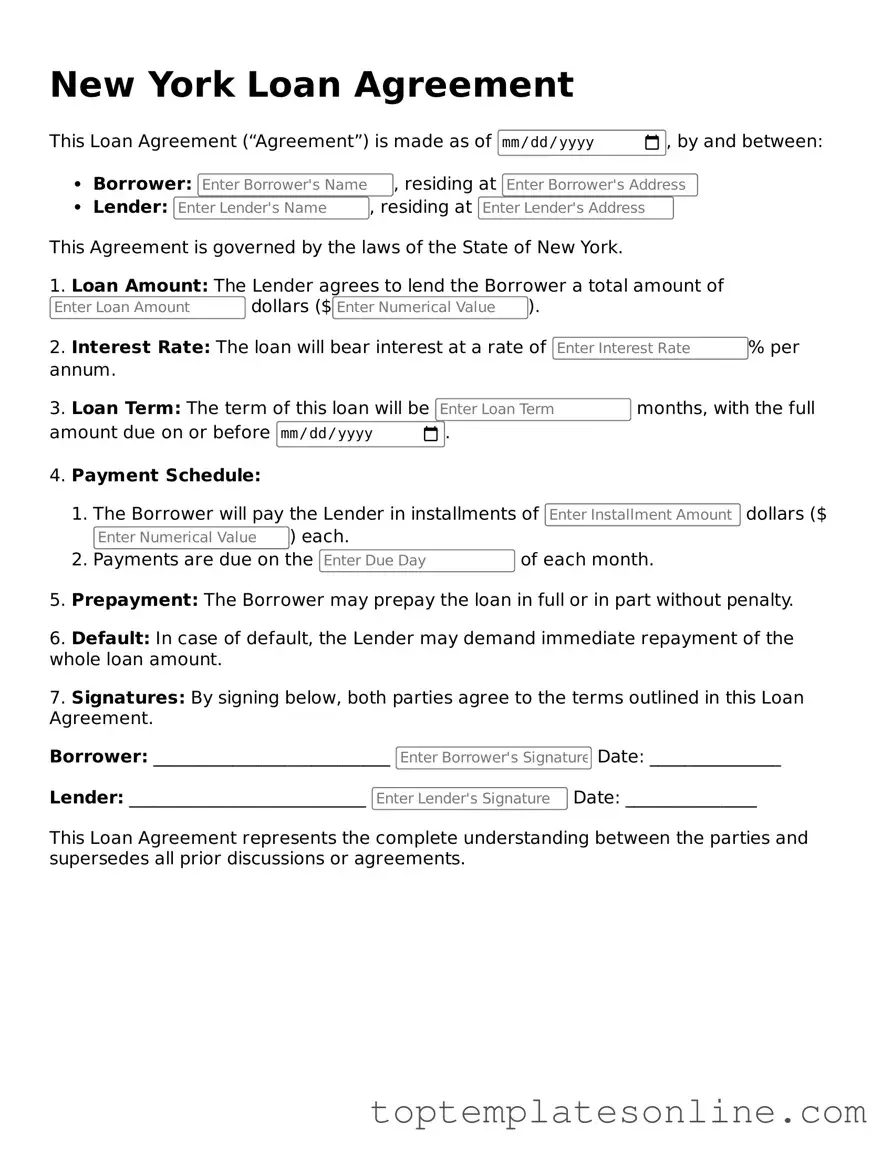

Blank Loan Agreement Template for New York State

The New York Loan Agreement form serves as a crucial document in the realm of lending, outlining the terms and conditions agreed upon by both the lender and the borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it may specify the rights and responsibilities of each party, ensuring clarity and reducing the potential for disputes. In many cases, the agreement will also address what happens in the event of a default, providing a framework for resolution. By laying out these key elements, the New York Loan Agreement form helps to create a transparent and structured lending process, fostering trust between the parties involved. Understanding its components can be beneficial for anyone looking to enter into a loan agreement in New York, whether for personal or business purposes.

Some Other State-specific Loan Agreement Templates

Georgia Promissory Note - The agreement may include provisions for default and remedies available to the lender.

Landlords looking to initiate an eviction process should be familiar with the importance of the Florida Notice to Quit form, as it not only informs tenants of the need to vacate but also aligns with legal requirements. For easy access to this document and other related resources, landlords may refer to Florida Forms, which provide the necessary templates and guidelines.

Texas Promissory Note Template - It can stipulate the currency in which the loan will be repaid, if applicable.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields. Missing information can delay processing or result in rejection of the application.

-

Incorrect Loan Amount: Applicants often miscalculate the amount they need. This can lead to financial strain if the loan is insufficient for their needs.

-

Failure to Review Terms: Some people overlook the terms and conditions of the loan. Not understanding the repayment schedule or interest rates can create future complications.

-

Inaccurate Personal Information: Errors in personal details, such as name or address, can cause issues with communication and documentation.

-

Not Providing Supporting Documents: Individuals sometimes neglect to attach necessary documentation. This oversight can lead to delays in approval or additional requests for information.

Guide to Writing New York Loan Agreement

Filling out the New York Loan Agreement form requires careful attention to detail. Once completed, this form will help outline the terms of the loan between the lender and the borrower. Follow these steps to ensure all necessary information is accurately provided.

- Begin by entering the date at the top of the form. This is the date when the agreement is being executed.

- Next, fill in the name and address of the lender. This identifies who is providing the loan.

- After that, enter the name and address of the borrower. This specifies who is receiving the loan.

- In the designated section, indicate the loan amount. This is the total sum being borrowed.

- Specify the interest rate applicable to the loan. This is usually expressed as a percentage.

- Provide the repayment terms, including the frequency of payments (e.g., monthly, quarterly) and the duration of the loan.

- Include any fees associated with the loan, if applicable. This may cover processing fees or other charges.

- Both the lender and borrower should sign and date the form at the bottom. This signifies their agreement to the terms outlined.

- Finally, make copies of the signed agreement for both parties to keep for their records.

Documents used along the form

When entering into a loan agreement in New York, several other forms and documents may be necessary to ensure that both parties are protected and that the transaction proceeds smoothly. Understanding these documents can help borrowers and lenders navigate the process more effectively.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being pledged. It protects the lender's interest in the collateral should the borrower default on the loan.

- Personal Guarantee: In some cases, especially with business loans, a personal guarantee may be required. This document holds an individual personally responsible for the loan if the borrowing entity fails to repay.

- Disclosure Statement: This form provides essential information about the loan, including the total cost of borrowing, terms, and any fees. It ensures transparency and helps borrowers make informed decisions.

- Loan Application: Before a loan is approved, the borrower typically fills out a loan application. This document collects personal and financial information to assess the borrower's creditworthiness.

- Durable Power of Attorney Form: For ensuring your financial decisions are honored, refer to the comprehensive Durable Power of Attorney form resources that help you appoint a decision-maker in case of incapacitation.

- Closing Statement: At the end of the loan process, a closing statement details all financial transactions involved in the loan. It summarizes the amounts being borrowed, fees, and any other costs associated with closing the loan.

Each of these documents plays a crucial role in the lending process, ensuring clarity and protection for both parties. Familiarity with them can lead to a more confident and informed approach to securing a loan in New York.