Blank Durable Power of Attorney Template for New York State

The New York Durable Power of Attorney form serves as a crucial legal tool for individuals seeking to appoint someone they trust to manage their financial affairs, especially in situations where they may become incapacitated. This form allows the appointed agent, often referred to as the attorney-in-fact, to make decisions regarding financial matters, such as paying bills, managing investments, and handling real estate transactions. One of the key features of this document is its durability; it remains effective even if the principal becomes mentally or physically unable to make decisions. This ensures that there is no interruption in the management of the principal's financial responsibilities. Additionally, the form can be tailored to grant specific powers or to limit the agent's authority, providing flexibility to meet individual needs. It is important for individuals to understand the implications of granting such powers, as the agent will have significant control over their financial well-being. By completing and signing this form, individuals can establish a clear plan for their financial future, ensuring that their wishes are respected even in challenging circumstances.

Some Other State-specific Durable Power of Attorney Templates

Durable Power of Attorney Georgia - Distributed copies of the form should be kept in accessible locations for stakeholders.

Power of Attorney in Ohio - This option allows flexibility in managing your affairs.

A Last Will and Testament form is a legal document that outlines how a person's assets and affairs should be managed after their death. In New York, this form serves as a crucial tool for individuals to express their final wishes clearly and ensure that their intentions are honored. For those looking to create this important document, resources such as NY Templates can provide valuable assistance in navigating the complexities of estate planning effectively.

North Carolina Power of Attorney Requirements - This form is essential for anyone seeking to ensure that their financial interests are protected in case of illness or injury.

Common mistakes

-

Not specifying powers clearly: Individuals often overlook the importance of clearly defining the powers granted to the agent. Vague language can lead to confusion and potential disputes later on.

-

Failing to sign in front of a witness: New York requires that the Durable Power of Attorney form be signed in the presence of a witness. Neglecting this step can invalidate the document.

-

Not dating the document: Some people forget to include the date on which the form is signed. A missing date can create complications, especially if the document is questioned in the future.

-

Choosing an untrustworthy agent: Selecting an agent without considering their reliability and integrity can lead to misuse of the powers granted. It's crucial to choose someone who will act in your best interest.

-

Ignoring state-specific requirements: Each state has its own rules regarding Durable Power of Attorney forms. Failing to adhere to New York’s specific requirements can render the document ineffective.

Guide to Writing New York Durable Power of Attorney

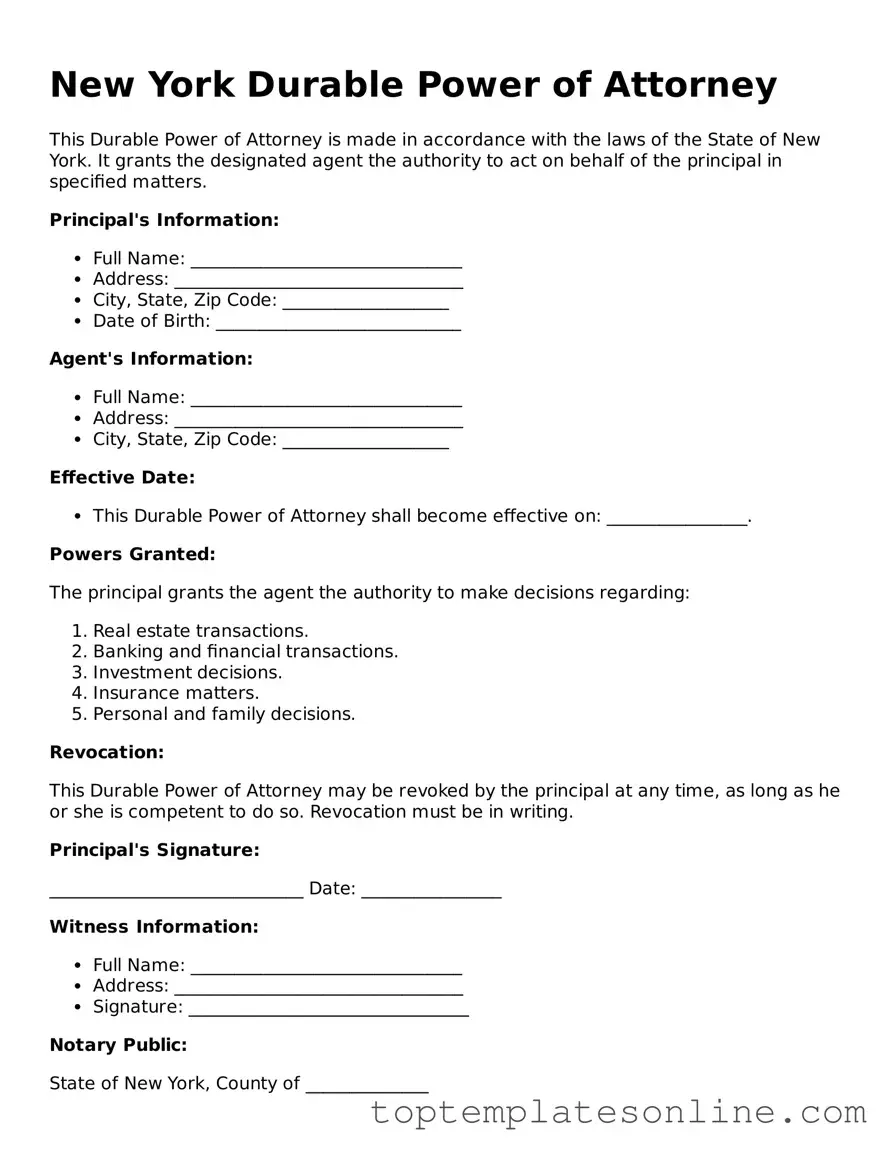

Completing the New York Durable Power of Attorney form requires careful attention to detail. This document will allow you to designate someone to make financial decisions on your behalf if you become unable to do so. Follow these steps to ensure the form is filled out correctly.

- Obtain the New York Durable Power of Attorney form. You can find it online or request a copy from a legal professional.

- Begin by filling in your name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the agent you are appointing. This person will act on your behalf.

- Specify the powers you are granting to your agent. You can choose to give broad authority or limit it to specific areas, such as banking or real estate.

- Sign and date the form in the designated area. Your signature must match the name you provided at the top of the form.

- Have the form notarized. A notary public must witness your signature to validate the document.

- Distribute copies of the completed form to your agent and any relevant financial institutions or parties involved.

Documents used along the form

A Durable Power of Attorney (DPOA) is an important legal document that allows an individual, known as the principal, to appoint someone else, called an agent, to manage their financial and legal affairs. Along with the DPOA, several other forms and documents may be necessary to ensure comprehensive management of an individual's affairs. Below is a list of commonly used documents that often accompany a New York Durable Power of Attorney.

- Health Care Proxy: This document allows an individual to appoint someone to make medical decisions on their behalf if they become incapacitated.

- Living Will: A living will outlines an individual's preferences regarding medical treatment and end-of-life care, providing guidance to healthcare providers and family members.

- Will: A will is a legal document that specifies how a person's assets should be distributed after their death, as well as naming guardians for minor children.

- Revocable Trust: This trust allows a person to manage their assets during their lifetime and designate beneficiaries to receive those assets after their death, avoiding probate.

- Advance Directive: An advance directive combines a living will and health care proxy, providing both treatment preferences and appointing a decision-maker for healthcare matters.

- Financial Power of Attorney: Similar to a DPOA, this document specifically grants authority to an agent to handle financial matters, which may be distinct from healthcare decisions.

- Hold Harmless Agreement: This agreement provides protection from liability and clearly outlines responsibilities, making it essential for various contexts such as construction projects or rental agreements. You can find the necessary documentation in the Hold Harmless Agreement form.

- Beneficiary Designations: These forms specify who will receive assets from accounts like life insurance policies or retirement accounts upon the account holder's death.

- Letter of Instruction: While not a legal document, this letter provides personal guidance and information to loved ones about the individual's wishes and important details regarding their affairs.

- Property Transfer Documents: These include deeds or other documents necessary for transferring real estate or other property to a trust or individual, ensuring clear ownership and management.

Each of these documents plays a crucial role in comprehensive estate planning and decision-making. It is advisable to consider all relevant documents to ensure that personal wishes are honored and that financial and medical matters are managed effectively.