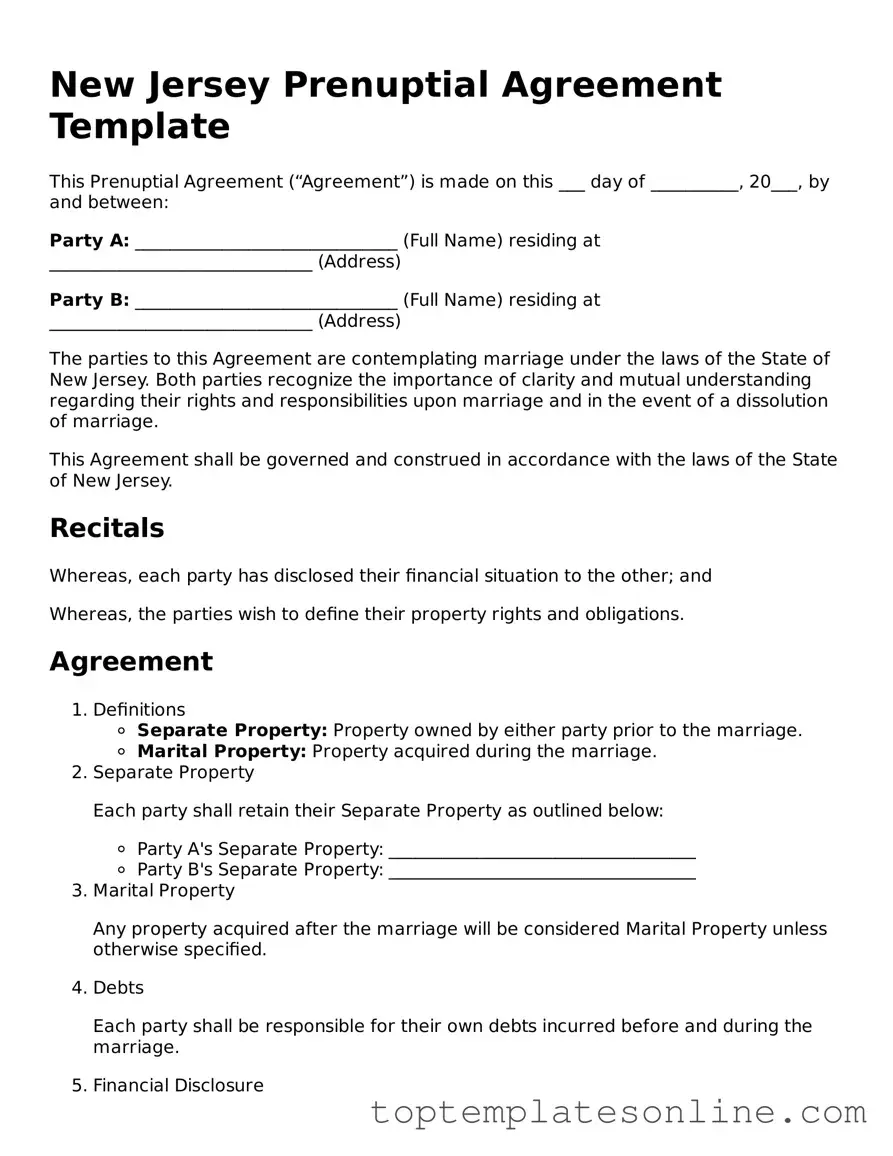

Blank Prenuptial Agreement Template for New Jersey State

Planning for the future is essential, especially when it comes to relationships. A prenuptial agreement can be a helpful tool for couples in New Jersey looking to clarify their financial responsibilities and rights before tying the knot. This legal document outlines how assets will be divided in the event of a divorce, ensuring both partners feel secure and understood. It typically covers various aspects, such as property ownership, debts, and even spousal support. By addressing these issues upfront, couples can focus on building their life together without the worry of potential disputes down the line. Understanding the New Jersey Prenuptial Agreement form is crucial, as it requires specific information and signatures to be valid. This form serves as a foundation for open communication about finances, allowing partners to enter marriage with a clear understanding of each other's expectations.

Some Other State-specific Prenuptial Agreement Templates

New York Prenuptial Contract - This agreement allows for the protection of family inheritances and gifts received during the marriage.

For those looking to formalize their understanding of liability protection, a Hold Harmless Agreement form in New York serves as an essential tool. By using this legal document, individuals or organizations can effectively release themselves from potential legal liabilities during various activities. This agreement is particularly important in contexts such as construction projects or events, where risks are present. For a convenient resource, you can access a sample of this agreement at https://newyorkform.com/free-hold-harmless-agreement-template/, ensuring you have the necessary protection in place.

Georgia Prenuptial Contract - A prenuptial agreement can ensure that both partners' wishes are respected.

Common mistakes

-

Inaccurate Information: One common mistake is providing incorrect personal information. This includes names, addresses, and financial details. Double-checking this information is crucial to avoid complications later.

-

Not Disclosing Assets: Failing to fully disclose all assets can lead to issues down the line. Both parties should list their assets, debts, and income clearly. Transparency is key to a fair agreement.

-

Skipping Legal Review: Some individuals fill out the form without consulting a lawyer. This can result in misunderstandings about the legal implications. Having a professional review the agreement ensures that it meets legal standards.

-

Not Considering Future Changes: People often overlook how their circumstances might change. It’s important to include provisions for future events, like children or changes in income. Planning for the future can help avoid conflicts later.

Guide to Writing New Jersey Prenuptial Agreement

Filling out a New Jersey Prenuptial Agreement form requires careful attention to detail. This document will help outline the financial rights and responsibilities of each party in the event of a divorce or separation. Follow these steps to ensure that you complete the form accurately.

- Gather personal information: Collect full names, addresses, and contact details for both parties. Ensure you have the correct legal names as they appear on official documents.

- Identify assets: List all assets owned individually by each party. This includes real estate, bank accounts, investments, and personal property.

- Determine debts: Document any debts each party has. This includes loans, credit card debts, and any other financial obligations.

- Discuss financial expectations: Have an open conversation about how finances will be managed during the marriage. This can include income, expenses, and savings plans.

- Outline terms: Clearly state the terms of the agreement. This includes how assets and debts will be divided in case of divorce or separation.

- Review legal requirements: Ensure that the agreement complies with New Jersey laws. This may involve consulting with a legal professional for guidance.

- Sign and date: Both parties must sign and date the document in the presence of a notary public. This step is crucial for the agreement to be legally binding.

- Store securely: Keep the signed agreement in a safe place. Each party should have a copy for their records.

Documents used along the form

When preparing a prenuptial agreement in New Jersey, several other forms and documents may be necessary to ensure clarity and legal protection for both parties. Each of these documents serves a specific purpose and can help in addressing various aspects of the relationship and future financial arrangements.

- Financial Disclosure Statement: This document outlines the financial situation of each partner, including assets, debts, and income. It promotes transparency and helps both parties understand each other's financial standing.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It can address changes in circumstances or clarify financial arrangements that may have evolved since the wedding.

- Trailer Bill of Sale: This form is essential for documenting the sale and transfer of ownership of a trailer in Florida. For more information, you can refer to Florida Forms.

- Separation Agreement: If a couple decides to separate, this document can help outline the terms of their separation, including asset division and support obligations, before divorce proceedings begin.

- Divorce Agreement: This document finalizes the terms of a divorce, including asset division, child custody, and support arrangements. It is essential for ensuring both parties agree on the terms of their separation.

- Will: A will outlines how a person's assets will be distributed after their death. Having a will can complement a prenuptial agreement by ensuring that both partners' wishes are respected regarding inheritance.

- Trust Documents: If either party has established a trust, these documents detail how the trust will be managed and how assets will be distributed. Trusts can provide additional financial security and protection.

- Power of Attorney: This document allows one partner to make financial or medical decisions on behalf of the other if they become incapacitated. It is crucial for ensuring that both partners' interests are protected in emergencies.

- Health Care Proxy: Similar to a power of attorney, this document designates someone to make health care decisions on behalf of another person if they cannot do so themselves. It ensures that medical wishes are honored.

Each of these documents plays a vital role in the overall legal framework surrounding a prenuptial agreement. They can help clarify expectations and protect both partners, making it easier to navigate the complexities of marriage and potential future changes.