Blank Lady Bird Deed Template for North Carolina State

In North Carolina, estate planning can be a complex process, but the Lady Bird Deed offers a straightforward solution for property owners looking to transfer their real estate while retaining control during their lifetime. This unique legal instrument allows individuals to transfer property to their beneficiaries upon death without going through the lengthy and often costly probate process. One of its key features is that the original owner maintains the right to live on and use the property, ensuring they can enjoy their home without disruption. Additionally, the Lady Bird Deed can help protect the property from creditors and may provide tax benefits, making it an attractive option for many. Understanding the nuances of this deed, including how it interacts with Medicaid planning and its implications for estate taxes, is crucial for anyone considering this route. By utilizing the Lady Bird Deed, property owners in North Carolina can simplify the transfer of their assets and provide peace of mind for themselves and their loved ones.

Some Other State-specific Lady Bird Deed Templates

Printable Life Estate Deed Form - The Donor can revoke or modify the deed at any time before their death.

Utilizing a well-drafted lease agreement is crucial for anyone entering into a rental arrangement in New York. This document serves to clarify expectations and obligations, fostering a positive relationship between tenants and landlords. For those seeking assistance with crafting their lease, resources such as newyorkform.com/free-lease-agreement-template can provide valuable templates and guidance.

How to Get a Lady Bird Deed in Michigan - It can be a helpful strategy in asset protection planning for Medicaid purposes.

Common mistakes

-

Failing to provide accurate property descriptions. It is essential to include the correct legal description of the property. This may involve consulting property records to ensure accuracy.

-

Not naming the beneficiaries correctly. Ensure that the names of all beneficiaries are spelled correctly and match their legal documents. This prevents confusion and potential legal issues later.

-

Overlooking the need for signatures. All required parties must sign the deed for it to be valid. Missing signatures can invalidate the deed.

-

Ignoring state-specific requirements. Different states have unique laws regarding property transfers. Review North Carolina's specific requirements to ensure compliance.

-

Failing to record the deed. After completing the form, it is crucial to file it with the appropriate county office. Without proper recording, the deed may not be enforceable.

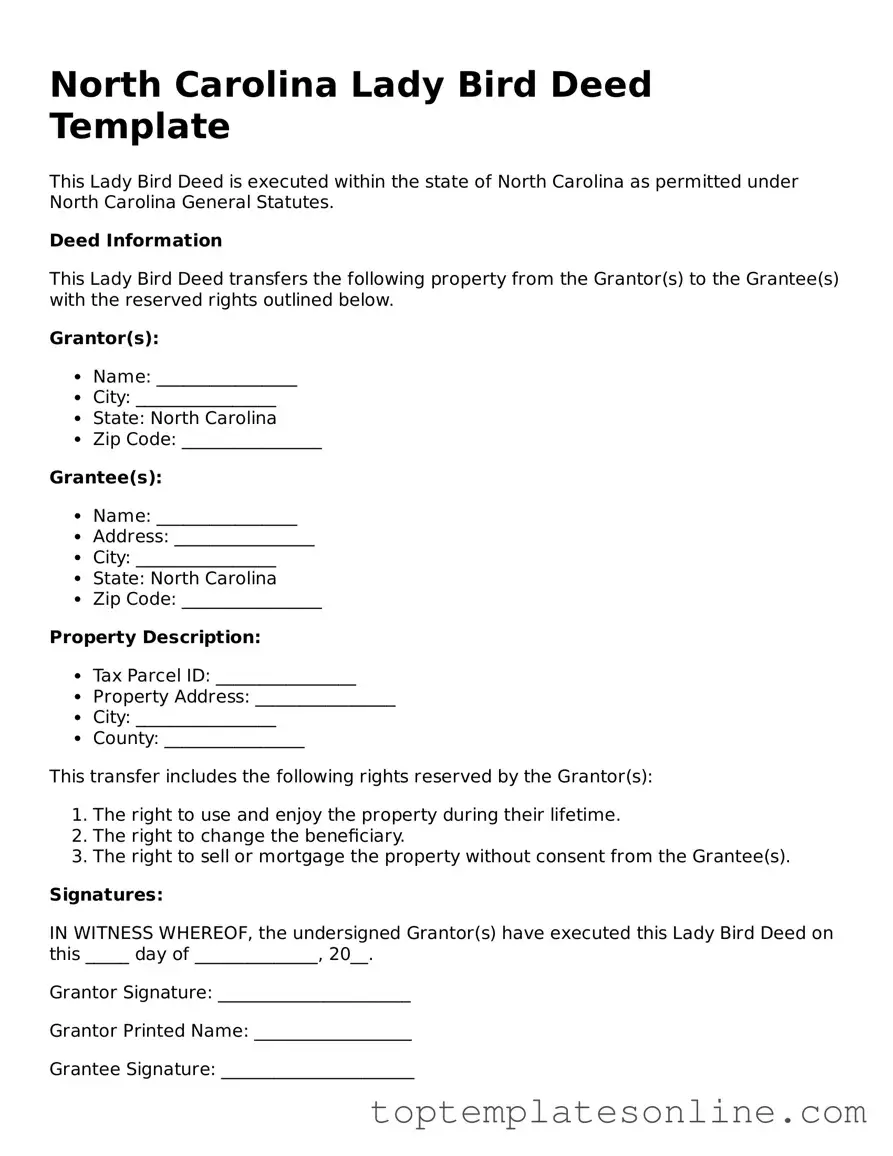

Guide to Writing North Carolina Lady Bird Deed

Filling out the North Carolina Lady Bird Deed form is a straightforward process. After completing the form, it is essential to ensure that all information is accurate and that the document is signed and notarized as required. This deed allows for the transfer of property while retaining certain rights, and it is important to follow the steps carefully to avoid any complications.

- Obtain the Lady Bird Deed form from a reliable source, such as a legal website or local government office.

- Begin by entering the names of the current property owners at the top of the form.

- Provide the property description, including the address and any relevant parcel numbers.

- Identify the beneficiaries who will receive the property upon the owner's death. List their names clearly.

- Specify any conditions or limitations regarding the property transfer, if applicable.

- Include the date of the deed and the signature of the current property owners.

- Have the form notarized to ensure its validity.

- File the completed deed with the local register of deeds office in the county where the property is located.

Documents used along the form

The North Carolina Lady Bird Deed is a valuable tool for property owners looking to transfer their real estate while retaining certain rights. However, it is often used in conjunction with other forms and documents to ensure a smooth transaction and to address various legal and financial considerations. Below is a list of documents that are commonly associated with the Lady Bird Deed.

- Durable Power of Attorney: This document allows an individual to designate someone else to make financial and legal decisions on their behalf, especially useful if the grantor becomes incapacitated.

- Living Will: A living will outlines an individual's wishes regarding medical treatment in situations where they cannot communicate their preferences, often relevant in estate planning.

- Power of Attorney: This legal document allows an individual to appoint an agent to make important decisions on their behalf, including financial and healthcare matters. For more information, you can visit Florida Forms.

- Last Will and Testament: This document specifies how a person's assets should be distributed after their death, complementing the Lady Bird Deed by addressing any remaining estate matters.

- Trust Agreement: A trust agreement establishes a trust, allowing for the management of assets during a person's lifetime and after their death, providing additional control over asset distribution.

- Transfer on Death Deed: Similar to the Lady Bird Deed, this document allows property to pass directly to beneficiaries upon the owner’s death, avoiding probate.

- Property Tax Exemption Forms: These forms can be submitted to claim exemptions or reductions in property taxes, which may be relevant when transferring property ownership.

- Affidavit of Heirship: This document is used to establish the identity of heirs in cases where a deceased person did not leave a will, helping to clarify ownership of property.

- Title Insurance Policy: This insurance protects against potential defects in the title of the property, ensuring that the new owner has clear ownership and can avoid legal disputes.

Each of these documents plays a crucial role in the estate planning process. They help clarify intentions, protect rights, and ensure that property is transferred smoothly and in accordance with the law. Understanding these forms can significantly enhance your ability to manage your estate effectively.