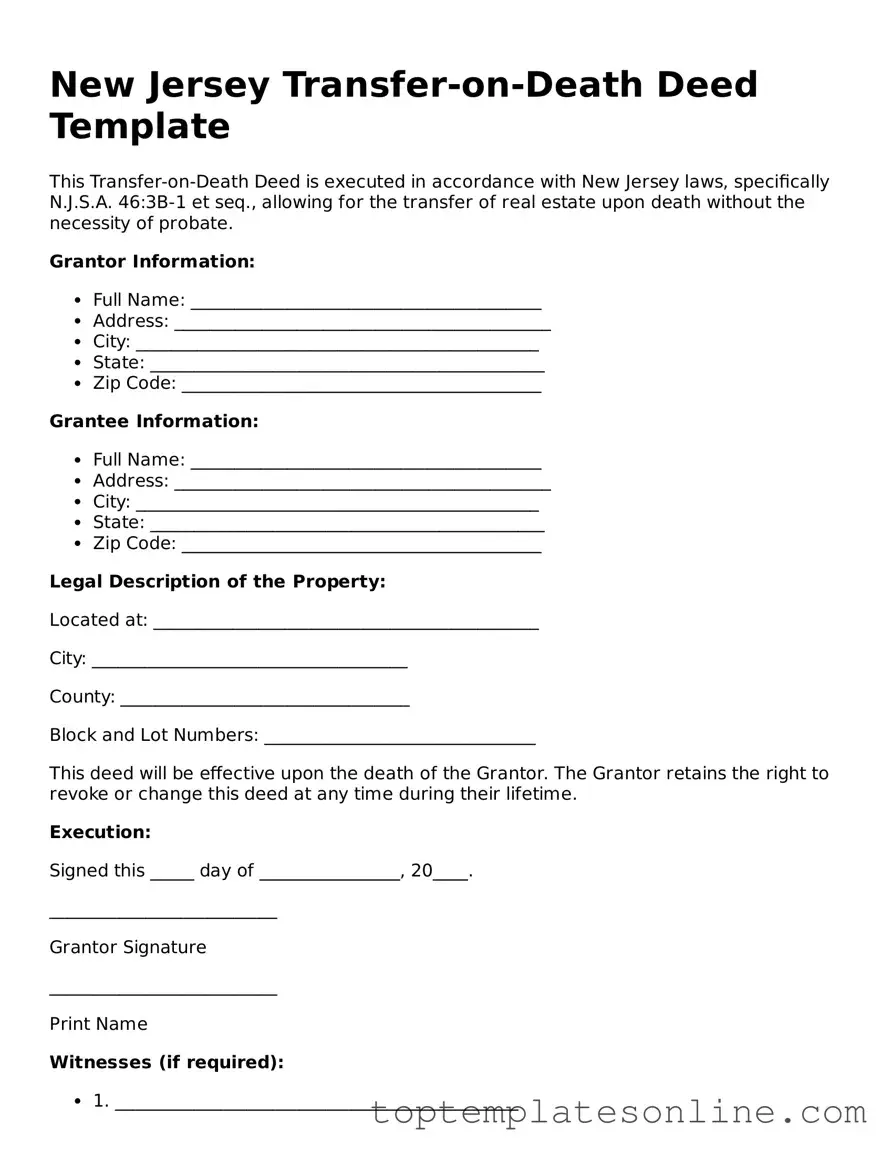

Blank Transfer-on-Death Deed Template for New Jersey State

The New Jersey Transfer-on-Death Deed form serves as a vital tool for property owners looking to streamline the transfer of real estate upon their death. This form allows individuals to designate beneficiaries who will automatically receive ownership of the property, thereby avoiding the often lengthy and costly probate process. By completing this deed, property owners can maintain full control over their assets during their lifetime, ensuring that their wishes are honored without the complications that can arise from traditional inheritance methods. The form must be properly executed and recorded to be effective, and it is essential to ensure that the designated beneficiaries are clearly identified. Additionally, understanding the implications of this deed, including the potential tax consequences and the rights of the beneficiaries, is crucial for making informed decisions. As estate planning becomes increasingly important, the Transfer-on-Death Deed provides a straightforward option for New Jersey residents to manage their real estate assets with confidence and clarity.

Some Other State-specific Transfer-on-Death Deed Templates

Tod Title - This form is often used to transfer real estate, including homes and land.

Acquiring a boat in New York necessitates the proper paperwork, and having the New York Boat Bill of Sale form is crucial for a seamless transition of ownership. This document not only protects both parties but also provides a thorough account of the transaction. For those seeking a template, the NY Templates offers a comprehensive resource to simplify this process and ensure that all legal requirements are met.

Can a Transfer on Death Account Be Contested - This deed can be a valuable estate planning tool for individuals with significant real estate holdings.

Common mistakes

-

Failing to include all required information. Every section of the form must be filled out completely. Missing information can lead to delays or rejection of the deed.

-

Not using the correct legal description of the property. It is essential to provide an accurate description to avoid confusion or disputes later.

-

Neglecting to sign the deed. A signature is necessary for the deed to be valid. Without it, the document cannot be executed.

-

Forgetting to have the deed notarized. New Jersey requires that the deed be notarized for it to be legally binding.

-

Not understanding the implications of the transfer. Individuals should be aware of how a Transfer-on-Death Deed affects their estate and beneficiaries.

-

Using outdated forms. Always ensure that the most current version of the Transfer-on-Death Deed form is being used to comply with current regulations.

-

Overlooking potential tax implications. Transferring property can have tax consequences that should be discussed with a financial advisor.

-

Failing to inform beneficiaries about the deed. Communication is key. Beneficiaries should be aware of the deed to avoid confusion or disputes in the future.

-

Not recording the deed with the county clerk. To ensure the transfer is legally recognized, the deed must be filed with the appropriate local office.

Guide to Writing New Jersey Transfer-on-Death Deed

Filling out the New Jersey Transfer-on-Death Deed form is an important step in ensuring your property is transferred smoothly to your chosen beneficiary upon your passing. This process can help avoid probate and simplify the transfer of ownership. Below are the steps to guide you through completing the form effectively.

- Begin by downloading the New Jersey Transfer-on-Death Deed form from a reliable source or your local government website.

- At the top of the form, enter your name as the current owner of the property.

- Provide your address, including the city, state, and zip code, to ensure proper identification.

- Next, describe the property you are transferring. Include the full address and any relevant details, such as the lot number or block number.

- Identify the beneficiary by entering their full name and address. This person will receive the property after your death.

- If you have multiple beneficiaries, list them in the order you wish for them to inherit the property.

- Include a statement indicating that the transfer will occur upon your death. This is crucial for the deed's validity.

- Sign the form in the designated area. Ensure that your signature matches the name you provided at the top.

- Have the form notarized. A notary public must witness your signature to validate the document.

- Finally, file the completed form with the county clerk's office where the property is located. This step is essential to make the deed effective.

Once the form is filed, the transfer-on-death deed will be in effect, allowing your property to pass directly to your beneficiary without the need for probate. Make sure to keep a copy of the filed deed for your records and inform your beneficiary about the arrangement.

Documents used along the form

When dealing with the New Jersey Transfer-on-Death Deed, several other forms and documents often come into play. These documents help ensure a smooth transfer of property and clarify the intentions of the parties involved. Here’s a look at some essential forms that work alongside the Transfer-on-Death Deed.

- Last Will and Testament: This legal document outlines how a person's assets should be distributed upon their death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in financial or legal matters. It can be crucial if the property owner becomes incapacitated and needs someone to manage their affairs.

- Power of Attorney: Grants someone the authority to act on behalf of another in legal matters, including managing property. This should be in place if decisions need to be made before a death occurs. For more information, visit https://newyorkform.com/free-power-of-attorney-template/.

- Affidavit of Heirship: This sworn statement helps establish the rightful heirs of a deceased person's estate. It may be necessary to clarify who inherits property when the owner passes away without a will.

- Property Deed: The original property deed provides proof of ownership and details about the property. It is essential to have this document on hand when executing a Transfer-on-Death Deed.

- Tax Assessor's Records: These records show the assessed value of the property and can help determine potential tax implications for the beneficiaries after the transfer occurs.

- Notice of Transfer: This document may be required to formally notify interested parties of the transfer of ownership. It ensures transparency and can help prevent disputes among family members or other stakeholders.

Understanding these accompanying documents is crucial for anyone considering a Transfer-on-Death Deed in New Jersey. Each form plays a unique role in the overall process, helping to safeguard the interests of both the property owner and their beneficiaries.