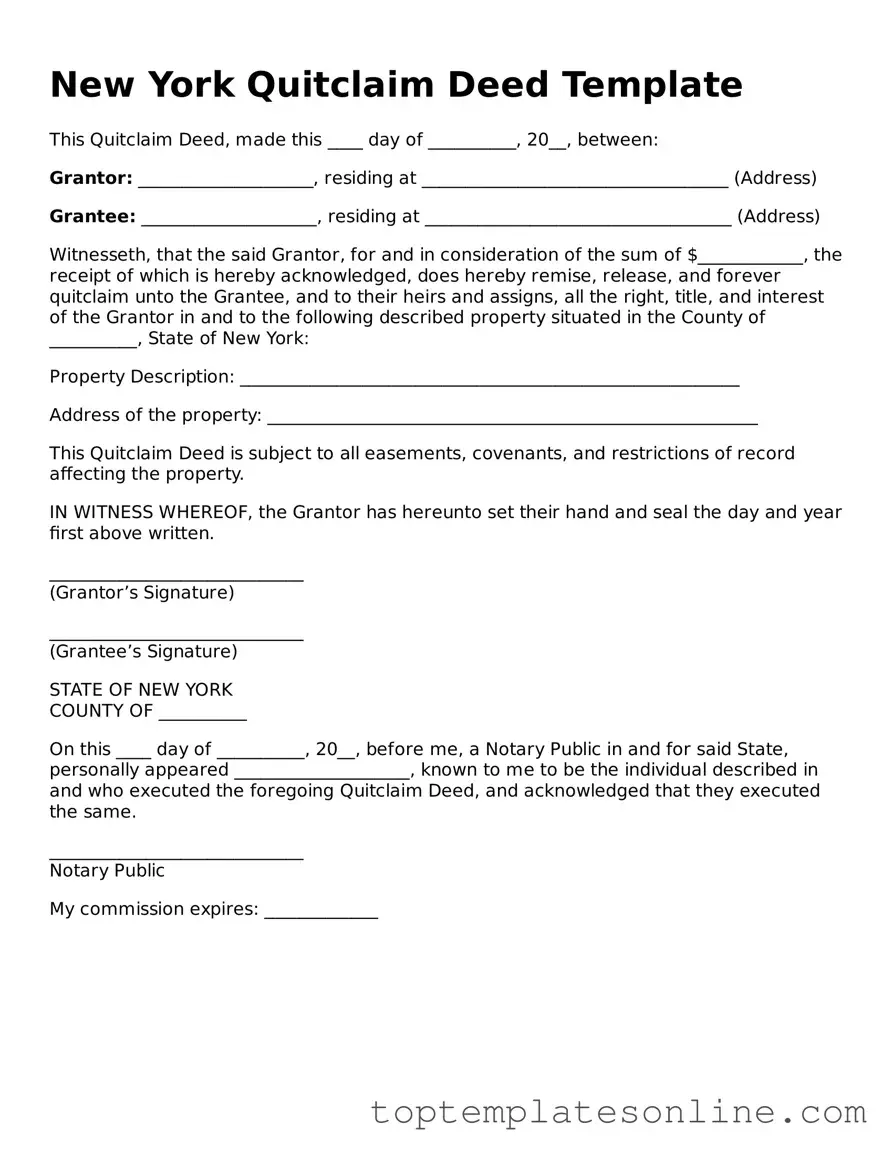

Blank Quitclaim Deed Template for New York State

The New York Quitclaim Deed is a crucial legal instrument used in real estate transactions, particularly when transferring property rights. This form allows an individual, known as the grantor, to convey any interest they may have in a property to another party, called the grantee, without making any promises about the quality of that interest. Unlike warranty deeds, which guarantee a clear title, the quitclaim deed offers no such assurances. It is often utilized in situations such as transferring property between family members, resolving title issues, or during divorce settlements. The form itself must include specific elements to be valid, such as the names of the parties involved, a description of the property, and the signatures of the grantor and a notary public. Understanding the nuances of this deed is essential for anyone engaged in property transactions in New York, as it can significantly impact ownership rights and responsibilities.

Some Other State-specific Quitclaim Deed Templates

Quit Deed Form Texas - This deed may help resolve issues when multiple owners want to reassign their interests in a property.

Quitclaim Deed Ohio - The buyer in a Quitclaim Deed is referred to as the grantee.

For an effective transaction, it is advisable to familiarize yourself with the necessary documentation, including the new motor vehicle bill of sale that outlines the terms between buyers and sellers. This form serves as a vital record, ensuring both parties are aware of their obligations and rights in the sale process.

How to Gift a House to a Family Member - A Quitclaim Deed can be revoked only through further legal action.

Warranty Deed - Always ensure that both parties agree on the terms prior to executing a Quitclaim Deed.

Common mistakes

-

Incorrect Grantee Information: One common mistake is providing inaccurate or incomplete information for the grantee. Ensure that the full legal name and address of the grantee are clearly stated. Missing or incorrect details can lead to future disputes or complications.

-

Failure to Sign: Both the grantor and grantee must sign the Quitclaim Deed. Sometimes, individuals forget to include their signatures, which renders the document invalid. Always double-check for signatures before submission.

-

Omitting Notarization: Many people overlook the requirement for notarization. A Quitclaim Deed must be notarized to be legally binding. Without a notary's signature and seal, the deed may not be accepted by the county clerk's office.

-

Incorrect Legal Description: The property description must be accurate and detailed. Errors in the legal description can create issues with property rights. Use a recent property survey or tax records to ensure accuracy.

-

Not Recording the Deed: After completing the Quitclaim Deed, it is essential to file it with the appropriate county office. Failing to record the deed can lead to complications in proving ownership. Ensure that you understand the recording process in your local jurisdiction.

Guide to Writing New York Quitclaim Deed

Once you have the New York Quitclaim Deed form ready, it’s important to fill it out accurately to ensure the transfer of property is legally recognized. After completing the form, it will need to be signed and notarized before being filed with the appropriate county clerk's office.

- Obtain the New York Quitclaim Deed form. This can be found online or at your local county clerk's office.

- Fill in the **grantor’s** information. This is the person transferring the property. Include their full name and address.

- Provide the **grantee’s** information. This is the person receiving the property. Include their full name and address as well.

- Describe the property being transferred. Include the street address and any other identifying information, such as the parcel number.

- Include the date of the transfer. This is the date when the deed will take effect.

- Sign the form in the presence of a notary public. The grantor must sign the deed to validate the transfer.

- Have the form notarized. The notary will confirm the identity of the grantor and witness the signing.

- File the completed deed with the county clerk's office where the property is located. There may be a filing fee, so check ahead.

Documents used along the form

When transferring property ownership in New York, the Quitclaim Deed is a vital document. However, several other forms and documents often accompany it to ensure a smooth transaction and compliance with legal requirements. Below are some of the key documents that may be used alongside the Quitclaim Deed.

- Property Transfer Tax Form: This form is required by the state of New York to report the transfer of property and to calculate any applicable transfer taxes. It provides essential information about the property and the parties involved in the transaction.

- Affidavit of Title: This document is a sworn statement by the seller affirming that they hold clear title to the property and that there are no undisclosed liens or encumbrances. It helps reassure the buyer of the seller's legal standing regarding the property.

- Articles of Incorporation: Establishing a corporation in New York requires filing the NY Templates which outlines the corporation's name, purpose, and structure.

- Title Search Report: Conducting a title search is crucial to verify the property's ownership history and to identify any potential issues that could affect the transfer. The report details any liens, easements, or claims against the property, providing transparency for both parties.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document outlines all financial aspects of the transaction, including the purchase price, closing costs, and any adjustments. It serves as a comprehensive summary for both the buyer and seller at the closing of the sale.

Incorporating these documents alongside the Quitclaim Deed can facilitate a more secure and efficient property transfer process. Ensuring that all necessary paperwork is in order protects the interests of both the buyer and the seller, paving the way for a successful transaction.