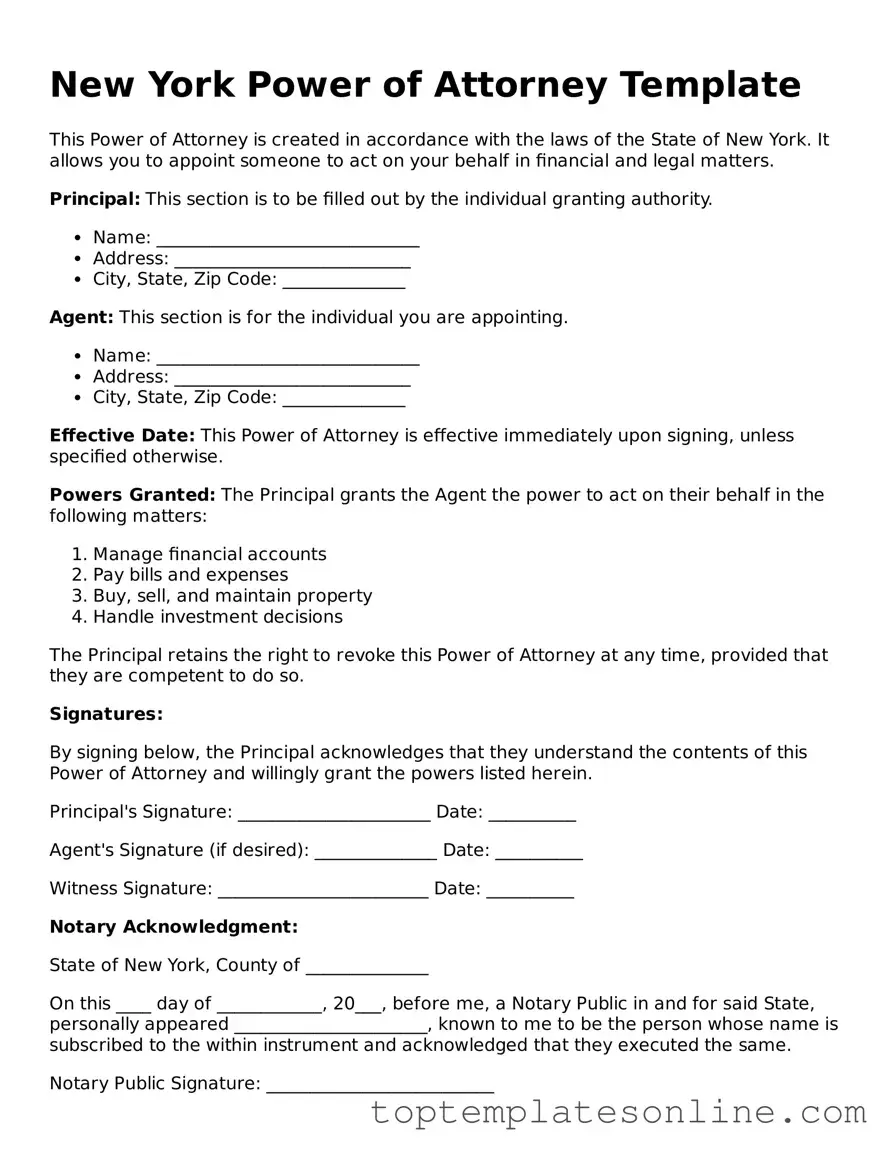

Blank Power of Attorney Template for New York State

When it comes to managing your financial and legal affairs, having a reliable Power of Attorney (POA) in place can make a significant difference. In New York, this important document allows you to appoint someone you trust to act on your behalf in various situations, whether it’s handling your finances, making healthcare decisions, or managing property matters. The New York Power of Attorney form is designed to be straightforward, ensuring that your chosen agent can make decisions that align with your wishes. This form encompasses several key elements, including the designation of your agent, the specific powers granted, and any limitations you wish to impose. It’s important to note that the POA can be tailored to your needs, allowing for broad or limited authority depending on your preferences. Additionally, understanding the legal requirements for executing this document, such as the need for witnesses and notarization, is crucial to ensure its validity. As you navigate the intricacies of this form, you’ll find that it serves as a vital tool for safeguarding your interests and ensuring that your affairs are managed according to your wishes, even when you may not be able to do so yourself.

Some Other State-specific Power of Attorney Templates

Ga Power of Attorney - Creating a Power of Attorney typically does not require a lawyer, but it may be beneficial.

When entering into any rental relationship, it is crucial to have a clear understanding of the obligations and expectations outlined in a lease. A well-structured Rental Contract serves as an essential reference point for both the landlord and tenant, detailing the specifics of the rental arrangement to prevent disputes and ensure a smooth tenancy.

Free Michigan Power of Attorney Forms to Print - Effective in transferring property rights when an individual is incapacitated.

Common mistakes

-

Not Specifying Powers Clearly: Many individuals fail to clearly outline the powers they are granting. It's crucial to be specific about what the agent can and cannot do. Ambiguity can lead to confusion and misuse of authority.

-

Forgetting to Sign and Date: A common oversight is neglecting to sign and date the form. Without a signature, the document is not valid. Ensure that all necessary parties have signed and dated the document.

-

Neglecting Witnesses or Notary: Some people overlook the requirement for witnesses or a notary. New York law mandates that the Power of Attorney form must be signed in the presence of a notary public or witnesses to be legally binding.

-

Using an Outdated Form: Using an outdated version of the Power of Attorney form can lead to complications. Always ensure you are using the most current form, as laws and requirements may change.

-

Not Reviewing the Document Thoroughly: Failing to review the entire document before submission can result in errors. Take the time to read through the form carefully to catch any mistakes or omissions.

Guide to Writing New York Power of Attorney

Filling out the New York Power of Attorney form is an important step in ensuring that your financial and legal matters can be managed by someone you trust. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Below are the steps you should follow to complete the form.

- Begin by downloading the New York Power of Attorney form from a reliable source or obtain a hard copy from a legal office.

- Fill in your name and address in the designated section at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Specify the powers you wish to grant to your agent. You can choose to give them broad authority or limit their powers to specific tasks.

- In the section provided, add any additional instructions or limitations regarding the powers you are granting.

- Sign and date the form in the appropriate area. Your signature must be witnessed by at least one person, who must also sign the document.

- Have the form notarized. This step is crucial, as it adds an extra layer of verification to your document.

- Make copies of the completed form for your records and to provide to your agent and any relevant financial institutions.

After completing these steps, your Power of Attorney form will be ready for use. Ensure that you keep it in a safe place and inform your agent where it can be found when needed.

Documents used along the form

When dealing with a New York Power of Attorney, several other forms and documents may be necessary to ensure that your legal and financial affairs are handled effectively. Each of these documents serves a specific purpose and can complement the Power of Attorney, enhancing its effectiveness and clarity.

- Health Care Proxy: This document allows you to appoint someone to make medical decisions on your behalf if you become unable to do so. It ensures that your healthcare preferences are respected even when you cannot communicate them yourself.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you are terminally ill or incapacitated. This document works alongside a Health Care Proxy to provide clear guidance to your appointed agent.

- Motor Vehicle Power of Attorney: This legal document allows one person to authorize another to act on their behalf regarding motor vehicle transactions, such as title transfers and registration. It is essential to have the Motor Vehicle Power of Attorney form ready when handling vehicle-related matters efficiently.

- Will: A Will details how your assets will be distributed after your death. It can also appoint guardians for minor children. Having a Will in place can prevent disputes and ensure that your wishes are honored.

- Advance Directive: This document combines elements of both a Health Care Proxy and a Living Will. It allows you to express your healthcare preferences and designate someone to make decisions for you, ensuring that your choices are known and respected.

- Financial Power of Attorney: Similar to a general Power of Attorney, this specific document grants someone authority to manage your financial affairs. It can be tailored to cover specific transactions or broader financial responsibilities.

Understanding these documents can help you create a comprehensive plan for managing your affairs. Each form plays a vital role in ensuring that your wishes are respected and that your loved ones are prepared to act on your behalf when necessary.