Blank Last Will and Testament Template for New York State

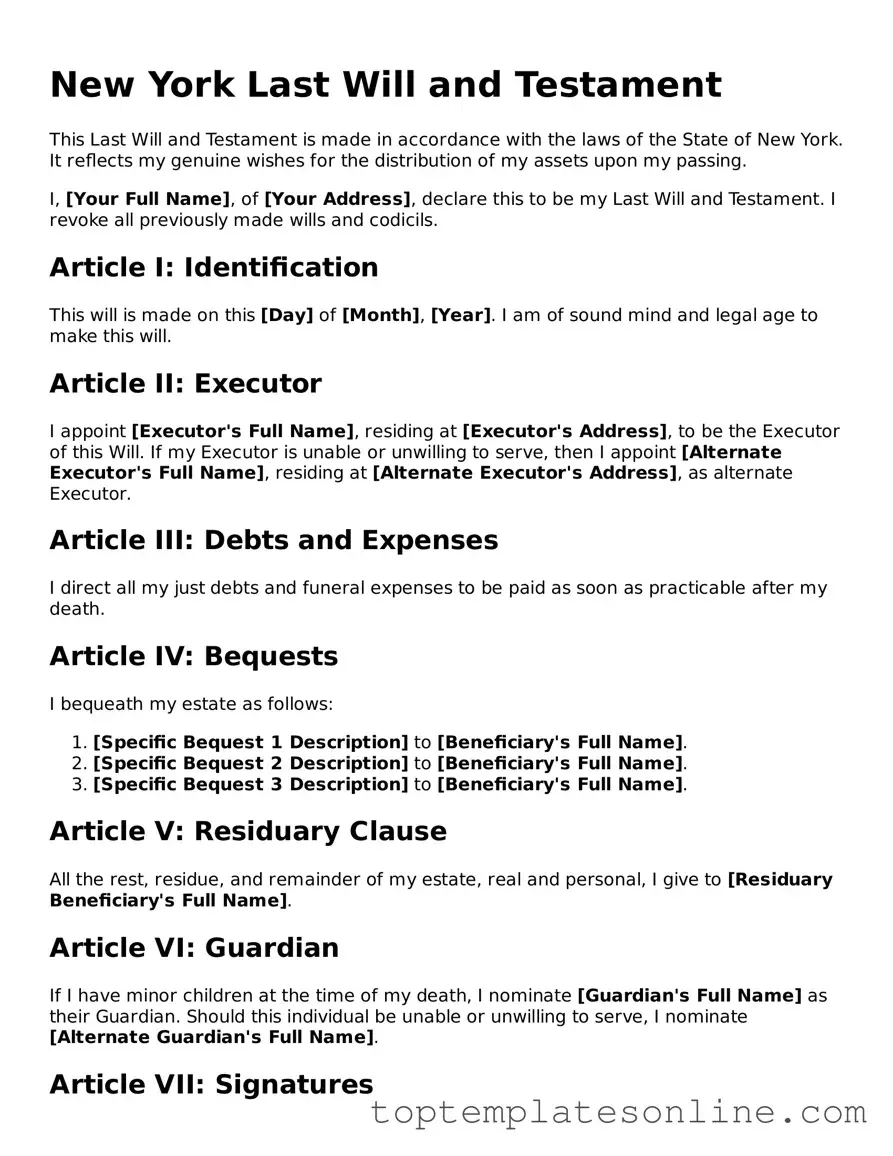

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In New York, this legal document outlines how your assets will be distributed, who will care for your minor children, and who will execute your estate. The form typically includes important sections such as the identification of the testator, the appointment of an executor, and detailed instructions on asset distribution. It also allows you to name guardians for any dependents, ensuring they are cared for by someone you trust. Additionally, the will must be signed and witnessed according to New York law to be valid. Understanding these components can help you navigate the process smoothly and ensure that your final wishes are respected. Whether you are starting from scratch or revising an existing will, knowing what to include can make a significant difference in how your estate is handled. This article will explore the New York Last Will and Testament form, providing insights into its structure and importance in estate planning.

Some Other State-specific Last Will and Testament Templates

Will Template Georgia - A vital part of responsible financial planning for individuals of all ages.

How to Make a Will in Nj - An essential tool for ensuring your wishes are honored after death.

When engaging in the sale of a dirt bike, it is important to utilize a properly formatted Dirt Bike Bill of Sale form to ensure all necessary details are recorded. This legal document not only facilitates the transfer of ownership but also safeguards the interests of both the buyer and seller. For those in New York looking to streamline this process, the NY Templates offer convenient options that can help simplify the paperwork and ensure compliance with local regulations.

Last Will and Testament Michigan - Outlines how to handle any potential tax liabilities resulting from the estate.

Common mistakes

-

Not signing the document properly. A will must be signed by the testator (the person making the will) in the presence of at least two witnesses. Failing to do this can render the will invalid.

-

Forgetting to date the will. It is essential to include the date when the will is signed. Without a date, it may be difficult to determine which version of the will is the most current.

-

Neglecting to name an executor. An executor is responsible for carrying out the wishes outlined in the will. Failing to appoint one can lead to complications and delays in the probate process.

-

Using vague language. Clear and specific language is crucial. Ambiguities can lead to disputes among beneficiaries and may result in the will being contested.

-

Not updating the will. Life changes, such as marriage, divorce, or the birth of children, can affect your wishes. Regularly reviewing and updating the will ensures it reflects your current intentions.

Guide to Writing New York Last Will and Testament

Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. This document outlines how your assets will be distributed and can help prevent disputes among family members. Once you have filled out the form, it’s crucial to ensure it is signed and witnessed properly to make it legally binding.

- Begin by obtaining the New York Last Will and Testament form. You can find this form online or at a legal stationery store.

- At the top of the form, fill in your full name and address. Make sure this information is accurate to avoid any confusion later.

- Clearly state that this document is your Last Will and Testament. This is typically done by including a title at the beginning of the document.

- Designate an executor. This is the person who will carry out your wishes as stated in the will. Include their full name and address.

- List your beneficiaries. These are the individuals or organizations that will receive your assets. Provide their full names and the specific assets they will inherit.

- Include any specific bequests. If you want to leave particular items to specific people, detail those items and their recipients.

- Address any debts or expenses. Specify how any outstanding debts or expenses should be handled, including funeral costs and taxes.

- Sign the document at the bottom. Your signature is essential for the will to be valid.

- Have the will witnessed. In New York, you need at least two witnesses who are not beneficiaries. They should sign the document in your presence.

- Consider having the will notarized. While not required, notarization can add an extra layer of validity.

Documents used along the form

A Last Will and Testament is a crucial document for individuals looking to outline their wishes regarding the distribution of their assets after death. However, several other forms and documents are often used in conjunction with a will to ensure a comprehensive estate plan. Below is a list of commonly associated documents.

- Living Will: This document outlines an individual's preferences for medical treatment in the event they become incapacitated and unable to communicate their wishes. It provides guidance to healthcare providers and loved ones regarding end-of-life care.

- Durable Power of Attorney: This legal document grants another person the authority to make financial and legal decisions on behalf of the individual if they become unable to do so. It remains effective even if the individual becomes incapacitated.

- Healthcare Proxy: Similar to a durable power of attorney, a healthcare proxy designates someone to make medical decisions on behalf of the individual when they are unable to do so. This document ensures that healthcare preferences are respected.

- Non-disclosure Agreement Form: To protect sensitive information, consider utilizing the important Non-disclosure Agreement resources that help establish confidentiality between parties.

- Revocable Living Trust: A revocable living trust allows individuals to place their assets into a trust during their lifetime, which can be managed by them or a designated trustee. This can help avoid probate and provide more control over asset distribution upon death.

These documents, when used alongside a Last Will and Testament, can create a more robust estate plan. They help ensure that an individual's wishes are clearly communicated and legally upheld, providing peace of mind for both the individual and their loved ones.