Blank Power of Attorney Template for New Jersey State

In New Jersey, the Power of Attorney form is an essential legal document that empowers an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This form can cover a wide range of responsibilities, including financial matters, medical decisions, and property management, allowing the agent to act in the principal's best interest when they are unable to do so themselves. The Power of Attorney can be tailored to be effective immediately or can be set to activate only under specific circumstances, such as the principal's incapacitation. Furthermore, New Jersey law requires certain formalities, including the principal's signature and the presence of a notary public, to ensure that the document is legally binding. Understanding the various types of Power of Attorney, such as durable, springing, and limited, is crucial for anyone looking to establish this important legal arrangement. By carefully considering the powers granted and the choice of agent, individuals can create a document that reflects their wishes and provides peace of mind for both themselves and their loved ones.

Some Other State-specific Power of Attorney Templates

Types of Power of Attorney Ohio - A Power of Attorney document grants someone authority to act on your behalf.

When creating a General Power of Attorney form in New York, it's important to ensure that all necessary details are included to avoid any complications later on. For those seeking guidance on how to properly fill out this document, resources like NY Templates can be invaluable in providing the right templates and instructions.

How to Get Power of Attorney in North Carolina - Helps avoid court intervention during periods of incapacity.

How to Get Power of Attorney in Ny - The agent must keep accurate records of all transactions performed under the granted authority.

Ga Power of Attorney - Having a Power of Attorney can simplify medical or financial issues for family members.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the powers granted to the agent. This can lead to confusion about what the agent can and cannot do on behalf of the principal.

-

Not Signing in Front of a Notary: Many individuals forget that the Power of Attorney must be signed in front of a notary public. Without this step, the document may not be legally valid.

-

Choosing the Wrong Agent: Selecting an agent who may not have the principal's best interests at heart can be detrimental. It’s essential to choose someone trustworthy and capable of handling the responsibilities.

-

Ignoring State-Specific Requirements: Each state has specific rules regarding Power of Attorney forms. Failing to adhere to New Jersey's requirements can invalidate the document.

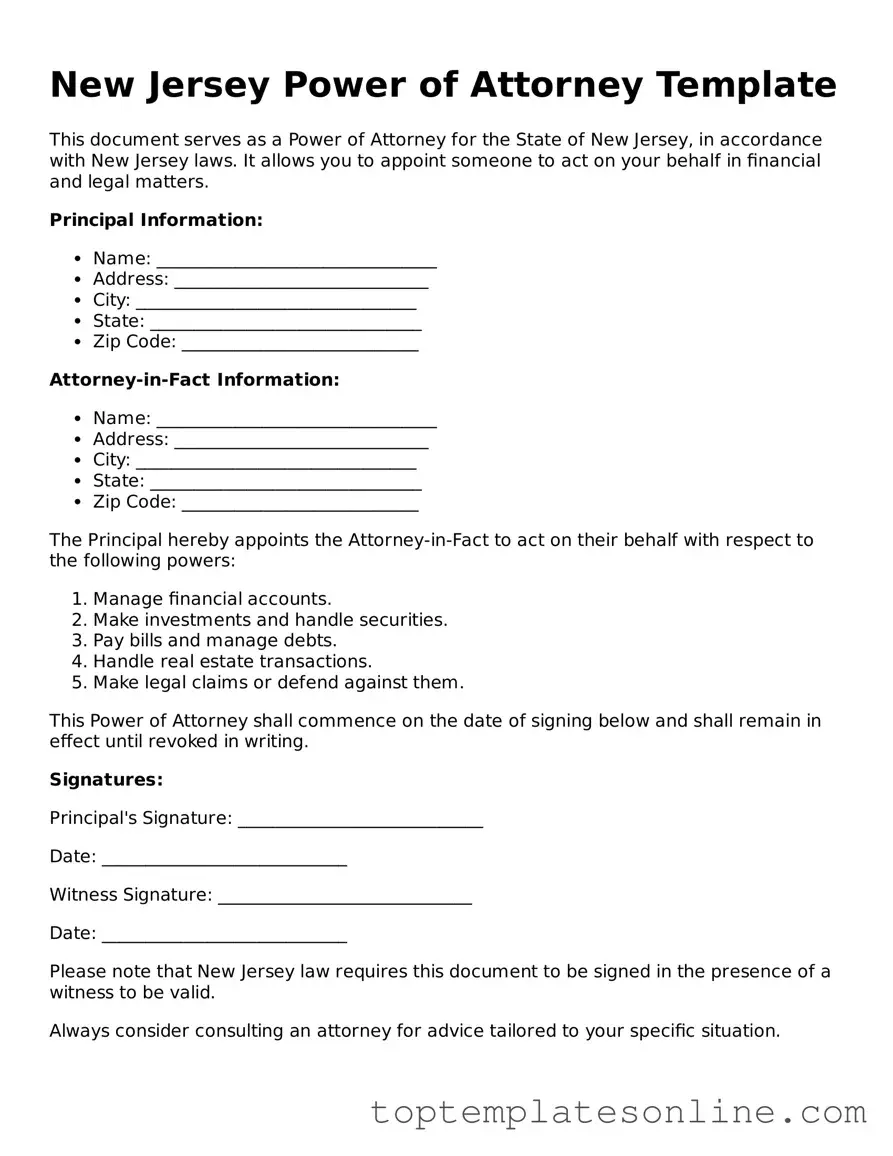

Guide to Writing New Jersey Power of Attorney

Filling out the New Jersey Power of Attorney form is an important step in designating someone to act on your behalf in financial or legal matters. Once the form is completed and signed, it should be shared with the designated agent and any relevant institutions or parties. This ensures that your wishes are known and can be acted upon when necessary.

- Obtain the New Jersey Power of Attorney form. This can be downloaded from the New Jersey government website or obtained from a legal office.

- Begin by filling in your full name and address in the designated sections. Ensure that the information is accurate and up-to-date.

- Next, provide the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Specify the powers you wish to grant to your agent. You may select general powers or limit them to specific areas, such as financial decisions or property management.

- Include any special instructions or limitations regarding the agent’s authority. This can help clarify your intentions and protect your interests.

- Sign and date the form in the appropriate section. Your signature must be witnessed by at least one person or notarized, depending on your preference.

- Provide copies of the completed form to your agent and any relevant institutions, such as banks or healthcare providers, to ensure they are aware of the arrangement.

Documents used along the form

When creating a New Jersey Power of Attorney, several other forms and documents may be necessary to ensure comprehensive legal coverage. Below is a list of commonly used documents that complement the Power of Attorney form.

- Advance Healthcare Directive: This document outlines a person's healthcare preferences in case they become unable to communicate their wishes. It may include instructions about medical treatments and appoints a healthcare proxy.

- Living Will: A living will specifies a person's desires regarding medical treatment in situations where they cannot express their wishes. It focuses on end-of-life care and life-sustaining treatments.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if the principal becomes incapacitated. It allows an agent to manage financial and legal matters on behalf of the principal.

- Operating Agreement: Essential for LLCs in New York, this document outlines the business's financial and functional decisions, ensuring clarity and safeguarding members' personal assets. For a template, visit https://newyorkform.com/free-operating-agreement-template.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization: This form grants permission for healthcare providers to share medical information with designated individuals. It is essential for ensuring that the agent can make informed decisions regarding health care.

- Financial Power of Attorney: This document specifically focuses on financial matters, allowing an agent to handle banking, investments, and other financial transactions for the principal.

- Will: A will outlines how a person's assets will be distributed after their death. It can also name guardians for minor children and appoint an executor to manage the estate.

- Trust Agreement: This document establishes a trust, allowing a trustee to manage assets on behalf of beneficiaries. It can help with estate planning and may reduce probate costs.

These documents work together with the New Jersey Power of Attorney to create a robust plan for managing personal, medical, and financial affairs. It's important to consider each document's role in your overall estate planning strategy.