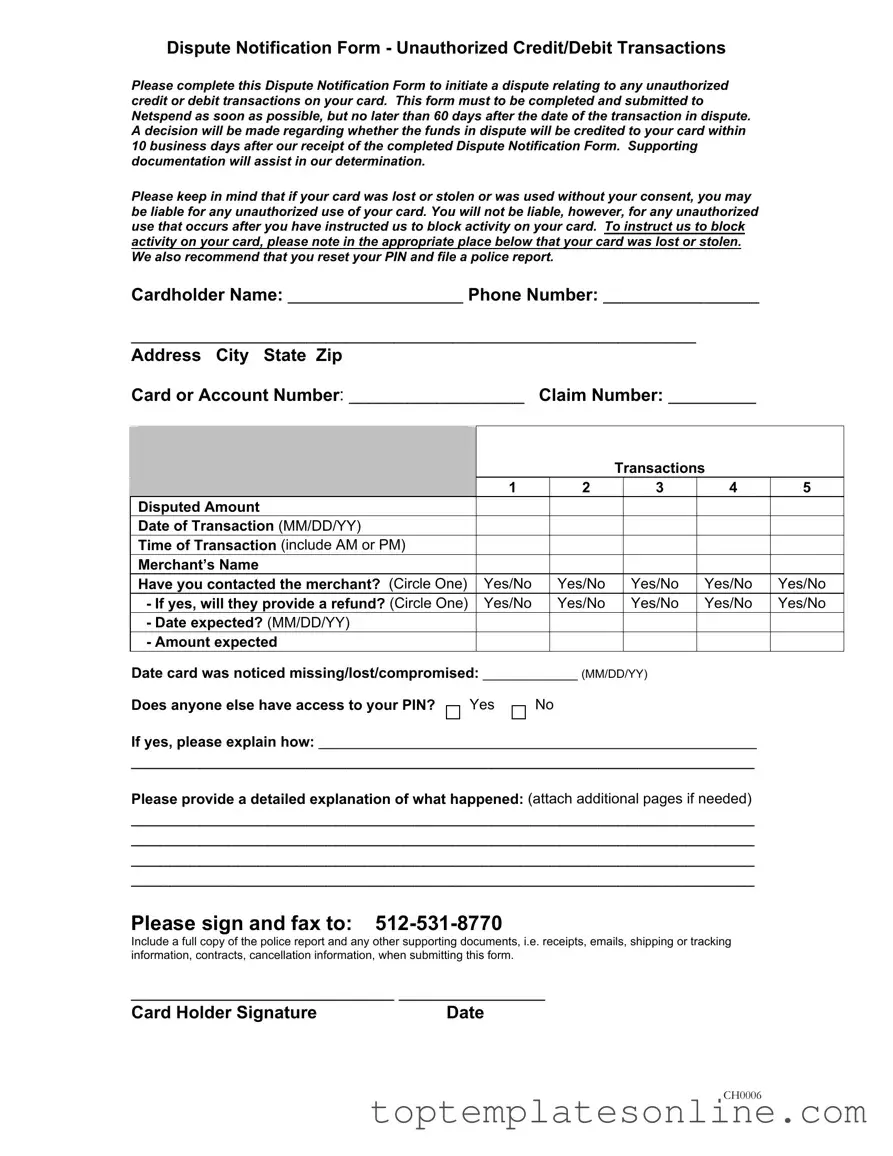

When dealing with unauthorized transactions on your Netspend card, the Dispute Notification Form serves as a crucial tool for cardholders seeking resolution. This form is designed to help you report any unauthorized credit or debit transactions swiftly and effectively. It is essential to complete and submit the form within 60 days of the disputed transaction to ensure your claim is considered. Once Netspend receives your completed form, they will assess the situation and typically provide a decision regarding the disputed funds within 10 business days. To strengthen your case, including supporting documents such as receipts or police reports can be beneficial. If your card has been lost or stolen, it's important to indicate this on the form, as you may not be held liable for transactions made after you’ve requested to block your card. The form also prompts you to detail each disputed transaction, including the merchant's name and whether you've contacted them for a refund. By filling out this form carefully and accurately, you take a significant step toward protecting your financial interests and addressing any unauthorized activity on your account.

Common PDF Templates

P&l Sheet - It provides a year-over-year comparison for better trend analysis.

For those seeking clarity on their business structure, understanding the New York LLC requirements is vital, including the significance of the necessary Operating Agreement documentation that dictates operational guidelines and member responsibilities.

Transfer of Shares Form - State "original issue" if applicable or provide the transferring party's name.

Common mistakes

-

Failing to submit within the timeframe: Individuals often overlook the requirement to submit the form within 60 days of the transaction date. Missing this deadline may result in the dispute being denied.

-

Inaccurate personal information: Providing incorrect details such as the cardholder name, phone number, or address can delay the processing of the dispute.

-

Insufficient transaction details: Not including all necessary information about the disputed transactions, such as the date, time, and merchant’s name, can hinder the investigation.

-

Neglecting to contact the merchant: Failing to indicate whether the merchant was contacted can lead to complications. This information is vital for the dispute process.

-

Not providing supporting documentation: Individuals may forget to attach necessary documents, such as a police report or receipts, which are essential for substantiating the claim.

-

Ignoring the PIN access question: Not answering whether anyone else has access to the PIN can raise concerns about the security of the account.

-

Inadequate explanation of the incident: Providing a vague or incomplete explanation of what happened may result in misunderstandings or insufficient information for the review process.

-

Failure to sign the form: Omitting the signature can lead to the rejection of the dispute. A signature is necessary to validate the claim.

Guide to Writing Netspend Dispute

Filling out the Netspend Dispute form is straightforward. You’ll need to provide some personal information, details about the disputed transactions, and any supporting documents. Once you complete the form, you can submit it to Netspend for review. They will aim to make a decision within 10 business days.

- Start with your personal information: Fill in your name, phone number, and address, including city, state, and zip code.

- Provide your card or account number: Write down the number associated with the card you are disputing.

- Claim number: If you have a claim number, include it in the designated space.

- List the disputed transactions: You can dispute up to five transactions on one form. For each transaction, fill in the following:

- Disputed amount

- Date of transaction (MM/DD/YY)

- Time of transaction (include AM or PM)

- Merchant’s name

- Indicate if you contacted the merchant (circle Yes or No)

- If yes, will they provide a refund? (circle Yes or No)

- Date expected for refund (MM/DD/YY)

- Amount expected as a refund

- Report missing or stolen card: If your card was lost or stolen, provide the date you noticed it was missing (MM/DD/YY).

- PIN access: Indicate if anyone else has access to your PIN (circle Yes or No). If yes, explain how.

- Provide a detailed explanation: Describe what happened. Attach additional pages if needed.

- Sign and date the form: Make sure to sign and write the date at the bottom of the form.

- Submit the form: Fax the completed form to 512-531-8770. Include a full copy of the police report and any other supporting documents.

Documents used along the form

The Netspend Dispute Form is essential for initiating a dispute regarding unauthorized transactions. However, several other documents may be necessary to support your claim effectively. Below is a list of forms and documents that are often used alongside the Netspend Dispute Form.

- Police Report: If your card was lost or stolen, a police report serves as official documentation of the incident. This report can strengthen your case and may be required for your dispute.

- Transaction Receipts: Providing receipts for transactions in question can help clarify the details of your dispute. These documents can show proof of the original transaction and assist in verifying your claims.

- Merchant Correspondence: Any emails or written communication with the merchant regarding the disputed transaction can be crucial. This documentation shows your attempts to resolve the issue directly with the merchant.

- Cancellation Confirmation: If you canceled a transaction or service, a cancellation confirmation can support your claim. This document proves that you took steps to prevent unauthorized charges.

- Durable Power of Attorney: Understanding how to manage your affairs even during incapacity is crucial. For a comprehensive template, refer to NY Templates.

- Shipping or Tracking Information: If the dispute involves an item that was supposed to be delivered, shipping or tracking information can provide evidence of the transaction's status and any issues related to it.

- Identity Verification Documents: In some cases, you may need to provide proof of identity, such as a government-issued ID. This helps verify that you are the legitimate cardholder.

- Account Statements: Recent account statements can offer a broader view of your transactions and highlight any unauthorized activity. These statements help illustrate the context of the disputed transaction.

- Affidavit of Fraud: This is a sworn statement declaring that you did not authorize the transaction. It can serve as a formal declaration of your claim and may be required in some cases.

By gathering these documents, you can enhance your dispute's credibility and increase the chances of a favorable resolution. Always ensure that you submit all relevant information promptly to facilitate the process.