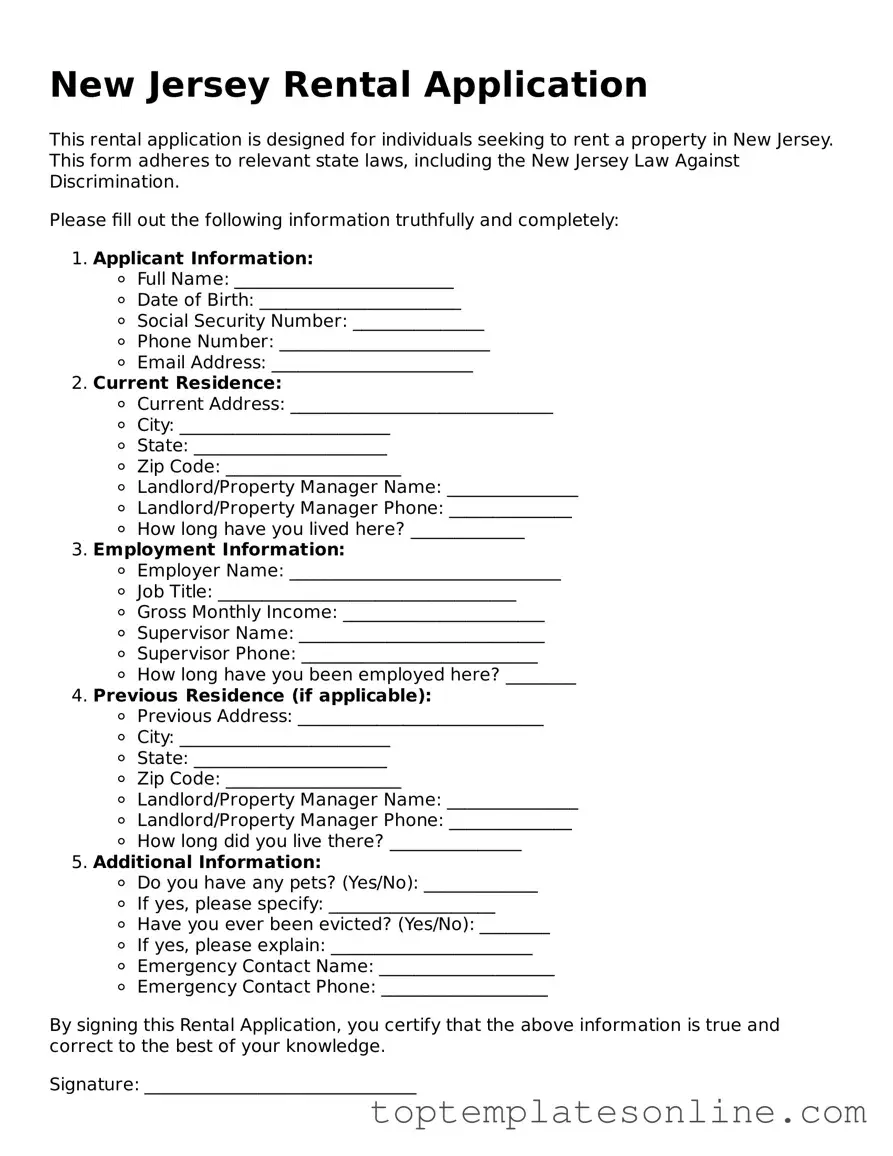

Blank Rental Application Template for New Jersey State

When seeking a rental property in New Jersey, understanding the rental application form is essential for both prospective tenants and landlords. This form serves as a crucial tool for gathering necessary information about applicants, including their employment history, income, rental history, and personal references. It typically requires individuals to provide details such as their Social Security number, contact information, and any previous addresses. Additionally, landlords may request consent to conduct background checks, which can include credit history and criminal background. By completing this form accurately, applicants can present themselves favorably to potential landlords while ensuring that landlords have the information they need to make informed decisions. Familiarity with the rental application process can significantly enhance the chances of securing a desired rental property, making it a vital step in the journey of finding a new home.

Some Other State-specific Rental Application Templates

Tenant Screening Form - Provide a brief personal statement about yourself.

Ga Rental Application - State your preferred method of communication regarding the application.

The Florida Operating Agreement form is a crucial document for limited liability companies (LLCs) in the state. This form outlines the management structure, responsibilities, and financial arrangements of the company, ensuring all members are on the same page. By clearly defining roles and expectations, it helps prevent misunderstandings and promotes smooth operations. For more information, you can refer to the Florida Forms.

Prospective Tenant Application Form - Describe your rental history, including past addresses.

Common mistakes

-

Incomplete Information: Many applicants fail to fill out all sections of the rental application. Missing details can lead to delays or even disqualification.

-

Incorrect Contact Information: Providing wrong phone numbers or email addresses can hinder communication. Always double-check your contact details before submitting.

-

Failure to Disclose Income: Some applicants underestimate the importance of accurately reporting their income. Lenders and landlords need this information to assess your ability to pay rent.

-

Neglecting to List Previous Addresses: Omitting past residences can raise red flags. Landlords often want to verify your rental history.

-

Not Providing References: Failing to include personal or professional references can weaken your application. References can vouch for your reliability and character.

-

Ignoring Credit History: Some applicants do not review their credit reports before applying. A poor credit score can impact your chances of approval.

-

Submitting Without Proof of Identity: Many overlook the requirement to provide identification. A valid ID is often necessary to verify your identity and prevent fraud.

Guide to Writing New Jersey Rental Application

After obtaining the New Jersey Rental Application form, you’re ready to begin the process of filling it out. This form collects essential information that landlords need to evaluate your application. Be prepared to provide personal details, financial information, and references.

- Personal Information: Start by entering your full name, current address, and contact information, including your phone number and email address.

- Rental History: Provide details about your previous addresses. Include the names of landlords, duration of residence, and reasons for leaving each property.

- Employment Information: Fill in your current employer’s name, your job title, and the length of employment. If applicable, include previous employers as well.

- Income Details: List your monthly income and any additional sources of income. Be honest and accurate, as this information helps verify your financial stability.

- References: Include at least two personal or professional references. Make sure to provide their names, contact information, and your relationship to them.

- Background Check Consent: Sign and date the section that allows the landlord to conduct a background check. This is a standard part of the application process.

- Additional Information: If there are any special circumstances or additional details that may help your application, include them here.

Once you have completed the form, review all your entries for accuracy. It’s important to ensure that everything is correct before submitting your application to the landlord or property manager.

Documents used along the form

When applying for a rental property in New Jersey, a rental application form is often accompanied by several other documents. These documents help landlords assess the suitability of potential tenants and ensure a smooth leasing process. Here are five common forms and documents that may be required along with the rental application.

- Credit Report: A credit report provides a detailed account of an applicant's credit history. It includes information about outstanding debts, payment history, and credit score. Landlords use this report to evaluate the financial responsibility of the applicant.

- Background Check Authorization: This document allows landlords to conduct a background check on the applicant. It typically includes consent for checking criminal records and previous rental history. This step helps landlords ensure the safety and security of their property.

- Proof of Income: Applicants often need to provide documentation that verifies their income. This can include pay stubs, tax returns, or bank statements. Landlords use this information to assess whether the applicant can afford the rent.

- Rental History Verification: This document may be requested to confirm the applicant's previous rental experiences. It includes contact information for former landlords and details about the duration of the tenancy. A positive rental history can strengthen an applicant's case.

- Statement of Fact Texas Form: To comply with Texas law regarding vehicle transactions, the texasformspdf.com/ offers this essential document that certifies significant details and minimizes legal risks.

- Pet Policy Agreement: If the rental property allows pets, landlords may require a separate agreement outlining the pet policy. This document specifies any restrictions, fees, or deposits associated with having pets in the rental unit.

Having these documents ready can streamline the application process and improve the chances of securing a rental property. Each document serves a specific purpose in helping landlords make informed decisions about potential tenants.