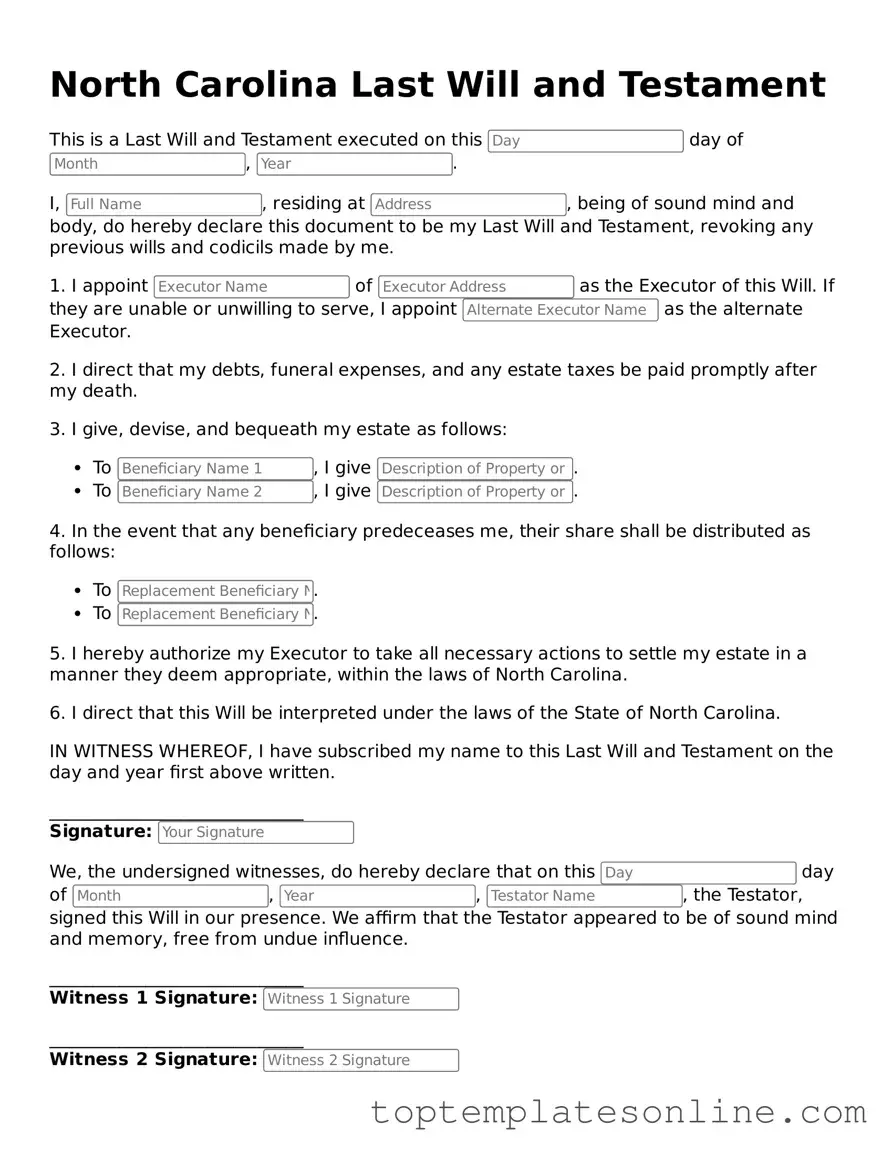

Blank Last Will and Testament Template for North Carolina State

Creating a Last Will and Testament is an important step in ensuring that your wishes are respected after you pass away. In North Carolina, this legal document allows individuals to specify how their assets should be distributed, who will take care of any minor children, and who will manage their estate. The form typically includes sections for naming beneficiaries, appointing an executor, and detailing any specific bequests. It is essential to understand that a valid will must be signed by the testator and witnessed by at least two individuals. Additionally, the will should reflect the testator's true intentions and be free from undue influence. By taking the time to prepare a Last Will and Testament, individuals can provide peace of mind for themselves and their loved ones, ensuring that their final wishes are honored and that their estate is handled according to their desires.

Some Other State-specific Last Will and Testament Templates

Last Will and Testament Template New York Pdf - Offers peace of mind by clarifying intentions about asset distribution and family welfare.

When engaging in a boat transaction, it is crucial to utilize the New York Boat Bill of Sale form to ensure a smooth transfer of ownership. This document not only protects both parties by documenting the sale but also helps prevent any future disputes regarding the ownership of the watercraft. For a comprehensive template to assist with this process, you can visit NY Templates.

Last Will and Testament Michigan - Conveys wishes that may reflect personal beliefs or family traditions.

Free Ohio Last Will and Testament Form Pdf - This document can be stored in a safe place for easy access after passing.

Common mistakes

-

Not Naming an Executor: One common mistake is failing to designate an executor. The executor is responsible for carrying out the wishes outlined in the will. Without a named executor, the court may need to appoint someone, which can lead to delays and potential disputes.

-

Inadequate Witness Signatures: In North Carolina, a will must be signed by at least two witnesses. Many people overlook this requirement, thinking that their signature alone suffices. If the will isn’t properly witnessed, it may not be considered valid.

-

Vague Language: Clarity is essential when drafting a will. Using vague terms can lead to confusion about your intentions. Be specific about who receives what. Ambiguities can result in disputes among heirs and may require court intervention to resolve.

-

Failing to Update the Will: Life changes such as marriage, divorce, or the birth of a child should prompt a review of your will. Many individuals neglect to update their documents, which can lead to unintended consequences regarding asset distribution.

Guide to Writing North Carolina Last Will and Testament

Once you have gathered the necessary information, you can begin filling out the North Carolina Last Will and Testament form. This process involves providing specific details about your assets, beneficiaries, and any special instructions you wish to include. Following these steps will help ensure that your will is completed accurately.

- Begin by entering your full name and address at the top of the form.

- State that you are of sound mind and over the age of 18, affirming your capacity to create a will.

- List your beneficiaries. Include their full names and relationship to you.

- Detail the specific assets you wish to distribute. Be clear about which beneficiary receives which asset.

- If you have minor children, designate a guardian for them in your will.

- Include any specific instructions or wishes regarding your funeral or burial arrangements.

- Sign and date the form in the designated area. Your signature must be witnessed.

- Have at least two witnesses sign the document, affirming they saw you sign it.

After completing the form, keep it in a safe place. Consider sharing its location with a trusted family member or attorney. This ensures that your wishes will be carried out as you intended.

Documents used along the form

When preparing a Last Will and Testament in North Carolina, it's often beneficial to consider additional documents that can complement your estate planning. These forms help ensure that your wishes are clear and legally binding, providing peace of mind for you and your loved ones.

- Durable Power of Attorney: This document allows you to appoint someone to make financial decisions on your behalf if you become incapacitated. It grants authority to manage your assets, pay bills, and handle other financial matters.

- Healthcare Power of Attorney: This form designates an individual to make medical decisions for you if you are unable to do so. It ensures that your healthcare preferences are respected and followed by medical professionals.

- Power of Attorney: For a comprehensive estate plan, it's important to consider the Power of Attorney form. This document allows you to appoint someone to make vital decisions on your behalf when you're unable to, ensuring your affairs are managed as you wish. You can find a free template for this document here: https://newyorkform.com/free-power-of-attorney-template.

- Living Will: A living will outlines your wishes regarding medical treatment in the event of a terminal illness or irreversible condition. It provides guidance on life-sustaining measures and end-of-life care.

- Trust Agreement: A trust can help manage your assets during your lifetime and after your death. It can provide for beneficiaries in a more controlled manner, often avoiding probate and offering privacy.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, like life insurance policies and retirement accounts. They ensure that these assets pass directly to your chosen beneficiaries, bypassing probate.

Incorporating these documents into your estate planning can help clarify your intentions and provide a comprehensive strategy for managing your affairs. Each document serves a unique purpose, and together they create a robust plan that can ease the burden on your loved ones during difficult times.