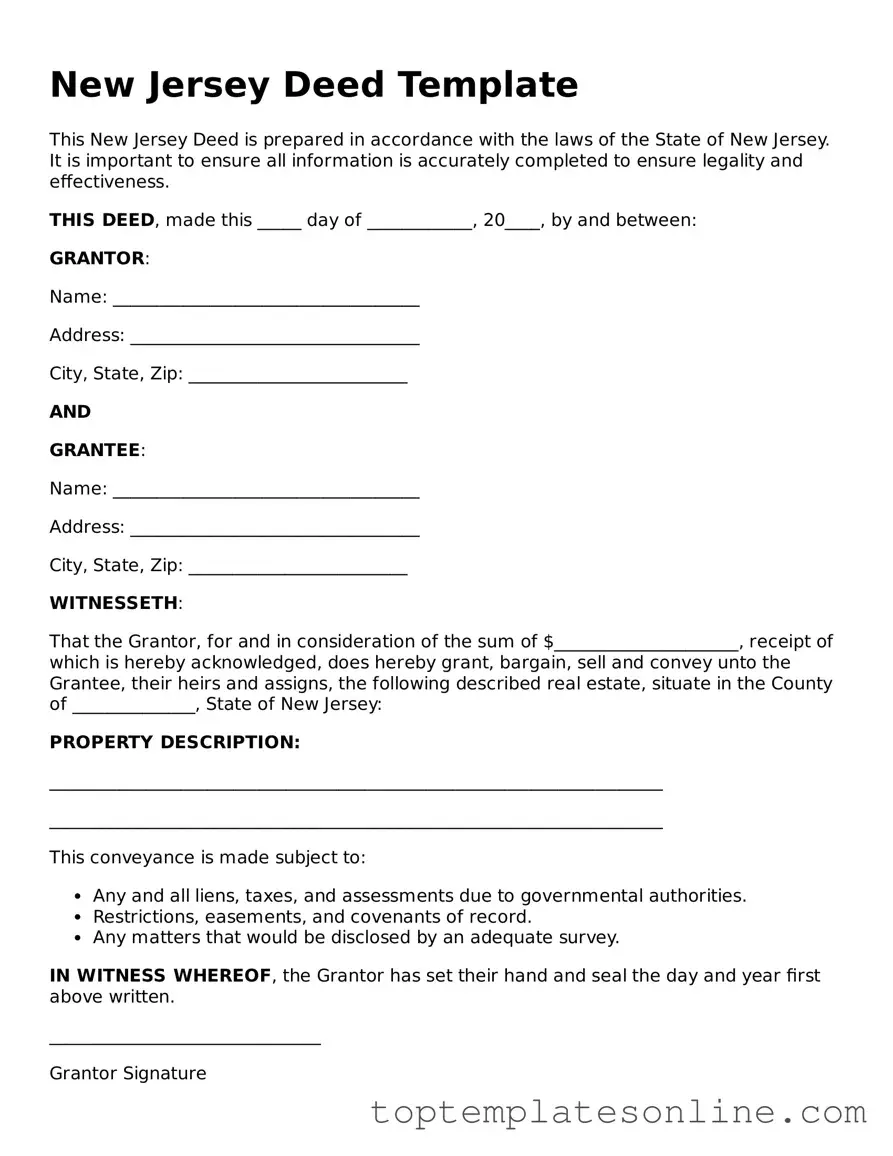

Blank Deed Template for New Jersey State

In the realm of real estate transactions, the New Jersey Deed form serves as a crucial document that facilitates the transfer of property ownership. This form encapsulates essential details, including the names of the parties involved, a legal description of the property, and the consideration paid for the transfer. Typically, the deed must be signed by the seller, known as the grantor, and may require notarization to ensure authenticity. Various types of deeds exist in New Jersey, such as the warranty deed and quitclaim deed, each serving different purposes and offering varying levels of protection to the buyer. Additionally, the form must be properly recorded with the county clerk's office to provide public notice of the ownership change. Understanding these elements is vital for anyone engaged in property transactions, as they lay the groundwork for legal ownership and future rights associated with the property.

Some Other State-specific Deed Templates

Ohio Warranty Deed Form - A quitclaim deed transfers whatever interest the seller has without guarantees.

Property Transfer Form - Inheritance often involves executing a Deed to transfer property from a deceased individual.

New York Warranty Deed Form - May have legal implications for ownership disputes in the future.

The importance of having a properly executed Florida Trailer Bill of Sale cannot be overstated, as it serves as a key record of the ownership transfer and helps prevent future disputes. For those needing a template, the floridaforms.net/blank-trailer-bill-of-sale-form/ provides a comprehensive resource to ensure all necessary details are included in this essential document.

Legal House Deed Document - Different types of Deeds exist, including Warranty Deeds and Quitclaim Deeds.

Common mistakes

-

Incorrect Names: One common mistake involves the spelling of names. Individuals often misspell their own names or the names of the grantee. It is crucial to ensure that names match exactly as they appear on legal documents.

-

Improper Property Description: Failing to provide a clear and accurate description of the property can lead to significant issues. The description should include the lot number, block number, and any relevant boundaries. Incomplete or vague descriptions can create confusion about ownership.

-

Missing Signatures: Signatures from all parties involved are essential. Sometimes, individuals forget to sign the document or assume that only one signature is necessary. All grantors must sign the deed for it to be valid.

-

Not Notarizing the Document: Many people overlook the requirement for notarization. A deed must be notarized to be legally binding. Without a notary's signature and seal, the deed may not be accepted by the county clerk.

-

Failure to Record the Deed: After completing the deed, it is vital to record it with the appropriate county office. Neglecting this step can lead to disputes over property ownership and make it difficult to establish legal rights in the future.

Guide to Writing New Jersey Deed

Once you have the New Jersey Deed form in hand, it’s time to fill it out carefully. Accurate completion of this form is essential for proper property transfer. Follow these steps to ensure you fill it out correctly.

- Obtain the form: Download the New Jersey Deed form from an official state website or acquire a physical copy from a local office.

- Identify the parties: Fill in the names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide the property description: Clearly describe the property being transferred. Include the street address and any additional identifying information, such as lot number or block number.

- State the consideration: Indicate the amount of money or value exchanged for the property. This is often referred to as the purchase price.

- Sign the form: The grantor must sign the deed in front of a notary public. Ensure that the signature matches the name provided on the form.

- Notarization: Have the deed notarized to verify the identities of the signers and the authenticity of the signatures.

- Record the deed: Take the completed and notarized deed to the county clerk's office where the property is located. Pay any required recording fees.

After completing these steps, the deed will be officially recorded, ensuring the transfer of property rights is recognized. Keep a copy for your records, as it serves as proof of ownership.

Documents used along the form

When transferring property in New Jersey, the Deed form is just one of several important documents that may be required. Each of these documents serves a specific purpose in the transaction process, ensuring that the transfer is legal and properly recorded. Below is a list of other forms and documents that are often used alongside the New Jersey Deed form.

- Property Transfer Tax Form: This form is necessary for reporting the sale of real estate and calculating the transfer tax owed to the state. It provides essential information about the transaction and the parties involved.

- Affidavit of Title: This document is a sworn statement by the seller confirming their ownership of the property and that there are no undisclosed liens or encumbrances. It helps protect the buyer by ensuring clear title.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document outlines all financial details of the transaction, including costs, fees, and the final amounts due from both the buyer and seller at closing.

- Title Insurance Policy: This policy protects the buyer and lender from any future claims against the property that may arise from issues not discovered during the title search. It is a critical safeguard in real estate transactions.

- Notice to Quit: This form serves as an essential legal document, allowing landlords to notify tenants to vacate the property, providing them a clear timeframe and reasons for the eviction process, much like the guidelines outlined in the Florida Forms.

- Mortgage Document: If the buyer is financing the purchase, this document details the terms of the loan, including the amount borrowed, interest rate, and repayment schedule. It secures the lender's interest in the property.

- Certificate of Occupancy: This document is issued by the local municipality and verifies that the property meets all building codes and is safe for occupancy. It is often required before a sale can be finalized.

- Power of Attorney: If the seller cannot be present at closing, this document allows another person to act on their behalf. It grants the designated individual the authority to sign necessary documents to complete the transaction.

Understanding these documents is crucial for anyone involved in a real estate transaction in New Jersey. Each form plays a vital role in ensuring a smooth transfer of property, protecting the interests of all parties involved. Being well-informed can help navigate the complexities of real estate transactions with confidence.