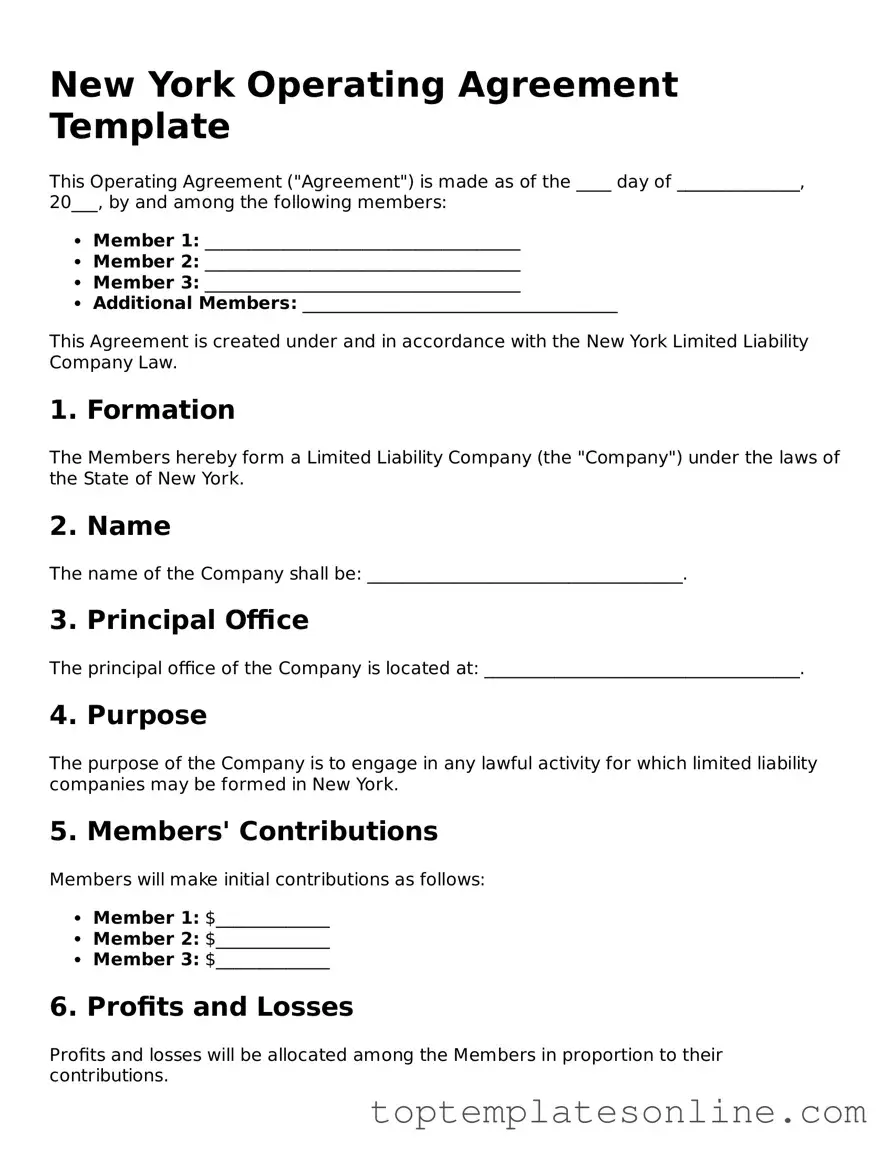

Blank Operating Agreement Template for New York State

When starting a business in New York, one crucial document that every Limited Liability Company (LLC) should consider is the Operating Agreement. This form serves as the backbone of your LLC, outlining how the business will be managed and operated. It addresses key aspects such as ownership structure, member roles, and decision-making processes. By clearly defining these elements, the Operating Agreement helps prevent misunderstandings among members and provides a roadmap for resolving disputes. Additionally, it can outline procedures for adding new members or handling the departure of existing ones, ensuring the LLC can adapt as it grows. Importantly, while New York does not require LLCs to file this agreement with the state, having one in place is essential for establishing credibility and protecting your business interests. Understanding the components of the Operating Agreement is vital for any entrepreneur looking to build a solid foundation for their LLC.

Some Other State-specific Operating Agreement Templates

Texas Llc Filing Fee - An Operating Agreement outlines the legal framework for the business's operations.

To ensure a smooth transaction when transferring ownership, it is advisable to download a copy of the California Dog Bill of Sale. For those looking for a convenient option, the PDF Documents Hub offers an easy way to access this essential legal document, making the process straightforward for both the seller and the buyer.

Create an Operating Agreement - This document helps outline expectations for member contributions, both financial and otherwise.

How to Make an Operating Agreement - It can outline capital contributions required from members.

Common mistakes

-

Neglecting to Include Member Information: One common mistake is failing to provide complete and accurate information about each member. This includes names, addresses, and ownership percentages. Omitting any of this information can lead to confusion and disputes later on.

-

Using Vague Language: Clarity is crucial in an Operating Agreement. Many individuals use ambiguous terms that can be interpreted in multiple ways. This vagueness can create misunderstandings among members, resulting in potential conflicts.

-

Ignoring State-Specific Requirements: Each state has its own laws governing LLCs. Failing to comply with New York's specific requirements can invalidate the agreement. It is essential to understand and incorporate these legal nuances into the document.

-

Overlooking Management Structure: Some people do not clearly define the management structure of the LLC. Whether it is member-managed or manager-managed, this distinction is vital. A lack of clarity can lead to operational inefficiencies and disputes over decision-making authority.

-

Forgetting to Address Profit Distribution: Another frequent oversight is not specifying how profits and losses will be distributed among members. This can create tension and dissatisfaction if expectations are not aligned. Clearly outlining this in the agreement can prevent future disputes.

-

Failing to Update the Agreement: An Operating Agreement is not a static document. It should evolve as the business grows and changes. Many individuals forget to revisit and update the agreement to reflect changes in membership, structure, or business goals. Regular reviews are crucial for maintaining relevance and effectiveness.

Guide to Writing New York Operating Agreement

Completing the New York Operating Agreement form is an important step in establishing the structure and rules for your business entity. Follow these steps carefully to ensure all necessary information is accurately provided.

- Begin by entering the name of the LLC as it appears in your Articles of Organization.

- Provide the principal office address of the LLC, including street address, city, state, and zip code.

- List the names and addresses of all members involved in the LLC.

- Indicate the management structure by specifying whether the LLC will be managed by members or appointed managers.

- Detail the ownership percentages for each member, ensuring the total equals 100%.

- Include any additional provisions that may be relevant to the operation of the LLC, such as profit distribution or decision-making processes.

- Have all members sign and date the agreement to confirm their acceptance of the terms outlined.

After completing the form, keep a copy for your records. It may be necessary to present this document during business transactions or legal proceedings.

Documents used along the form

When forming a Limited Liability Company (LLC) in New York, the Operating Agreement is a crucial document that outlines the management structure and operational guidelines. However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance and clarity in business operations. Below are some of the key documents that you may need to consider.

- Articles of Organization: This document is filed with the New York Department of State to officially create your LLC. It includes basic information such as the company name, address, and the name of the registered agent. Without this form, your LLC cannot exist legally.

- California Motor Vehicle Bill of Sale: This legal document serves as proof of the transfer of ownership for a vehicle and can be found at Motor Vehicle Bill of Sale form.

- Member Consent Forms: These forms are used to document the agreement of members on significant decisions or changes within the LLC. They serve as a record of consent for actions that may not require a formal vote, helping to maintain transparency and accountability among members.

- Bylaws: While not required for LLCs, bylaws can provide additional structure and rules for the internal operations of the company. They typically cover topics such as meeting procedures, voting rights, and the roles of members, ensuring that everyone is on the same page regarding governance.

- Tax Forms: Depending on the nature of your LLC and its income, various tax forms may be necessary. For instance, an LLC may need to file IRS Form 1065 for partnership taxation or elect to be taxed as an S Corporation. Understanding your tax obligations is essential for compliance and financial health.

Each of these documents plays a vital role in the establishment and ongoing management of your LLC. By ensuring that all necessary forms are completed and filed correctly, you can help safeguard your business and promote a clear understanding among all members involved. Taking these steps may seem daunting, but they are essential for a successful and compliant business operation.