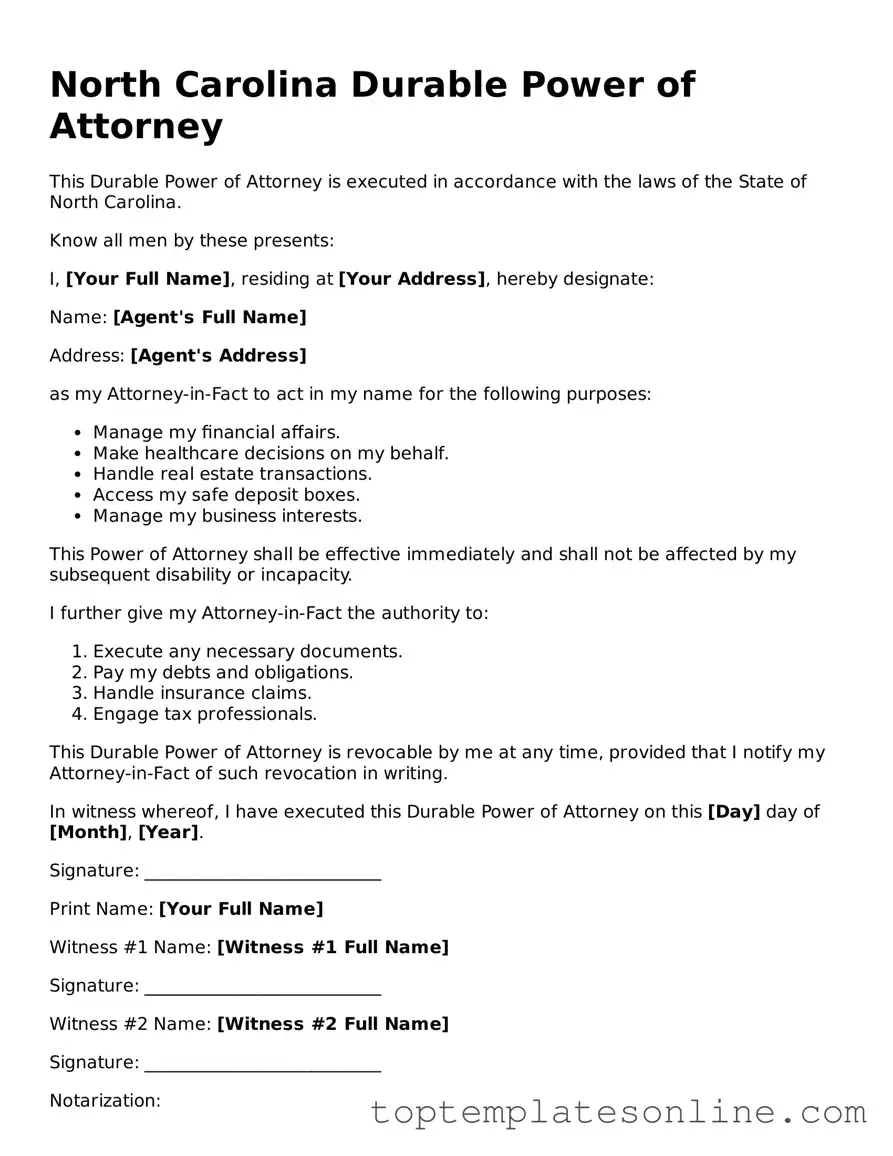

Blank Durable Power of Attorney Template for North Carolina State

In North Carolina, the Durable Power of Attorney form serves as a crucial legal document that empowers individuals to designate someone they trust to make decisions on their behalf, particularly when they are unable to do so themselves. This form is not just about granting authority; it provides a framework for ensuring that your financial and healthcare choices are honored according to your wishes. It allows you to specify the extent of the authority you wish to grant, whether it be limited to specific tasks or broad enough to cover all financial matters. Importantly, this document remains effective even if you become incapacitated, ensuring that your affairs can continue to be managed seamlessly. It is essential to understand the responsibilities of the appointed agent, as they will have significant control over your assets and decisions. Additionally, the form requires careful consideration regarding who you choose as your agent, as trust and reliability are paramount. Whether you are planning for the future or addressing immediate needs, understanding the Durable Power of Attorney in North Carolina can provide peace of mind and security for you and your loved ones.

Some Other State-specific Durable Power of Attorney Templates

Financial Power of Attorney Form New Jersey - This form is crucial for planning for unforeseen medical situations.

Texas Statutory Durable Power of Attorney - As with any legal document, make sure it reflects your wishes accurately, as this is vital for its effectiveness.

For any homeowner, understanding the importance of a well-drafted mobile home bill of sale is crucial. This document not only formalizes the transaction but also details specific terms. For a thorough understanding, you can refer to the guide on the necessary mobile home bill of sale.

Power of Attorney in Michigan - With a Durable Power of Attorney, the appointed agent can handle financial matters, including banking and property transactions.

Common mistakes

-

Inadequate Understanding of the Document's Purpose: Many individuals fill out the Durable Power of Attorney (DPOA) form without fully grasping its significance. This document allows someone to make financial or legal decisions on behalf of another person. Misunderstanding this can lead to assigning the wrong person or providing them with too much authority.

-

Failure to Specify Powers: It is crucial to clearly outline the powers granted to the agent. Some people leave this section vague, which can create confusion and limit the agent's ability to act effectively. Specifying whether the agent can handle real estate transactions, manage bank accounts, or make healthcare decisions is essential.

-

Not Choosing a Reliable Agent: Selecting the right person as an agent is vital. Sometimes, individuals choose a family member or friend without considering their reliability or ability to handle such responsibilities. It is important to choose someone trustworthy and capable of making sound decisions.

-

Ignoring Witness and Notarization Requirements: In North Carolina, the DPOA must be signed in the presence of a notary public and two witnesses. Some people overlook this requirement, which can invalidate the document. Ensuring all necessary signatures are obtained is critical to the form's legality.

-

Neglecting to Review and Update the Document: Life circumstances change, and so do relationships. Failing to review and update the DPOA can result in outdated information. Regularly revisiting the document ensures that it reflects current wishes and that the appointed agent is still the best choice.

Guide to Writing North Carolina Durable Power of Attorney

Completing the North Carolina Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes. This process requires careful attention to detail. Below are the steps to successfully fill out the form.

- Obtain the North Carolina Durable Power of Attorney form. You can find it online or request a physical copy from a legal office.

- Begin by filling in your full name and address at the top of the form. Ensure that this information is accurate.

- Next, identify the agent you wish to appoint. Provide their full name and address. This person will have the authority to act on your behalf.

- Clearly outline the powers you wish to grant to your agent. This may include financial decisions, real estate transactions, or healthcare decisions. Be specific to avoid confusion.

- Include any limitations or conditions you want to place on the powers granted. This step is crucial for clarity.

- Sign and date the form at the designated area. Your signature must match your legal name.

- Have the form witnessed by at least one person who is not named as your agent. The witness should sign and date the form as well.

- If required, consider having the form notarized for added validity. This step may not be necessary, but it can enhance the document's acceptance.

- Keep a copy of the completed form for your records. Distribute copies to your agent and any relevant parties, such as financial institutions or healthcare providers.

Documents used along the form

When establishing a Durable Power of Attorney in North Carolina, it is essential to consider several other documents that may complement or enhance your legal planning. Each of these documents serves a specific purpose and can provide additional clarity and protection for your wishes.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and appoints someone to make healthcare decisions on your behalf if you become unable to do so.

- Living Will: A Living Will specifies your wishes regarding end-of-life care and medical interventions, ensuring that your desires are respected during critical health situations.

- Last Will and Testament: This legal document details how your assets and property will be distributed after your death, providing peace of mind to your loved ones.

- Articles of Incorporation: Essential for establishing a corporation in New York, this form outlines important details about the corporation, including its name and purpose. It sets the foundation for your business and understanding its components can be crucial for a smooth process. For more information, you can refer to the NY Templates.

- HIPAA Release Form: This form allows you to designate individuals who can access your medical records and health information, ensuring that your healthcare agents can make informed decisions.

- Revocation of Power of Attorney: Should you need to cancel a previously granted Power of Attorney, this document formally revokes the authority given to your agent.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants authority to manage financial matters, which may be necessary for different circumstances.

- Property Transfer Documents: These documents are used to transfer ownership of real estate or personal property, ensuring that your assets are managed according to your wishes.

Carefully considering and preparing these documents can significantly impact your future and the well-being of your loved ones. It is advisable to consult with a legal professional to ensure that all documents align with your intentions and comply with state laws.