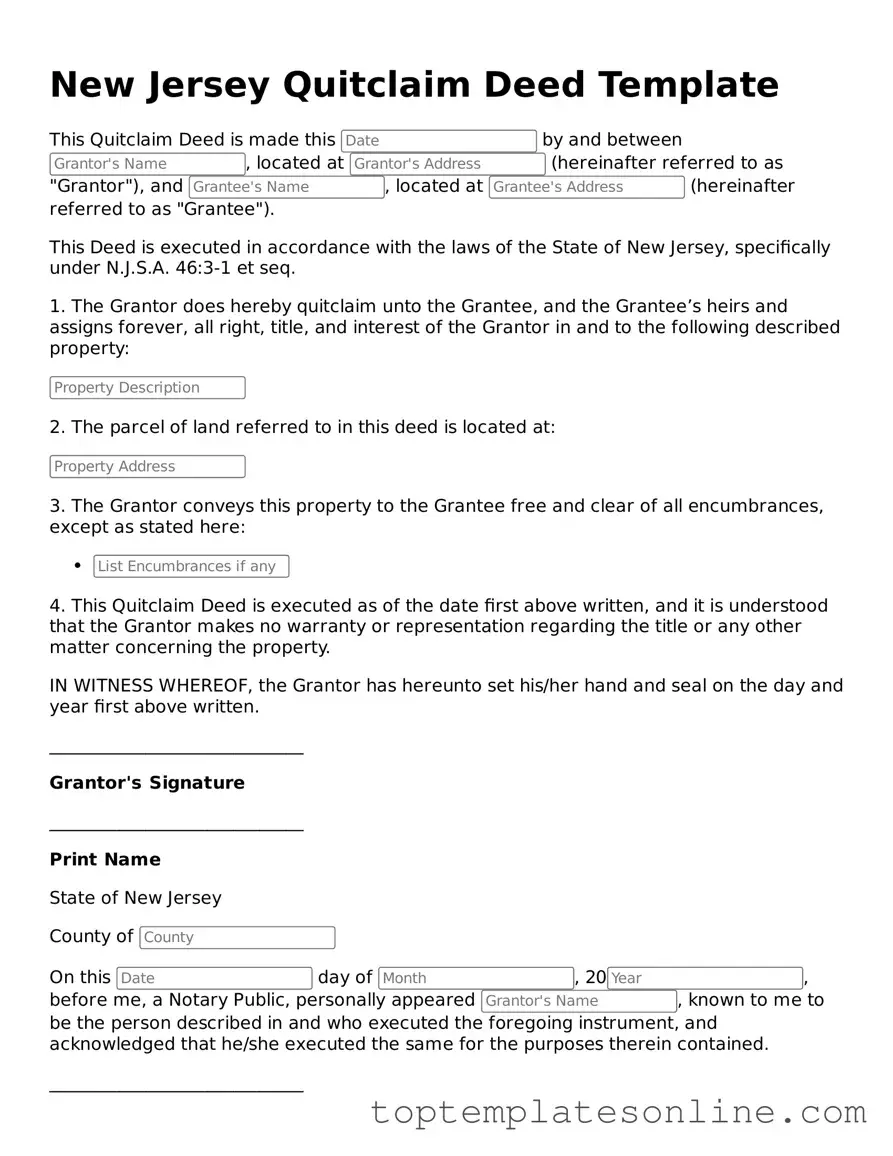

Blank Quitclaim Deed Template for New Jersey State

The New Jersey Quitclaim Deed form serves as an essential tool for property owners looking to transfer their interest in real estate quickly and efficiently. This straightforward document allows one party, known as the grantor, to convey their rights to another party, the grantee, without making any guarantees about the property's title. It's particularly useful in situations such as transferring property between family members or during divorce settlements, where speed and simplicity are often priorities. The form requires basic information, including the names of both parties, a legal description of the property, and the date of the transfer. While it doesn’t provide warranties or assurances regarding the title's validity, it can be a practical solution for those who understand the implications of such a transfer. Understanding how to fill out and file this form correctly is crucial, as it ensures that the transaction is legally recognized and that the new owner can claim their rights to the property without complications.

Some Other State-specific Quitclaim Deed Templates

Quit Claim Deed Form New York Pdf - This form fosters transparency in personal and business property dealings.

For those looking to apply for the Access-A-Ride NYC program, it's essential to have the correct forms and documentation ready. The application process can be streamlined by utilizing resources such as NY Templates, which provide helpful templates to ensure all necessary information is included for a successful application.

Quitclaim Deed Ohio - A Quitclaim Deed is a legal document used to transfer ownership of property.

Common mistakes

-

Incorrect Grantee Information: People often make mistakes when entering the name of the person or entity receiving the property. Ensure that the grantee's name is spelled correctly and matches their legal identification.

-

Failure to Include a Legal Description: A precise legal description of the property is essential. Omitting this information can lead to confusion and potential disputes over property boundaries.

-

Not Signing the Deed: The grantor must sign the Quitclaim Deed for it to be valid. Neglecting to sign can render the document ineffective.

-

Not Having the Deed Notarized: In New Jersey, a Quitclaim Deed must be notarized to be legally recognized. Failing to obtain a notary's signature can result in issues during the recording process.

-

Improper Witness Requirements: While New Jersey does not require witnesses for a Quitclaim Deed, some individuals mistakenly believe they do. Understanding the state's requirements is crucial.

-

Ignoring Local Filing Requirements: Each county in New Jersey may have specific requirements for filing a Quitclaim Deed. Not checking these requirements can lead to delays or rejection of the deed.

-

Not Paying Required Fees: There are fees associated with recording a Quitclaim Deed. Failing to pay these fees can prevent the deed from being recorded properly.

-

Not Keeping Copies: After filing the Quitclaim Deed, individuals should keep copies for their records. Neglecting to do so can lead to difficulties in proving ownership later on.

Guide to Writing New Jersey Quitclaim Deed

Once you have the New Jersey Quitclaim Deed form in hand, it’s essential to fill it out accurately to ensure a smooth transfer of property. Follow the steps below carefully to complete the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the name of the grantor (the person transferring the property). Include their full legal name.

- Next, provide the address of the grantor. This should be a complete address, including city, state, and ZIP code.

- Now, enter the name of the grantee (the person receiving the property). Again, include their full legal name.

- Fill in the address of the grantee, ensuring it is complete with city, state, and ZIP code.

- In the designated area, describe the property being transferred. Include details like the street address and any relevant lot or block numbers.

- Sign the form in the space provided. The grantor must sign in the presence of a notary public.

- Have the signature notarized. The notary will complete their section, verifying the identity of the grantor.

- Finally, make copies of the completed and notarized form for your records before submitting it to the county clerk’s office for recording.

Documents used along the form

When transferring property in New Jersey, the Quitclaim Deed is a crucial document. However, several other forms and documents are often necessary to ensure a smooth transaction. Here’s a list of some commonly used documents that accompany the Quitclaim Deed.

- Property Transfer Form: This form provides information about the property being transferred, including its description and the parties involved in the transaction. It is typically required for tax assessment purposes.

- Affidavit of Title: This document affirms that the seller has clear title to the property and outlines any encumbrances or claims against it. It protects the buyer by confirming the seller's legal right to sell the property.

- Power of Attorney: A Florida Power of Attorney form is crucial for enabling designated agents to make decisions on behalf of the principal, especially in situations where the principal may be unable to act personally. For more information, visit Florida Forms.

- Title Search Report: Conducting a title search is essential to identify any liens, mortgages, or other claims against the property. This report helps ensure that the buyer receives a clear title upon transfer.

- Mortgage Release or Satisfaction Document: If there is an existing mortgage on the property, this document proves that the mortgage has been paid off and releases the property from the lender’s claim.

- Settlement Statement: This document outlines all costs associated with the property transfer, including taxes, fees, and any other expenses. It ensures transparency in the transaction and clarifies the financial obligations of both parties.

- Power of Attorney: In some cases, a seller may not be able to attend the closing. A Power of Attorney allows another person to act on their behalf in signing the Quitclaim Deed and other necessary documents.

Understanding these accompanying documents is essential for anyone involved in a property transfer. Each serves a specific purpose and helps protect the interests of both the buyer and seller. Properly managing these documents will facilitate a successful transaction.