Blank Operating Agreement Template for New Jersey State

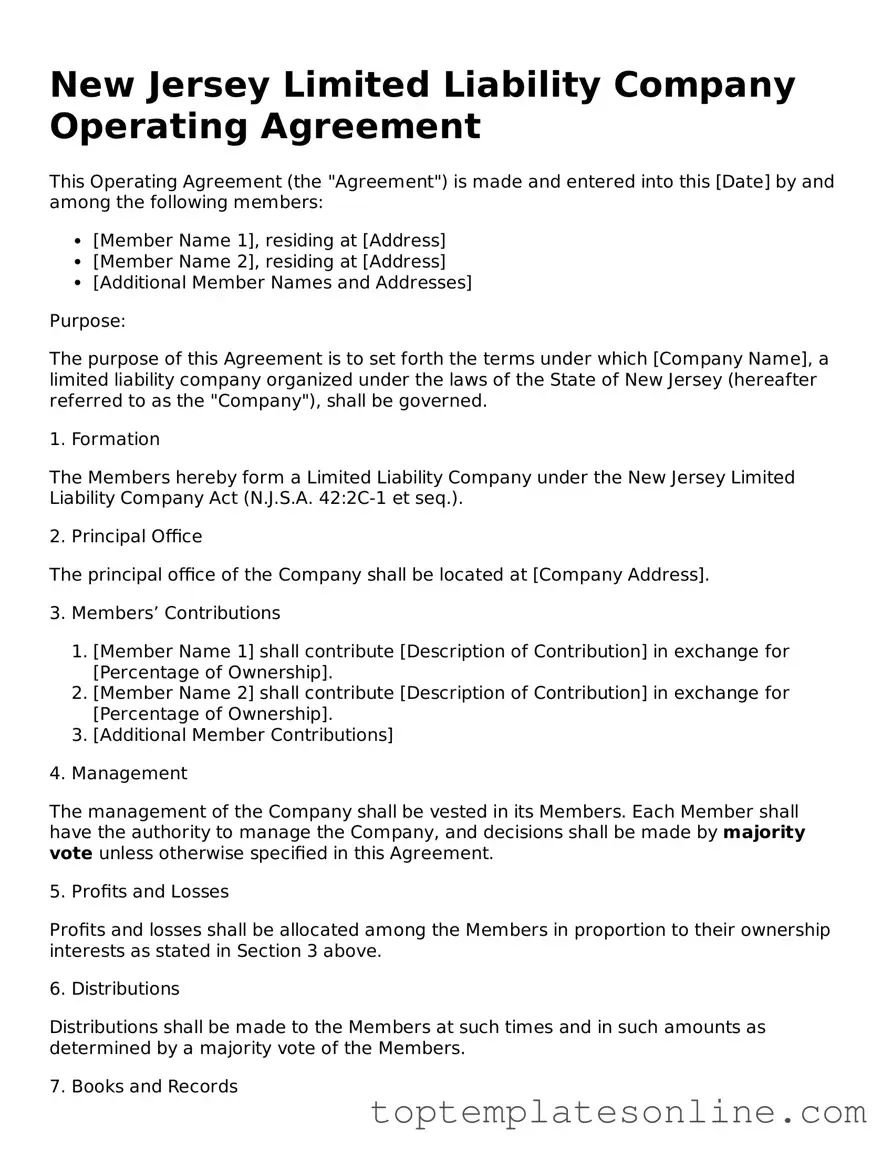

In New Jersey, the Operating Agreement is a crucial document for Limited Liability Companies (LLCs), serving as the backbone of the business's internal structure and management. This form outlines the roles and responsibilities of members, establishes the procedures for decision-making, and provides guidelines for profit distribution. By clearly defining the rights of each member, the Operating Agreement helps to prevent disputes and misunderstandings among partners. It also addresses important aspects such as the process for adding or removing members, the handling of financial contributions, and the procedures for dissolving the LLC if necessary. Having a well-drafted Operating Agreement is not just a good practice; it is essential for protecting the interests of all members involved. This document ensures that everyone is on the same page, fostering a collaborative environment that can adapt to the changing needs of the business. Whether you're starting a new LLC or revising an existing agreement, understanding the key components of the New Jersey Operating Agreement is vital for smooth operations and long-term success.

Some Other State-specific Operating Agreement Templates

Texas Llc Filing Fee - An Operating Agreement can help maintain an organized business structure.

Operating Agreement for Llc Georgia - The Operating Agreement can help in structuring a family-owned LLC.

For those looking to understand and utilize the General Power of Attorney form in New York, it's essential to know that this document grants someone the authority to handle various matters on your behalf, particularly when you are unable to do so yourself. To facilitate the process, resources such as NY Templates can provide useful templates and guidance, ensuring that you complete the form correctly and comprehensively.

Ohio Llc Operating Agreement Template - This document clarifies ownership rights among members and managers.

Common mistakes

-

Not including all members' names: It's essential to list every member involved in the LLC. Omitting a member can lead to disputes later.

-

Failing to specify the ownership percentages: Each member's share in the LLC should be clearly defined. This prevents confusion over profit distribution.

-

Ignoring the management structure: Clearly outline whether the LLC will be member-managed or manager-managed. This decision impacts how the business operates.

-

Not detailing the decision-making process: Specify how decisions will be made. Will it require a majority vote, or will certain decisions need unanimous consent?

-

Overlooking the distribution of profits and losses: Clearly state how profits and losses will be shared among members. This is crucial for financial transparency.

-

Neglecting to include buyout provisions: Address what happens if a member wants to leave the LLC. A buyout clause can prevent future conflicts.

-

Not addressing dispute resolution: Outline how disputes will be handled. This could include mediation or arbitration processes.

-

Failing to update the agreement: As the business evolves, the Operating Agreement should be reviewed and updated. Failing to do so can lead to outdated terms.

-

Not having the agreement signed: Ensure that all members sign the Operating Agreement. Without signatures, the document may not hold up in court.

Guide to Writing New Jersey Operating Agreement

Completing the New Jersey Operating Agreement form is an important step for any business. This document outlines the management structure and operational guidelines for your company. After filling out the form, you will have a clear framework for how your business will operate and how decisions will be made.

- Begin by entering the name of your LLC at the top of the form.

- Next, provide the principal address of your LLC. This should be a physical address, not a P.O. Box.

- List the names of all members involved in the LLC. Include their full legal names.

- Indicate the percentage of ownership for each member. This shows how profits and losses will be shared.

- Outline the management structure. Specify whether the LLC will be member-managed or manager-managed.

- Provide details about how decisions will be made. Include voting rights and procedures for meetings.

- Include provisions for adding or removing members in the future. This ensures clarity on membership changes.

- Specify how profits and losses will be distributed among members.

- Review the document for accuracy. Ensure all information is correct and complete.

- Finally, have all members sign and date the form. This confirms their agreement to the terms outlined.

Documents used along the form

When forming a limited liability company (LLC) in New Jersey, the Operating Agreement is a crucial document that outlines the management structure and operating procedures of the business. However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance with state laws and to facilitate smooth business operations. Below is a list of these documents, each serving a specific purpose in the formation and management of an LLC.

- Certificate of Formation: This is the official document filed with the New Jersey Division of Revenue and Enterprise Services to legally establish the LLC. It includes essential information such as the LLC's name, address, and registered agent.

- Business License: Depending on the nature of the business, a local or state business license may be required. This document grants permission to operate legally within a specific jurisdiction.

- Operating Agreement Addendum: This document can be used to modify or clarify specific provisions of the original Operating Agreement. It is helpful for addressing changes in ownership or management structure.

- Member Resolutions: These are formal documents that record decisions made by the members of the LLC. They are important for maintaining proper corporate governance and documenting significant business actions.

- Tax Identification Number (TIN): Obtaining a TIN from the IRS is necessary for tax purposes. This number is used to identify the business entity for federal tax filings.

- Membership Certificates: While not required, issuing membership certificates can provide a tangible representation of ownership in the LLC. They can help clarify each member's stake in the company.

- Bylaws: Although not mandatory for LLCs, bylaws can outline the internal rules and procedures governing the LLC's operations. They serve as a guide for decision-making and member conduct.

- Operating Agreement: Essential for outlining the financial and functional decisions of the LLC, this document can be found at newyorkform.com/free-operating-agreement-template and serves to protect personal assets and clarify member responsibilities.

- Annual Reports: New Jersey requires LLCs to file annual reports to maintain good standing. These reports provide updated information about the company and ensure compliance with state regulations.

- Operating Agreement Checklist: This document can serve as a guide for ensuring that all necessary provisions are included in the Operating Agreement. It can help prevent oversights during the drafting process.

Each of these documents plays a vital role in the formation and ongoing management of an LLC in New Jersey. It is essential for business owners to understand their importance and ensure that they are prepared to address all necessary legal requirements. By doing so, they can establish a solid foundation for their business and navigate the complexities of entrepreneurship with confidence.