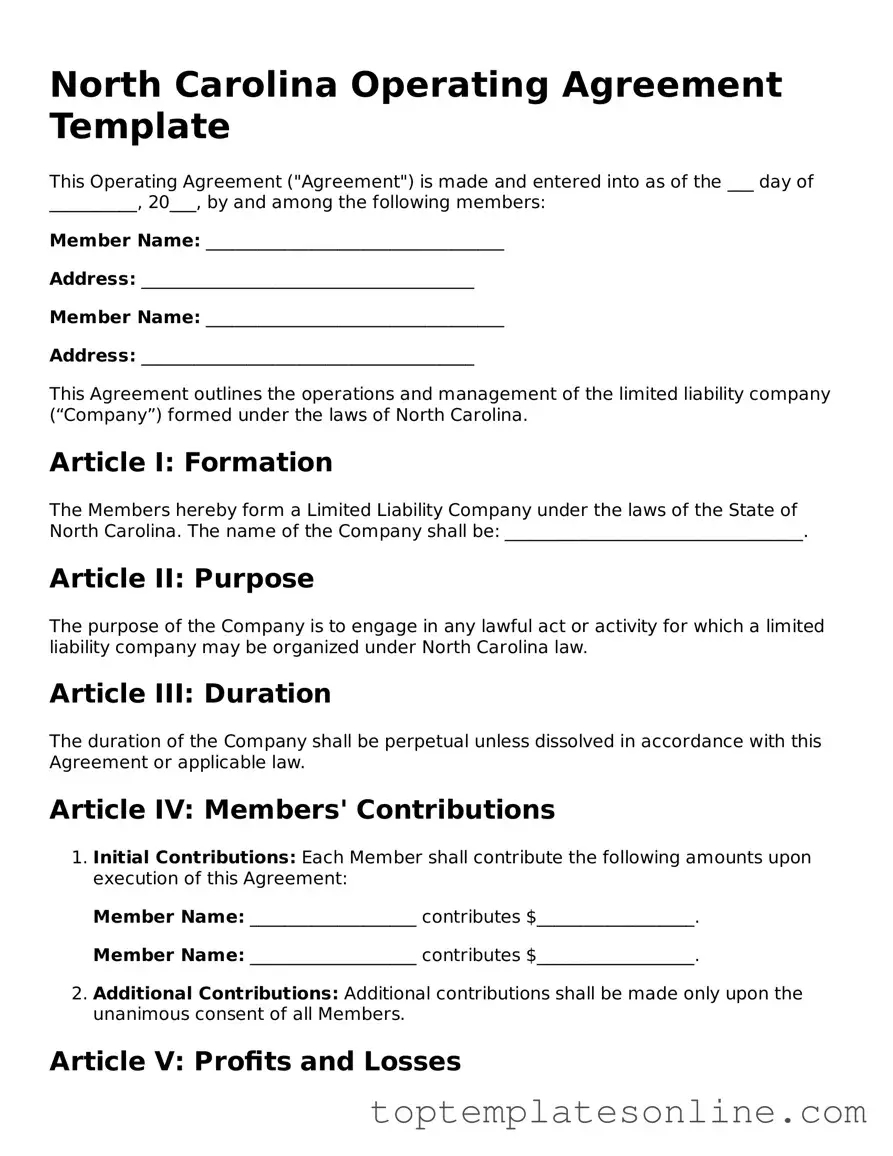

Blank Operating Agreement Template for North Carolina State

When starting a business in North Carolina, particularly a limited liability company (LLC), having a solid foundation is crucial. One of the key documents that can help establish this foundation is the North Carolina Operating Agreement form. This form serves as an internal document that outlines the management structure, responsibilities, and operational guidelines for the LLC. It addresses important aspects such as ownership percentages, profit distribution, and procedures for adding or removing members. By clearly defining the roles of each member and the decision-making processes, the Operating Agreement can help prevent conflicts and misunderstandings down the road. Additionally, it can provide a roadmap for the company’s growth and outline how to handle various situations, such as member disputes or changes in ownership. While North Carolina does not legally require an Operating Agreement, having one in place can significantly enhance the credibility and professionalism of your business. Ultimately, this document is not just a formality; it’s a vital tool that can help ensure your LLC operates smoothly and effectively.

Some Other State-specific Operating Agreement Templates

Nys Llc - The Operating Agreement can define termination rights for the LLC and its members.

Texas Llc Filing Fee - An Operating Agreement is vital for clarifying member agreements and expectations.

How to Make an Operating Agreement - The Operating Agreement can establish a buy-sell agreement among members.

By utilizing the Texas VTR-850 form, vehicle owners can navigate the process of securing classic license plates, which not only provides a unique identity for vehicles over 25 years old but also enhances their historical significance; for further details, visit https://texasformspdf.com/ to ensure compliance with all requirements.

Operating Agreement for Llc Georgia - An Operating Agreement can detail the process for capital contributions.

Common mistakes

-

Failing to identify all members of the LLC. Each member must be clearly listed to avoid confusion and potential disputes.

-

Not specifying the percentage of ownership for each member. This detail is crucial for profit distribution and decision-making.

-

Overlooking the management structure. Clearly stating whether the LLC will be member-managed or manager-managed is essential.

-

Neglecting to outline the voting rights of members. This can lead to misunderstandings during important decisions.

-

Not including provisions for adding new members. An agreement should address how new members can be admitted to the LLC.

-

Failing to address the process for member withdrawal or removal. This is important to ensure a smooth transition if a member leaves.

-

Omitting the procedures for handling disputes. A clear dispute resolution process can save time and resources in the future.

-

Not specifying how profits and losses will be allocated. This should reflect the ownership percentages unless otherwise agreed.

-

Ignoring state-specific requirements. Each state may have unique regulations that must be adhered to in the operating agreement.

-

Failing to have the agreement reviewed by a legal professional. A thorough review can prevent costly mistakes down the line.

Guide to Writing North Carolina Operating Agreement

Filling out the North Carolina Operating Agreement form is a straightforward process that helps define the structure and operation of your business. Once completed, this document will serve as a vital reference for the members of your LLC, outlining their rights and responsibilities. Here are the steps to guide you through the process.

- Begin by gathering all necessary information about your LLC, including the name, address, and purpose of the business.

- Identify the members of the LLC. List each member's name and their respective ownership percentages.

- Decide on the management structure. Will the LLC be member-managed or manager-managed? Indicate your choice clearly.

- Outline the voting rights of the members. Specify how decisions will be made and what percentage of votes is required for different types of decisions.

- Include details about profit and loss distribution. Clarify how profits will be shared among members.

- Address the process for adding new members or removing existing ones. This should include any necessary approvals or conditions.

- Define the duration of the LLC. Specify whether it will exist indefinitely or for a set period.

- Include any additional provisions that may be relevant to your specific business needs, such as dispute resolution processes.

- Review the completed form for accuracy. Ensure that all members agree with the terms outlined in the agreement.

- Finally, have all members sign and date the document to make it official.

Documents used along the form

The North Carolina Operating Agreement is an essential document for limited liability companies (LLCs) as it outlines the management structure and operational guidelines. Alongside this agreement, several other forms and documents may be required to ensure compliance and effective functioning of the LLC. Below is a list of commonly used documents that complement the Operating Agreement.

- Articles of Organization: This document is filed with the North Carolina Secretary of State to officially create the LLC. It includes basic information such as the company name, address, and registered agent.

- Non-disclosure Agreement: To protect sensitive information and maintain confidentiality, it's crucial to have a Non-disclosure Agreement in place. This legal document ensures that proprietary details remain secure and are not disclosed without permission, making it an essential tool for many businesses. For a helpful template, you can refer to https://newyorkform.com/free-non-disclosure-agreement-template.

- Bylaws: While not always required, bylaws outline the internal rules and procedures for the LLC. They govern the roles and responsibilities of members and managers.

- Member Consent Forms: These forms document the agreement of members on significant decisions, such as the admission of new members or major financial commitments.

- Operating Procedures: This document details the day-to-day operational processes of the LLC, ensuring that all members are on the same page regarding business activities.

- Membership Certificates: These certificates are issued to members as proof of ownership in the LLC. They can help clarify ownership stakes and rights among members.

- Tax Forms: Various tax forms, such as the IRS Form 1065 or Schedule K-1, may be needed to report income, deductions, and credits for the LLC's tax obligations.

- Annual Reports: Required by the state, these reports provide updated information about the LLC and ensure that the business remains in good standing with the state of North Carolina.

Having these documents in place not only supports the LLC's legal standing but also promotes transparency and accountability among members. Each document plays a vital role in the overall governance and operational success of the company.