Blank Promissory Note Template for New York State

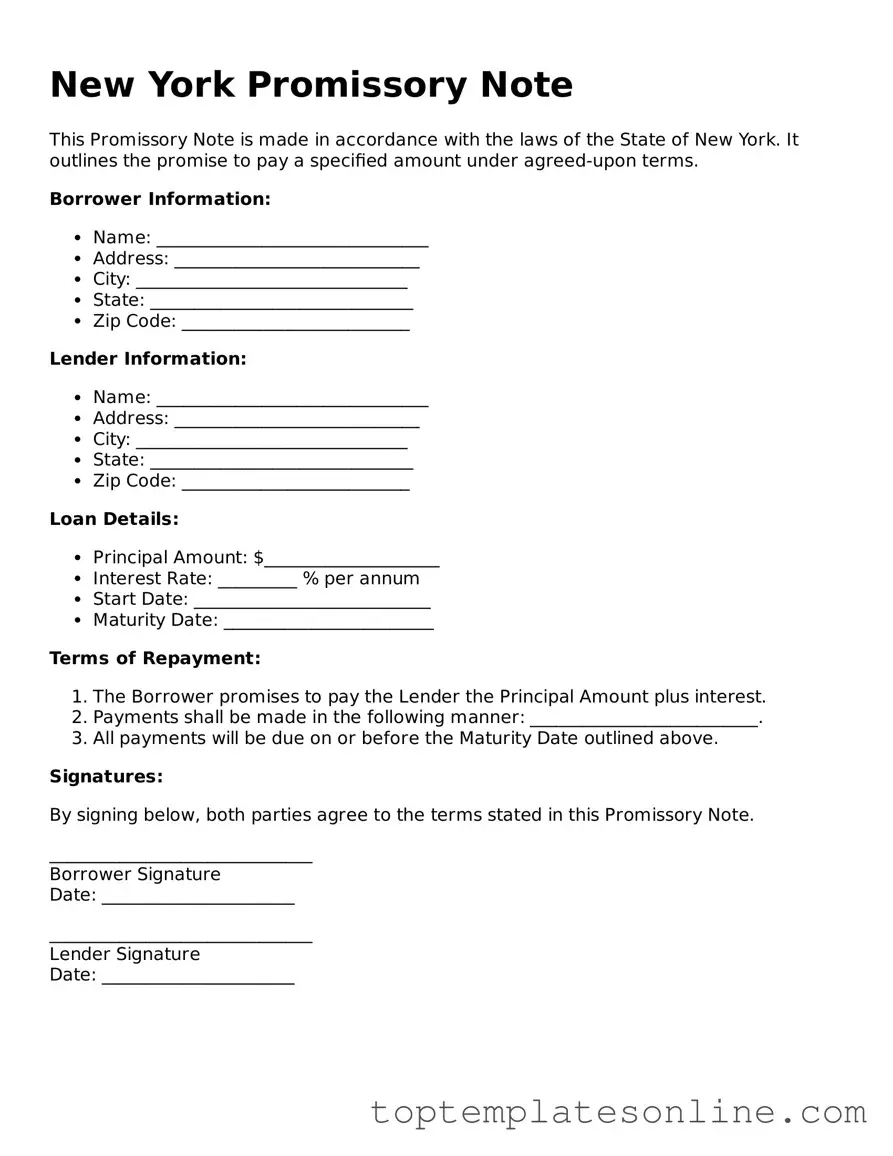

The New York Promissory Note form serves as a vital instrument in the realm of personal and business finance, facilitating the clear documentation of a borrower's promise to repay a specified sum to a lender. This legally binding agreement outlines essential details, including the principal amount borrowed, the interest rate applicable, and the repayment schedule. Additionally, it may incorporate terms regarding late fees, prepayment options, and default consequences, ensuring that both parties understand their rights and obligations. The form can be tailored to suit various financial arrangements, whether for a personal loan between friends or a more formal business transaction. By providing clarity and structure, the New York Promissory Note not only protects the interests of the lender but also offers the borrower a transparent framework for managing their debt. Understanding the components and implications of this document is crucial for anyone engaging in financial agreements within the state, as it lays the groundwork for trust and accountability in lending relationships.

Some Other State-specific Promissory Note Templates

Ohio Promissory Note Requirements - Prompt administration of a promissory note can prevent misunderstandings.

Nc Promissory Note - A useful form for private lending agreements outside of banks.

Filing the New York Articles of Incorporation form is vital for starting your business journey in New York, as it provides a legal framework for your corporation. To assist you in this process, consider utilizing resources from NY Templates, which can help clarify the necessary steps and documentation required for successful incorporation.

Loan Agreement Template Texas - A promissory note is a written promise to pay a specified sum of money to another party.

Michigan Promissory Note Example - This document plays a crucial role in personal and business financial transactions.

Common mistakes

-

Incorrect Borrower Information: Individuals often fail to provide accurate details about the borrower, such as the full name and address. This can lead to confusion or disputes later on.

-

Missing Lender Information: Just as with the borrower, omitting the lender's full name and contact information can complicate the enforcement of the note.

-

Unclear Loan Amount: Some people write the loan amount incorrectly or ambiguously. It's crucial to clearly state the amount in both numbers and words to avoid misunderstandings.

-

Omitting Interest Rate: Not specifying the interest rate or leaving it blank can lead to legal issues. If interest is to be charged, it should be clearly defined.

-

Failure to Specify Payment Terms: Individuals sometimes neglect to outline how and when payments will be made. Clearly defined payment schedules help prevent future disputes.

-

Ignoring Late Payment Penalties: Some forms lack a clause about penalties for late payments. Including this can encourage timely payments and clarify consequences.

-

Not Including a Default Clause: A default clause outlines what happens if the borrower fails to repay. Without it, the lender may have limited options in case of non-payment.

-

Improper Signatures: All parties involved must sign the document. Failing to obtain the necessary signatures can render the note unenforceable.

-

Not Keeping Copies: After filling out the form, some forget to keep copies for their records. Having a copy is important for both parties to refer back to the terms agreed upon.

Guide to Writing New York Promissory Note

Once you have your New York Promissory Note form ready, it’s important to fill it out accurately. This document is essential for outlining the terms of a loan agreement between the borrower and lender. Following these steps will help ensure that all necessary information is included and clearly presented.

- Title the Document: At the top of the form, clearly label it as a "Promissory Note."

- Enter the Date: Write the date when the note is being created. This is typically the date you are signing the document.

- Borrower Information: Provide the full name and address of the borrower. This identifies who is responsible for repaying the loan.

- Lender Information: Include the full name and address of the lender. This identifies who is providing the loan.

- Loan Amount: Clearly state the total amount of money being borrowed. This should be written in both numbers and words for clarity.

- Interest Rate: Specify the interest rate that will apply to the loan. Make sure to indicate whether it is a fixed or variable rate.

- Payment Terms: Describe how the borrower will repay the loan. Include the payment schedule, such as monthly or quarterly payments, and the duration of the loan.

- Late Fees: If applicable, outline any fees that will be charged if a payment is missed or late.

- Signatures: Both the borrower and lender must sign the document. Include the date next to each signature to indicate when they signed.

- Witness or Notary: Depending on your needs, you may want to have the document witnessed or notarized for added legal protection.

After completing these steps, review the document to ensure all information is accurate and complete. Once satisfied, both parties can retain copies for their records. This will help maintain clarity and accountability regarding the loan agreement.

Documents used along the form

When dealing with a New York Promissory Note, several other forms and documents often accompany it to ensure clarity and legal compliance. Each of these documents serves a specific purpose, helping both parties understand their rights and obligations. Below is a list of commonly used forms that you might encounter alongside a promissory note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower, detailing expectations and responsibilities.

- Security Agreement: If the loan is secured by collateral, this document specifies what assets are being pledged. It protects the lender's interests by providing a legal claim to the collateral in case of default.

- Motor Vehicle Bill of Sale: When conducting vehicle transactions, refer to our comprehensive Motor Vehicle Bill of Sale documentation to ensure proper ownership transfer and legal compliance.

- Disclosure Statement: This form provides important information about the loan, including the total cost, interest rates, and any fees. It ensures that the borrower fully understands the financial implications of the loan before signing.

- Guaranty Agreement: In cases where a third party agrees to take responsibility for the loan if the borrower defaults, this document is used. It provides additional security for the lender and outlines the guarantor's obligations.

Having these documents in place can significantly reduce misunderstandings and disputes. They create a clear framework for the loan relationship, ensuring that both parties know their rights and responsibilities. This proactive approach can lead to a smoother lending experience and foster trust between the lender and borrower.