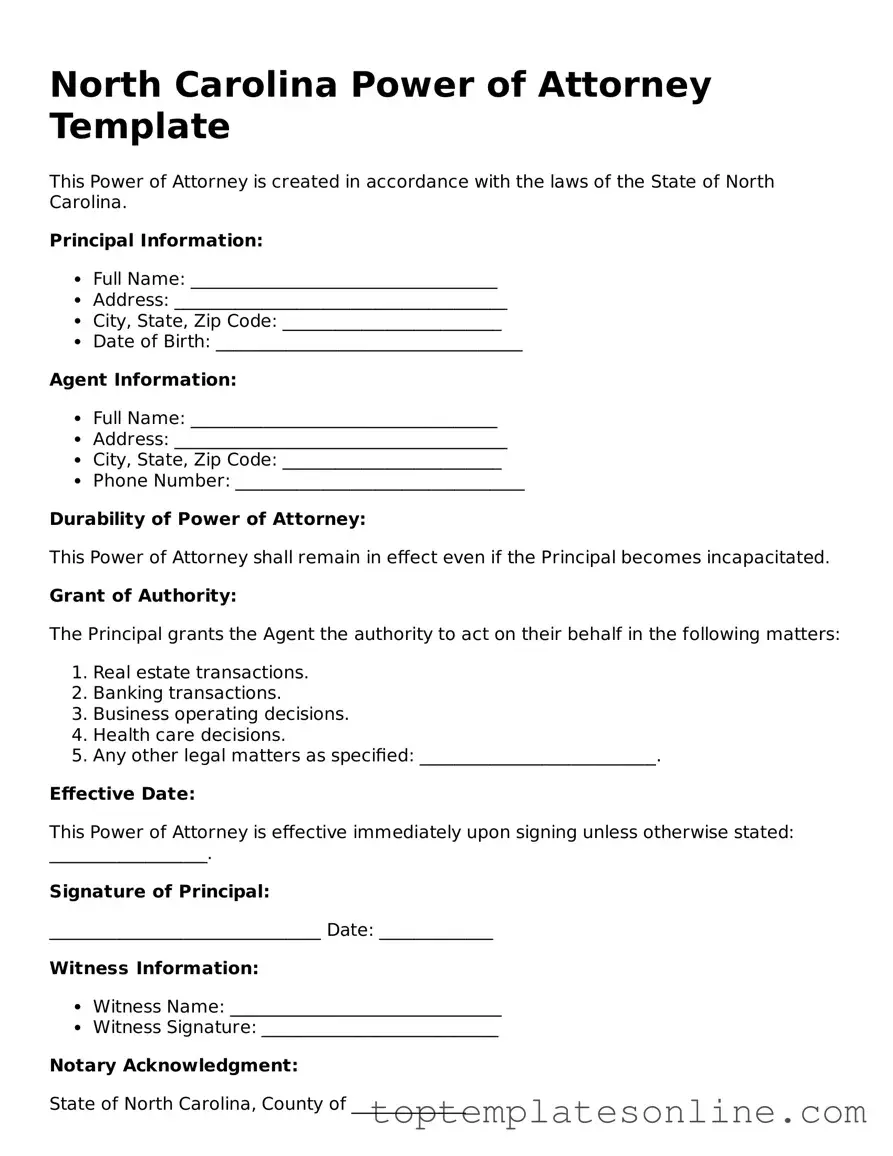

Blank Power of Attorney Template for North Carolina State

The North Carolina Power of Attorney form is a crucial legal document that allows individuals to designate someone they trust to make decisions on their behalf. This form is especially important for managing financial and healthcare matters when a person is unable to do so themselves. It outlines the specific powers granted to the agent, which can include handling banking transactions, managing real estate, or making medical decisions. In North Carolina, the form can be tailored to fit the needs of the principal, whether they want to grant broad authority or limit the powers to specific tasks. Additionally, the document must be signed in the presence of a notary public to ensure its validity. Understanding the implications of this form is essential, as it provides a framework for decision-making and can help avoid potential conflicts or confusion among family members during critical times.

Some Other State-specific Power of Attorney Templates

Printable Power of Attorney Form Nj - Agents have a fiduciary duty to act in the best interests of the principal at all times.

How to Get Power of Attorney in Ny - A durable Power of Attorney remains in effect even if the principal becomes incapacitated.

For those looking to understand the nuances of property rentals, the comprehensive Lease Agreement form is vital for establishing clear obligations between landlords and tenants. This document clarifies the terms of occupancy and enhances the rental experience for both parties involved. You can find more details regarding this process at the comprehensive Lease Agreement form.

Types of Power of Attorney Ohio - Facilitates healthcare management when you are unable to communicate.

Ga Power of Attorney - The form can cover medical decisions, allowing someone to make health care choices for an individual.

Common mistakes

-

Not specifying the powers granted: Some people fail to clearly outline the specific powers they are granting to their agent. This can lead to confusion or disputes later on.

-

Using outdated forms: It’s important to use the most current version of the Power of Attorney form. Outdated forms may not comply with current laws.

-

Not signing the document: A common mistake is neglecting to sign the form. Without a signature, the document is not legally binding.

-

Failing to date the form: Not including a date can create issues regarding when the powers take effect or when the document was executed.

-

Overlooking witness and notarization requirements: Some individuals forget that North Carolina requires either a witness or notarization for the Power of Attorney to be valid.

-

Not discussing the decision with the agent: It’s crucial to have a conversation with the person you are appointing. They should understand their responsibilities and your wishes.

-

Ignoring state-specific laws: Each state has its own rules regarding Power of Attorney forms. Failing to follow North Carolina’s specific requirements can invalidate the document.

-

Not considering alternative agents: It’s wise to name an alternate agent in case the primary agent is unavailable or unable to act.

-

Assuming the form is permanent: Some people believe that once they fill out a Power of Attorney, it cannot be changed. In reality, you can revoke or modify it at any time, as long as you are mentally competent.

Guide to Writing North Carolina Power of Attorney

Completing the North Carolina Power of Attorney form is a straightforward process. Follow these steps carefully to ensure that all necessary information is provided accurately. Once the form is filled out, it will need to be signed and possibly notarized, depending on your specific situation.

- Obtain the North Carolina Power of Attorney form from a reliable source, such as a legal website or local government office.

- Read the form carefully to understand the sections that need to be completed.

- Fill in the principal's name, address, and other required personal information in the designated areas.

- Identify the agent by providing their name, address, and relationship to the principal.

- Specify the powers granted to the agent. Be clear and detailed about what decisions the agent can make on behalf of the principal.

- Include any limitations or conditions regarding the agent's authority, if applicable.

- Sign and date the form in the appropriate section. Ensure that the signature matches the name provided at the top of the form.

- If required, have the form notarized. Check local requirements to confirm if notarization is necessary.

- Distribute copies of the completed form to the agent and any relevant parties, such as financial institutions or healthcare providers.

Documents used along the form

When establishing a Power of Attorney in North Carolina, several additional documents may complement this important legal instrument. Each serves a unique purpose and helps ensure that your intentions are clearly communicated and legally upheld. Below are four commonly used forms that often accompany a Power of Attorney.

- Advance Directive: This document outlines your preferences regarding medical treatment in the event that you become unable to communicate your wishes. It allows you to designate a healthcare agent to make decisions on your behalf, ensuring that your medical care aligns with your values and desires.

- Hold Harmless Agreement: A crucial document that releases parties from liability as they engage in potentially risky activities. For a comprehensive template, visit newyorkform.com/free-hold-harmless-agreement-template/.

- Living Will: A Living Will is a specific type of advance directive that details your wishes regarding end-of-life care. It provides guidance to healthcare providers and loved ones about your preferences for life-sustaining treatments, should you be in a terminal condition or a persistent vegetative state.

- Durable Power of Attorney for Health Care: Similar to a standard Power of Attorney, this document specifically grants someone the authority to make health care decisions for you. It remains effective even if you become incapacitated, making it a crucial tool for managing your health care needs.

- Financial Power of Attorney: This document allows you to appoint someone to handle your financial affairs. It can cover a wide range of responsibilities, from managing bank accounts to paying bills, ensuring that your financial matters are taken care of even if you are unable to do so yourself.

Incorporating these documents alongside the Power of Attorney can provide a comprehensive approach to managing both your financial and healthcare decisions. By clearly outlining your wishes and designating trusted individuals, you can help ensure that your preferences are honored during critical times.