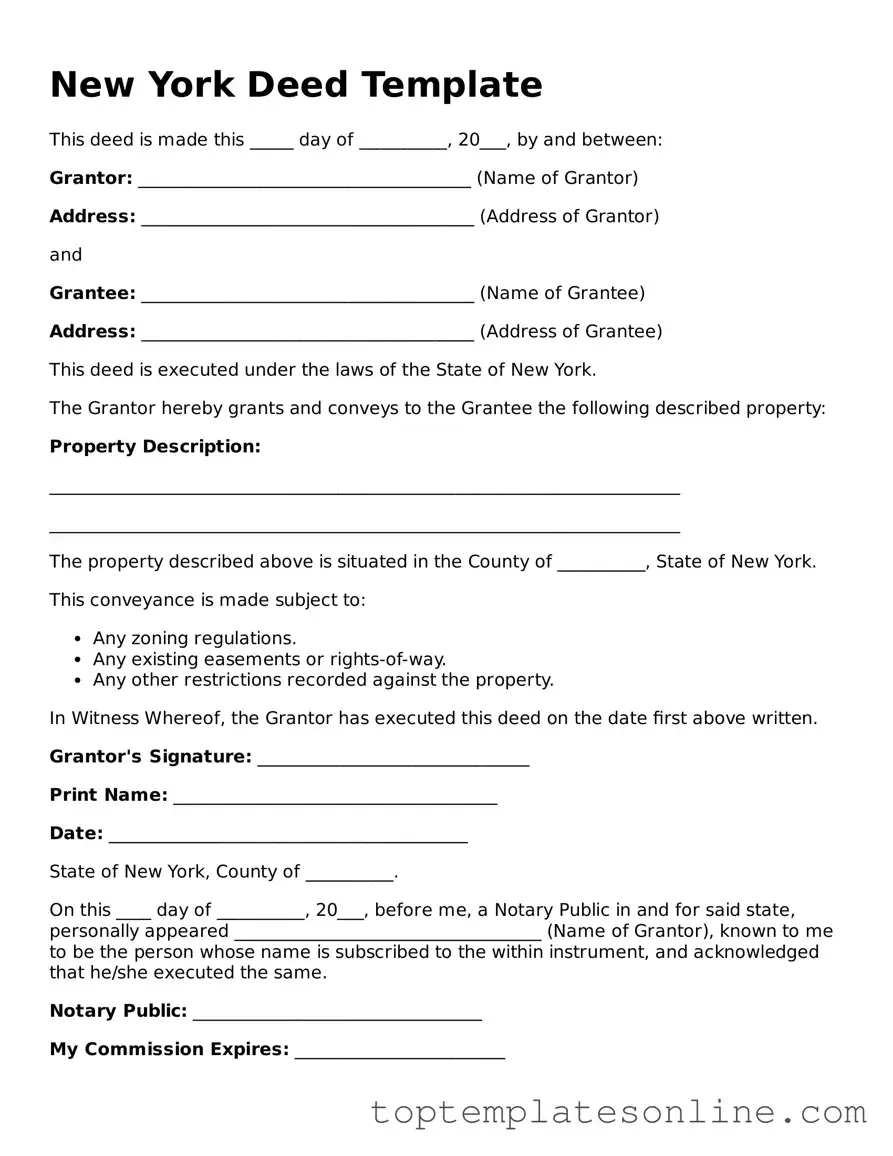

Blank Deed Template for New York State

The New York Deed form is a crucial document used in real estate transactions within the state. It serves to transfer ownership of property from one party to another, ensuring that the transaction is legally recognized. Various types of deeds exist, including warranty deeds and quitclaim deeds, each serving distinct purposes and offering different levels of protection to the buyer. The form typically includes essential details such as the names of the parties involved, a description of the property, and the signature of the grantor. Additionally, the deed must be notarized and recorded with the county clerk to provide public notice of the ownership change. Understanding the components and requirements of the New York Deed form is essential for anyone involved in property transactions, as it safeguards both the buyer’s and seller’s interests while complying with state laws.

Some Other State-specific Deed Templates

Michigan Property Transfer Affidavit - Real estate deeds can also be used for gifting property to family members or charities.

Understanding the provisions of a lease agreement is critical for both tenants and landlords, as it lays down essential details governing their relationship. To facilitate this process, you can access a free template that helps you draft your lease agreement, ensuring it meets legal standards and covers key elements effectively: https://newyorkform.com/free-lease-agreement-template/.

Georgia Quit Claim Deed - Used to officially change the title of real estate.

Property Transfer Form - Ensure all personal information on the Deed is accurate to avoid future issues.

Ohio Warranty Deed Form - There are various types of deeds, including warranty deeds and quitclaim deeds.

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a complete and accurate description of the property. This includes not specifying the lot number, block number, or the exact address. A vague description can lead to confusion and potential legal issues.

-

Missing Signatures: It’s crucial to ensure that all required parties sign the deed. A missing signature can render the deed invalid. Double-check that all owners or parties involved have signed where necessary.

-

Improper Notarization: Deeds must be notarized to be legally binding. Failing to have the document notarized, or using an unqualified notary, can lead to complications. Always confirm that the notary is authorized to act in your state.

-

Inaccurate Names: Spelling errors in the names of the grantor (seller) or grantee (buyer) can create significant problems. It’s important to use full legal names as they appear on identification documents.

-

Omitting the Date: Not including the date of the transaction can cause confusion about when the transfer of ownership took place. Always ensure the date is clearly indicated on the deed.

-

Failure to Include Consideration: The deed should specify the consideration, or the amount paid for the property. Omitting this detail can lead to misunderstandings regarding the transaction.

-

Not Checking Local Requirements: Different counties in New York may have specific requirements for deed forms. Not checking these local regulations can result in the rejection of the deed. Always verify with local authorities before submitting.

Guide to Writing New York Deed

Once you have the New York Deed form, you will need to fill it out accurately to ensure the transfer of property is properly documented. Follow the steps below to complete the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name of the grantor (the person transferring the property). Include their address and any additional identifying information.

- Next, enter the name of the grantee (the person receiving the property). Include their address as well.

- Clearly describe the property being transferred. This should include the street address, city, county, and a legal description of the property.

- Indicate the consideration (the amount paid for the property) in the appropriate section.

- Sign the form in the designated area. The grantor's signature is required.

- Have the signature notarized. A notary public must witness the signing of the form.

- Check that all information is complete and accurate before submitting the form.

After completing the form, it will need to be filed with the appropriate county clerk's office. Be sure to keep a copy for your records.

Documents used along the form

When transferring property ownership in New York, several documents often accompany the deed form to ensure a smooth and legally compliant transaction. Each of these documents serves a specific purpose and helps clarify the details of the property transfer.

- Title Search Report: This document outlines the history of ownership for the property. It reveals any liens, encumbrances, or claims against the property, ensuring that the buyer is fully informed before completing the transaction.

- Affidavit of Title: This sworn statement is provided by the seller, affirming that they hold clear title to the property and have the right to sell it. It serves to protect the buyer from potential disputes over ownership.

- Durable Power of Attorney Form: To secure your interests in situations of incapacity, consider the important Durable Power of Attorney resources that allow you to authorize someone to act on your behalf.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document itemizes all costs associated with the sale, including fees, taxes, and adjustments. It provides transparency for both the buyer and seller regarding the financial aspects of the transaction.

- Transfer Tax Form: This form is required for the payment of state and local transfer taxes when property ownership changes hands. It ensures compliance with tax obligations and is often submitted during the closing process.

Understanding these accompanying documents is crucial for anyone involved in a property transaction. They help ensure that all parties are aware of their rights and responsibilities, ultimately facilitating a successful transfer of ownership.