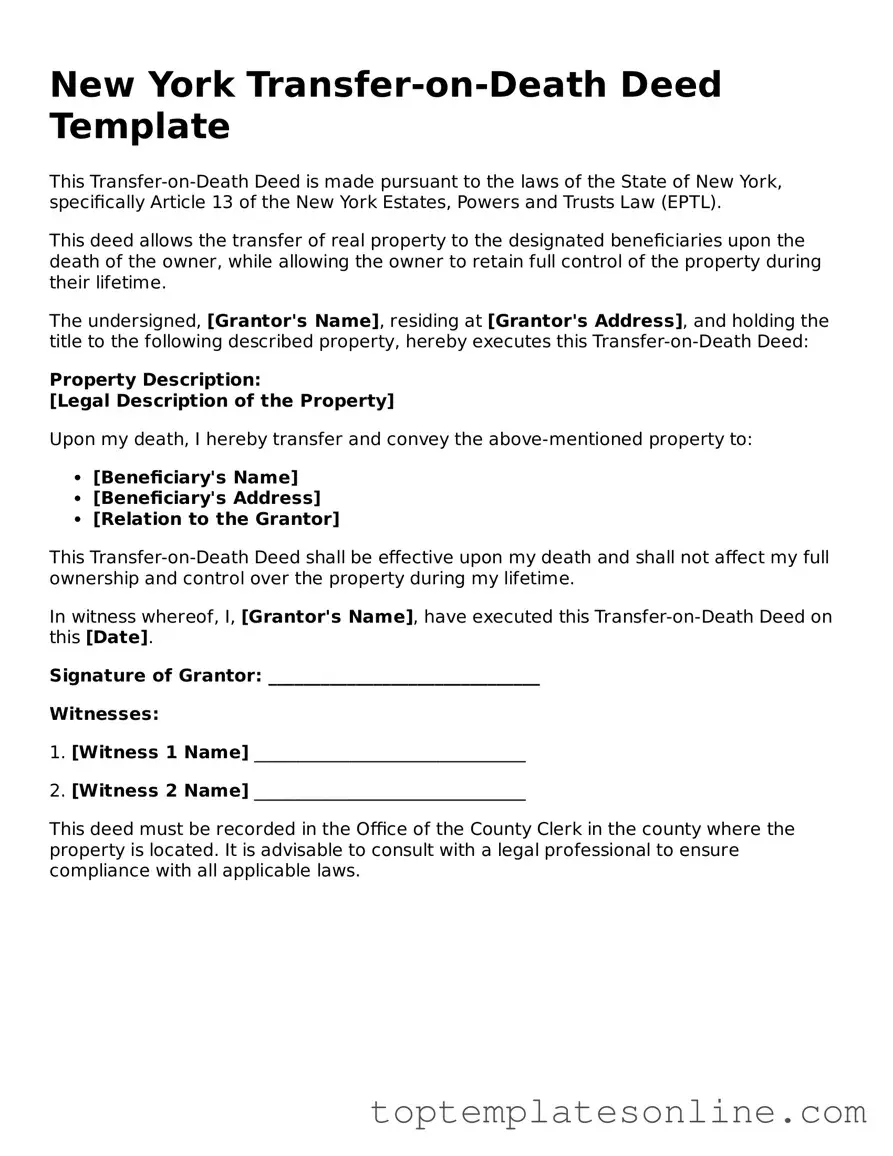

Blank Transfer-on-Death Deed Template for New York State

The New York Transfer-on-Death Deed form is an essential tool for property owners looking to streamline the transfer of their real estate assets upon their passing. This legal document allows individuals to designate a beneficiary who will automatically receive the property without the need for probate. By filling out this form, property owners can ensure that their loved ones inherit their property quickly and efficiently, avoiding the often lengthy and costly probate process. The form requires specific information, including the property owner’s details, a clear description of the property, and the beneficiary's information. It must be signed, notarized, and filed with the county clerk to be valid. Understanding the nuances of this form can significantly ease the transition of property ownership and provide peace of mind for both the owner and their chosen beneficiaries.

Some Other State-specific Transfer-on-Death Deed Templates

How to Gift Land to Family Member - Gary, a property owner, uses a Transfer-on-Death Deed to ensure that his children inherit his house without hassles.

A Florida Non-disclosure Agreement (NDA) is a legally binding contract designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping confidential information private, ensuring that proprietary details remain secure. For more information and resources on this topic, you can explore Florida Forms. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets in the state of Florida.

Transfer on Death Designation Affidavit - Individuals can retain full control of their property while they are alive, even after executing this deed.

Common mistakes

-

Incorrect Property Description: Individuals often fail to provide a precise legal description of the property. This can lead to confusion or disputes over which property is being transferred.

-

Not Including All Owners: If the property is co-owned, all owners must sign the deed. Omitting a co-owner can invalidate the deed.

-

Failure to Sign and Date: The deed must be signed and dated by the grantor. Neglecting to do so can render the document ineffective.

-

Improper Witnessing: New York law requires that the deed be witnessed. Failing to have the necessary witnesses can lead to complications in the transfer process.

-

Not Recording the Deed: After completion, the deed must be recorded with the county clerk. Failing to do this may result in the deed not being recognized legally.

-

Ignoring State-Specific Requirements: Each state has unique rules regarding transfer-on-death deeds. Not adhering to New York’s specific regulations can cause legal issues.

Guide to Writing New York Transfer-on-Death Deed

Filling out the New York Transfer-on-Death Deed form is a straightforward process that allows property owners to designate beneficiaries who will receive the property upon their passing. After completing the form, it must be signed, notarized, and filed with the county clerk in the appropriate jurisdiction.

- Obtain the New York Transfer-on-Death Deed form. You can find it online or at your local county clerk's office.

- Fill in the name of the property owner(s) in the designated section. Ensure that all names are spelled correctly and match the title of the property.

- Provide the legal description of the property. This may include the address and any relevant parcel identification numbers. You can usually find this information on your property tax statement.

- List the name(s) of the beneficiary or beneficiaries. Be specific and include any necessary identifying information, such as their relationship to you.

- Include a statement indicating that the deed is to be effective upon the death of the owner(s). This is typically a standard phrase included in the form.

- Sign the form in the presence of a notary public. Ensure that the notary also signs and stamps the document to validate it.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk's office in the county where the property is located. There may be a filing fee, so check with the office for details.

Documents used along the form

When dealing with estate planning in New York, the Transfer-on-Death Deed form is just one part of the puzzle. Several other documents may be necessary to ensure a smooth transfer of assets and to clarify your wishes. Below is a list of commonly used forms and documents that work alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how you want your assets distributed after your death. It can specify guardians for minor children and can include provisions for the care of pets.

- Trailer Bill of Sale: The floridaforms.net/blank-trailer-bill-of-sale-form is crucial for documenting the transfer of trailer ownership, ensuring a clear record of the transaction and safeguarding the rights of both buyers and sellers.

- Durable Power of Attorney: This form allows you to appoint someone to make financial decisions on your behalf if you become incapacitated. It ensures that your financial affairs are managed according to your wishes.

- Healthcare Proxy: This document designates someone to make medical decisions for you if you are unable to do so. It’s essential for ensuring that your healthcare preferences are respected.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you cannot communicate your preferences. It is particularly important for end-of-life care decisions.

- Affidavit of Heirship: This legal document can establish the heirs of a deceased person, helping to clarify who is entitled to inherit assets when there is no will.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to specify who will receive the assets upon your death. They often supersede wills and trusts.

- Trust Agreement: If you set up a trust, this document outlines the terms of the trust, including how assets should be managed and distributed. It can help avoid probate and provide privacy.

- Real Estate Transfer Forms: In addition to the Transfer-on-Death Deed, other forms may be needed to formally transfer ownership of real estate, especially if there are multiple properties involved.

Understanding these documents can help you create a comprehensive estate plan that reflects your wishes and protects your loved ones. It's always a good idea to consult with a legal professional to ensure that everything is in order and tailored to your specific needs.