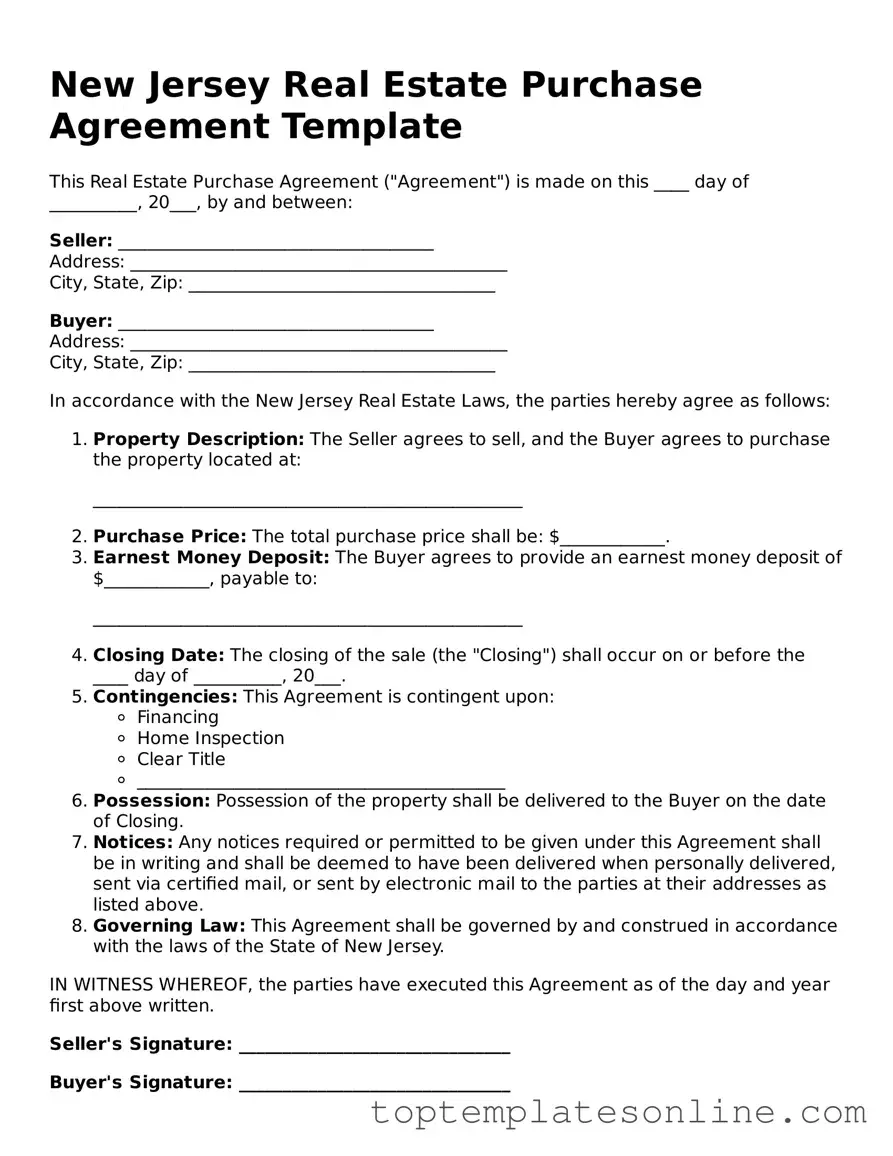

Blank Real Estate Purchase Agreement Template for New Jersey State

The New Jersey Real Estate Purchase Agreement form serves as a crucial document in the home buying process, outlining the terms and conditions agreed upon by both the buyer and the seller. This form encompasses essential details such as the purchase price, property description, and financing contingencies, ensuring that all parties have a clear understanding of their obligations. Additionally, it includes provisions related to earnest money deposits, closing dates, and inspections, which help protect the interests of both the buyer and the seller. By detailing the responsibilities of each party, the agreement fosters transparency and minimizes the potential for disputes. Understanding the components of this form is vital for anyone involved in a real estate transaction in New Jersey, as it lays the groundwork for a successful transfer of property ownership.

Some Other State-specific Real Estate Purchase Agreement Templates

Midland Title - This form is commonly used in both residential and commercial property transactions.

In New York, landlords must ensure they provide a Notice to Quit form, which can be crucial for effective communication with tenants about their rental obligations. For those looking for a clear template to use when issuing this notice, resources such as newyorkform.com/free-notice-to-quit-template/ can prove to be valuable in ensuring compliance with legal standards and facilitating a smoother eviction process if necessary.

North Carolina Association of Realtors - A Real Estate Purchase Agreement may outline customary seller concessions.

Common mistakes

-

Incorrect Property Description: Buyers often fail to provide a precise description of the property. This includes not specifying the lot number, block number, or other identifying details. A vague description can lead to disputes later.

-

Missing Signatures: It is crucial for all parties involved in the transaction to sign the agreement. Omitting a signature can render the contract invalid. Ensure that both the buyer and seller have signed the document.

-

Neglecting to Include Contingencies: Buyers sometimes overlook important contingencies, such as financing or inspection clauses. Without these provisions, they may face significant risks if issues arise after signing.

-

Inaccurate Dates: Failing to include or miswriting critical dates, such as the closing date or the date of acceptance, can create confusion. Clear timelines are essential for a smooth transaction process.

-

Ignoring Local Regulations: Some individuals do not consider local laws or regulations that may affect the purchase. Researching zoning laws or homeowners' association rules is vital to avoid future complications.

Guide to Writing New Jersey Real Estate Purchase Agreement

Once you have the New Jersey Real Estate Purchase Agreement form in hand, you will need to carefully fill it out to ensure all necessary information is included. This process requires attention to detail and accuracy. Below are the steps to guide you through completing the form.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of the buyer(s) and seller(s). Make sure to include all parties involved in the transaction.

- Fill in the property address, including the city, state, and zip code.

- Specify the purchase price of the property. This amount should be clearly stated in both numerical and written form.

- Indicate the amount of the deposit, if applicable. This is often a percentage of the purchase price.

- Complete the financing section. Detail whether the buyer will be obtaining a mortgage or paying in cash.

- Fill out the closing date. This is the date when the transaction will be finalized.

- Include any contingencies, such as home inspections or financing approvals, that may affect the sale.

- Sign and date the agreement at the bottom. Ensure all parties involved have signed the document.

After completing the form, review it for accuracy. It is advisable to consult with a real estate attorney or agent to ensure compliance with all applicable laws and regulations before submitting the agreement.

Documents used along the form

When engaging in real estate transactions in New Jersey, several key documents often accompany the Real Estate Purchase Agreement. Each of these documents serves a specific purpose, helping to ensure clarity and legal compliance throughout the buying process.

- Disclosure Statement: This document outlines any known issues or defects with the property. Sellers are required to provide this to inform buyers of potential concerns that could affect the property's value or safety.

- Title Report: A title report verifies the legal ownership of the property and identifies any liens or encumbrances. This ensures that the buyer receives a clear title upon purchase.

- Property Survey: A survey provides a detailed map of the property boundaries and any structures on it. This is essential for confirming the exact dimensions and any potential encroachments.

- Loan Commitment Letter: If financing is involved, this letter from a lender confirms the buyer's eligibility for a mortgage. It details the loan amount, interest rate, and terms, providing reassurance to both parties.

- Closing Statement: This document summarizes all financial transactions involved in the sale. It includes costs such as closing fees, taxes, and any adjustments, ensuring transparency at the closing table.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be properly executed and recorded to be valid.

- Power of Attorney for a Child: This legal document enables a parent or legal guardian to designate an individual to make decisions on behalf of their child, crucial when the parent cannot care for the child temporarily. For more information, visit Florida Forms.

- Home Inspection Report: This report provides an evaluation of the property's condition. Buyers often request this to identify any repairs needed before finalizing the purchase.

These documents collectively facilitate a smooth transaction, protecting the interests of both buyers and sellers. Understanding their roles can lead to more informed decisions and a successful real estate experience.