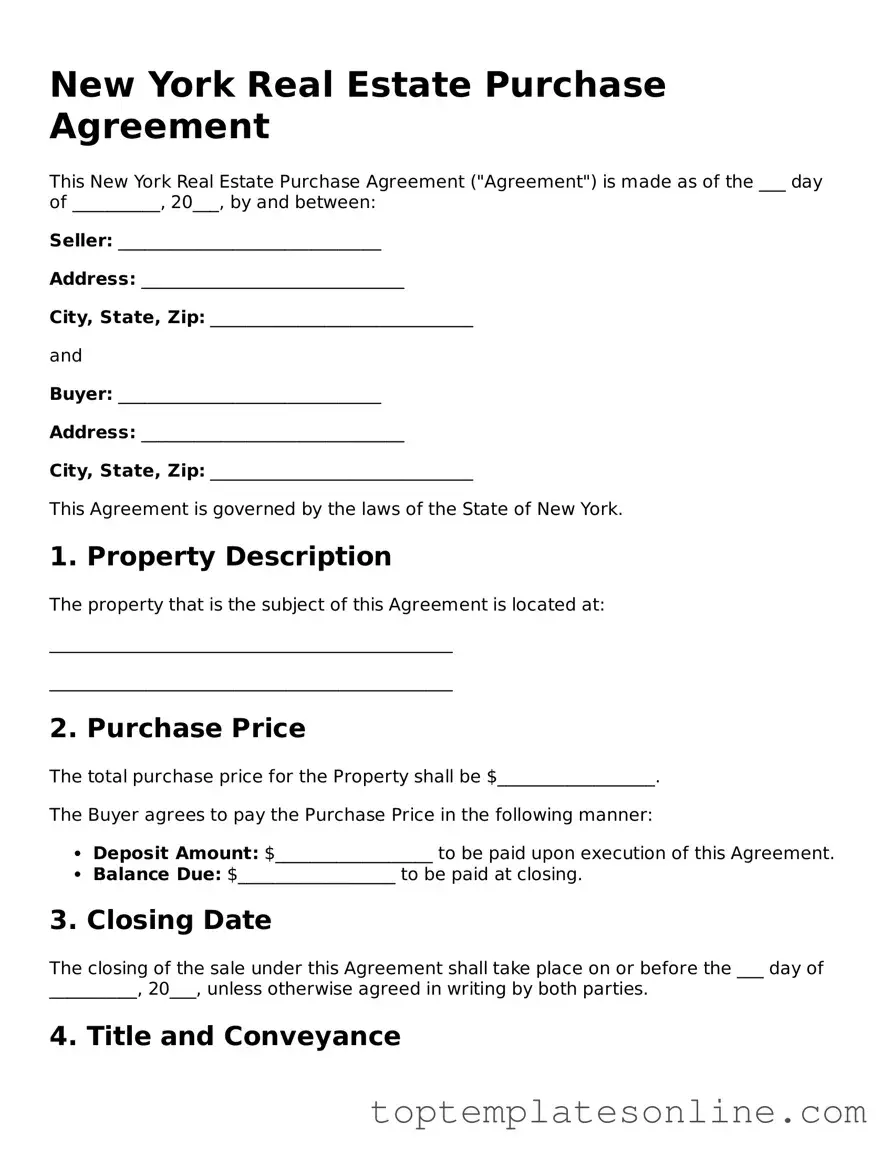

Blank Real Estate Purchase Agreement Template for New York State

The New York Real Estate Purchase Agreement form serves as a critical document in the process of buying and selling property in the state. This form outlines the essential terms of the transaction, including the purchase price, deposit amount, and closing date. It also specifies the responsibilities of both the buyer and the seller, ensuring that each party understands their obligations throughout the process. Key components such as contingencies, which may include financing and inspection clauses, provide necessary protections for buyers, while provisions for disclosures and title insurance safeguard the interests of sellers. Additionally, the agreement often includes details about the property itself, such as its legal description and any included fixtures or appliances. By clearly delineating these terms, the New York Real Estate Purchase Agreement helps to minimize misunderstandings and disputes, paving the way for a smoother transaction.

Some Other State-specific Real Estate Purchase Agreement Templates

North Carolina Association of Realtors - It includes provisions for the handling of utilities during the transition period.

Filling out the Access-A-Ride NYC Application form is essential for eligible individuals who wish to join the Commuter Benefits Program. This program offers the advantage of pre-tax deductions for transportation services, helping participants save on travel costs. For those looking for a simple way to complete their application, resources like NY Templates can provide helpful templates to guide the process.

Michigan Real Estate Forms - Documents any agreed-upon warranties or guarantees from the seller.

Trec Promulgated Forms - Indicates requirements for disclosures about lead-based paint for homes built before 1978.

Purchasing Agreements - The agreement details any contingencies that must be met.

Common mistakes

-

Incomplete Information: Buyers and sellers often leave sections blank. Every field should be filled out to avoid confusion.

-

Incorrect Property Description: Failing to accurately describe the property can lead to disputes. Ensure that the address and legal description are precise.

-

Missing Signatures: All parties must sign the agreement. Omitting a signature can render the contract invalid.

-

Improper Dates: Listing incorrect dates for the agreement or closing can cause significant delays. Double-check all dates for accuracy.

-

Ignoring Contingencies: Not including necessary contingencies, such as financing or inspection, can lead to problems later on. These protect the buyer’s interests.

-

Neglecting to Specify Inclusions: Failing to list items that are included in the sale, like appliances or fixtures, can create misunderstandings. Be specific.

-

Overlooking Earnest Money Details: Not specifying the amount or terms of earnest money can lead to complications. Clearly outline these details.

-

Misunderstanding Legal Terms: Some may not fully understand the implications of certain clauses. Seek clarification on any terms that are unclear.

-

Forgetting to Review the Agreement: Skipping a thorough review before signing can lead to overlooking critical details. Always take the time to read the entire document.

Guide to Writing New York Real Estate Purchase Agreement

Once you have the New York Real Estate Purchase Agreement form in hand, you are ready to proceed with filling it out. This document will require specific information about the transaction, the parties involved, and the property itself. Follow these steps to ensure that you complete the form accurately.

- Start by entering the date at the top of the form. This is the date on which the agreement is being executed.

- Identify the buyer(s) and seller(s). Fill in the full names and addresses of all parties involved in the transaction.

- Provide the property address. Include the street address, city, state, and zip code of the property being purchased.

- Specify the purchase price. Clearly state the amount that the buyer agrees to pay for the property.

- Outline the terms of the deposit. Indicate how much the buyer will put down as an earnest money deposit and the method of payment.

- Detail the closing date. Enter the anticipated date when the transaction will be finalized.

- Include any contingencies. If applicable, list any conditions that must be met for the sale to proceed, such as financing or inspections.

- Signatures are essential. Ensure that both the buyer and seller sign and date the agreement. If there are multiple buyers or sellers, all parties must sign.

- Make copies of the completed agreement for all parties involved. This ensures that everyone has a record of the terms agreed upon.

After filling out the form, review it carefully to confirm that all information is accurate and complete. Once all parties have signed, the agreement is legally binding, and you can move forward with the next steps in the real estate transaction.

Documents used along the form

When engaging in a real estate transaction in New York, several important forms and documents complement the Real Estate Purchase Agreement. Each document serves a unique purpose, ensuring that both buyers and sellers are protected and informed throughout the process. Here’s a list of commonly used forms:

- Property Disclosure Statement: This document outlines any known issues with the property, such as structural problems or past repairs. Sellers provide this information to inform potential buyers about the condition of the home.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint. It helps buyers make informed decisions regarding their health and safety.

- Title Report: This report reveals the legal ownership of the property and any liens or claims against it. Buyers should review this document to ensure there are no hidden issues that could affect their ownership.

- Quitclaim Deed: This form is essential for transferring property ownership without warranties. For more details on this process, visit Florida Forms.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document details all financial aspects of the transaction. It includes costs, fees, and the final amounts due at closing.

- Mortgage Application: If the buyer is financing the purchase, this form is submitted to a lender. It provides necessary information for the lender to assess the buyer’s eligibility for a mortgage.

- Home Inspection Report: After a buyer has an inspection conducted, this report details the findings. It can uncover issues that may require negotiation or repairs before finalizing the sale.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and that there are no undisclosed liens or claims against it. It provides additional assurance to the buyer.

- Escrow Agreement: This document outlines the terms under which an escrow agent will hold funds and documents until the sale is completed. It protects both parties during the transaction.

Understanding these documents is crucial for anyone involved in a real estate transaction. Each form plays a vital role in ensuring a smooth and legally sound process, protecting the interests of both buyers and sellers alike.