Blank Deed in Lieu of Foreclosure Template for New York State

In New York, homeowners facing the possibility of foreclosure have a valuable alternative known as the Deed in Lieu of Foreclosure. This legal document allows a property owner to voluntarily transfer the title of their property to the lender, effectively settling the mortgage debt without going through the lengthy and often stressful foreclosure process. By choosing this route, homeowners can avoid the negative impacts on their credit score that typically accompany foreclosure proceedings. The form itself outlines the terms of the transfer, including any conditions set forth by the lender, and serves as a formal agreement between both parties. It is crucial for homeowners to understand their rights and obligations when completing this form, as it can have lasting implications on their financial future. Additionally, the Deed in Lieu of Foreclosure can provide a fresh start, allowing individuals to move forward without the burden of an unpaid mortgage hanging over their heads. Understanding the intricacies of this form is essential for anyone considering this option as a means to navigate financial hardship.

Some Other State-specific Deed in Lieu of Foreclosure Templates

Georgia Foreclosure - The lender typically reviews the property's title to ensure there are no additional liens before finalizing the Deed in Lieu of Foreclosure.

For parents or legal guardians, it is essential to be well-informed about the Florida Power of Attorney for a Child form, as it enables the designation of another person to make crucial decisions on behalf of the child when the parent is unable to do so. To further assist in this process and ensure that the necessary legal documents are in place, you can explore resources such as Florida Forms, which provide valuable information and guidance.

Foreclosure Vs Deed in Lieu - Homeowners should ensure they fully understand the implications of signing a Deed in Lieu of Foreclosure.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details, such as the property address or the names of all parties involved. This can lead to delays or even rejection of the deed.

-

Not Reviewing the Terms: Some people overlook the importance of understanding the terms of the deed in lieu of foreclosure. It’s crucial to be aware of how this decision affects credit scores and future home ownership.

-

Ignoring Lienholders: Individuals often forget to inform all lienholders about the deed in lieu of foreclosure. This can result in complications if other debts are tied to the property.

-

Failure to Seek Professional Advice: Many people skip consulting with a legal or financial expert. Professional guidance can provide clarity and help avoid costly mistakes during the process.

-

Not Notarizing the Document: Some individuals neglect to have the deed notarized. Without proper notarization, the document may not be legally binding, which can create issues down the line.

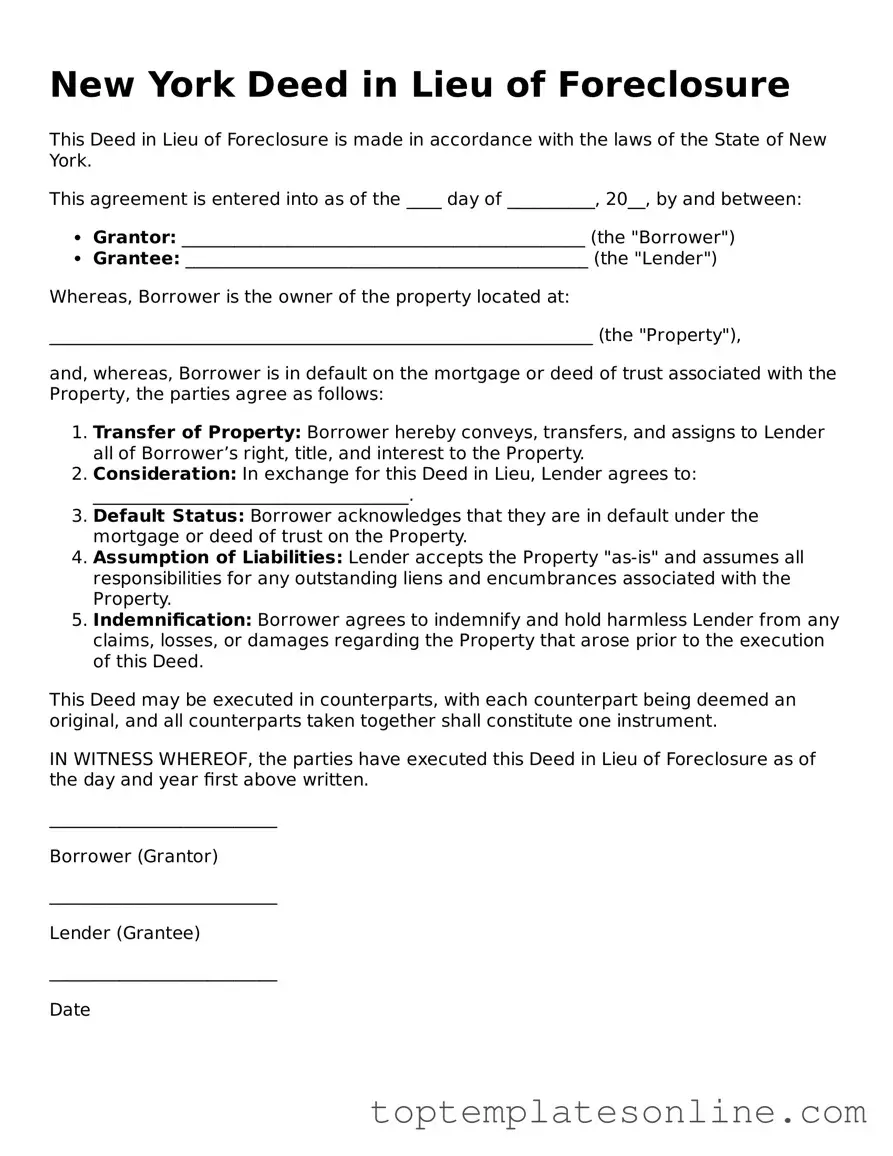

Guide to Writing New York Deed in Lieu of Foreclosure

Once you have the New York Deed in Lieu of Foreclosure form ready, it's time to fill it out carefully. This document requires specific information to ensure that it is valid and properly executed. Take your time to review each section before moving on to the next step.

- Identify the Parties: Begin by filling in the names of the grantor (the property owner) and the grantee (the entity receiving the property). Ensure that the names are spelled correctly and match the official documents.

- Property Description: Provide a detailed description of the property being transferred. Include the address and any relevant parcel numbers. This information is crucial for identifying the property in legal terms.

- Consideration: Indicate any consideration (if applicable) for the transfer. This could be a nominal amount or a statement that the transfer is made without consideration.

- Signatures: The grantor must sign the document. If there are multiple grantors, each one needs to sign. Ensure that signatures are dated appropriately.

- Notarization: Have the signatures notarized. This step is essential to validate the document. The notary will complete the notary section of the form.

- Filing the Deed: After the form is completed and notarized, file it with the county clerk's office in the county where the property is located. There may be a filing fee, so check with the local office for details.

After completing these steps, the Deed in Lieu of Foreclosure will be officially recorded. You should keep a copy for your records. This process is an important step in resolving a foreclosure situation and can help you move forward.

Documents used along the form

A Deed in Lieu of Foreclosure can be a helpful option for homeowners facing financial difficulties. However, it often involves several other forms and documents to ensure the process runs smoothly. Below is a list of commonly used documents that accompany the Deed in Lieu of Foreclosure in New York.

- Loan Modification Agreement: This document outlines any changes to the original loan terms, such as interest rates or payment schedules, which can help make payments more manageable for the homeowner.

- Property Inspection Report: This report provides an assessment of the property's condition. Lenders often require this to evaluate any potential repairs or issues before accepting a deed in lieu.

- Affidavit of Title: This sworn statement confirms that the homeowner has clear title to the property, meaning there are no outstanding liens or claims against it.

- Release of Liability: This document releases the homeowner from any further obligations on the mortgage after the deed is transferred to the lender, providing peace of mind.

- Lease Agreement: It's important to have a clear and comprehensive lease agreement to avoid ambiguities. For more information, you can refer to the newyorkform.com/free-lease-agreement-template.

- Notice of Default: This formal notification informs the homeowner that they are in default on their mortgage payments, often a precursor to foreclosure proceedings.

- Settlement Statement: This document outlines the financial details of the transaction, including any debts settled or payments made at the time of the deed transfer.

- Deed of Trust: In some cases, this document secures the loan by placing a lien on the property, ensuring the lender's interest is protected during the transaction.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, which can be helpful if the homeowner is unable to attend the closing.

- Closing Disclosure: This form provides a detailed account of the closing costs and final terms of the agreement, ensuring both parties are clear on the financial implications.

Understanding these accompanying documents can make the process of a Deed in Lieu of Foreclosure more manageable. Each document plays a crucial role in protecting the interests of both the homeowner and the lender, ensuring a smoother transition during a challenging time.