Blank Promissory Note Template for New Jersey State

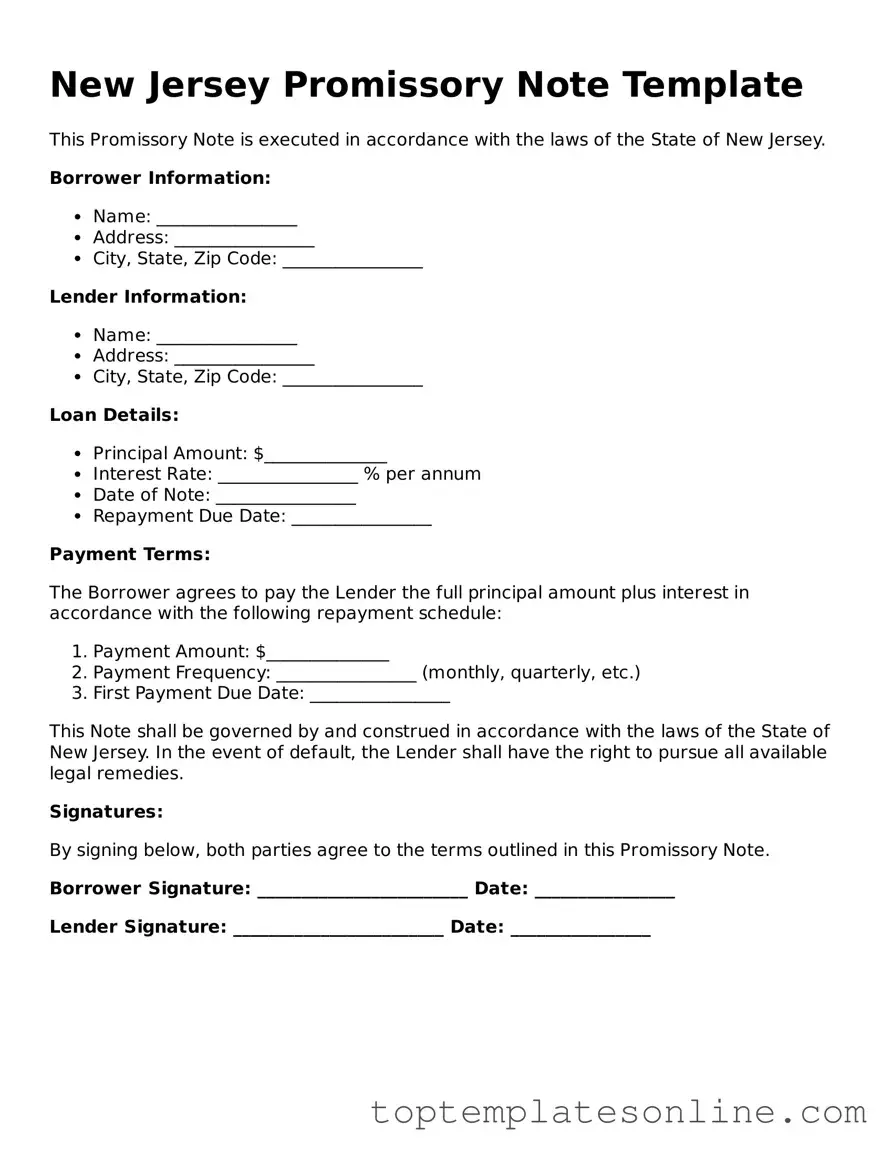

The New Jersey Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating clear agreements regarding the repayment of borrowed funds. This legally binding document outlines the principal amount, interest rate, and repayment schedule, ensuring both parties have a mutual understanding of their obligations. It includes essential details such as the names and addresses of the borrower and lender, the date of the loan, and the terms of default. The form also specifies whether the note is secured or unsecured, providing clarity on whether collateral is involved. In New Jersey, adhering to state-specific requirements is vital for the enforceability of the note, making it important for users to understand the local legal landscape. By using the Promissory Note form, parties can protect their interests and create a structured framework for financial transactions, fostering trust and accountability in lending relationships.

Some Other State-specific Promissory Note Templates

Promissory Note for Personal Loan - This document streamlines the borrowing process by outlining key responsibilities.

Obtaining a reliable guide for the necessary Power of Attorney documentation is crucial for individuals who need to assign decision-making rights responsibly. This formal arrangement ensures that your designated representative can act on your behalf, addressing various financial and medical needs as per your wishes.

Ohio Promissory Note Requirements - A promissory note is a written promise to pay a specified amount of money at a designated time.

Common mistakes

-

Not Including All Necessary Information: It's crucial to provide complete details. Missing information such as names, addresses, or loan amounts can lead to confusion or disputes later on.

-

Incorrectly Stating the Loan Amount: Double-check the loan amount. Typos or miscalculations can create issues in repayment and may complicate the agreement.

-

Neglecting to Specify Interest Rates: Clearly outline the interest rate. If it’s left blank or stated incorrectly, it can lead to misunderstandings about how much needs to be repaid.

-

Failing to Include Payment Terms: Define the payment schedule. Whether it’s monthly, quarterly, or a lump sum, clarity on when payments are due is essential for both parties.

-

Not Signing the Document: This may seem obvious, but forgetting to sign the promissory note can render it invalid. Both the lender and borrower should sign and date the document.

-

Ignoring Witness or Notary Requirements: Depending on the situation, having a witness or notary public may be necessary. This adds an extra layer of legitimacy to the agreement.

-

Overlooking State-Specific Regulations: Each state has its own rules regarding promissory notes. Make sure to be aware of New Jersey’s specific requirements to avoid future legal complications.

Guide to Writing New Jersey Promissory Note

Once you have your New Jersey Promissory Note form in front of you, it’s time to fill it out accurately. This form is essential for documenting a loan agreement between parties. Follow these steps carefully to ensure that all necessary information is included.

- Title the Document: At the top of the form, write “Promissory Note” to clearly indicate the purpose of the document.

- Identify the Borrower: In the first section, provide the full name and address of the borrower. This is the person who will be receiving the loan.

- Identify the Lender: Next, include the full name and address of the lender. This is the individual or entity providing the loan.

- Loan Amount: Clearly state the total amount of money being borrowed. This should be written both in numbers and words to avoid any confusion.

- Interest Rate: Specify the interest rate that will be applied to the loan. Ensure this is clearly stated as a percentage.

- Payment Terms: Outline the repayment schedule. Include details such as the frequency of payments (monthly, quarterly) and the due date for the first payment.

- Maturity Date: Indicate the date by which the loan must be fully repaid. This is crucial for both parties to understand the timeline.

- Signatures: Both the borrower and lender must sign and date the document. This signifies agreement to the terms outlined in the note.

After completing the form, make sure to keep copies for both parties. This helps maintain clear records of the loan agreement and protects everyone involved.

Documents used along the form

When dealing with a New Jersey Promissory Note, several other documents may be necessary to ensure clarity and legal compliance. Each document serves a specific purpose in the lending process. Below are some commonly used forms that accompany a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Durable Power of Attorney: This form designates an agent to manage financial and legal decisions for the principal, ensuring their wishes are honored, even in incapacitation. For more information, you can visit NY Templates.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged as security. It protects the lender’s interests in case of default.

- Truth in Lending Disclosure: This form provides borrowers with important information about the cost of credit. It includes details about the annual percentage rate (APR), finance charges, and total payments over the life of the loan.

- Notice of Default: If the borrower fails to make payments, this document formally notifies them of their default status. It may outline the consequences and next steps for resolution.

These documents work together to create a clear understanding between parties involved in the loan process. Having all necessary paperwork in order can help prevent misunderstandings and protect everyone's interests.