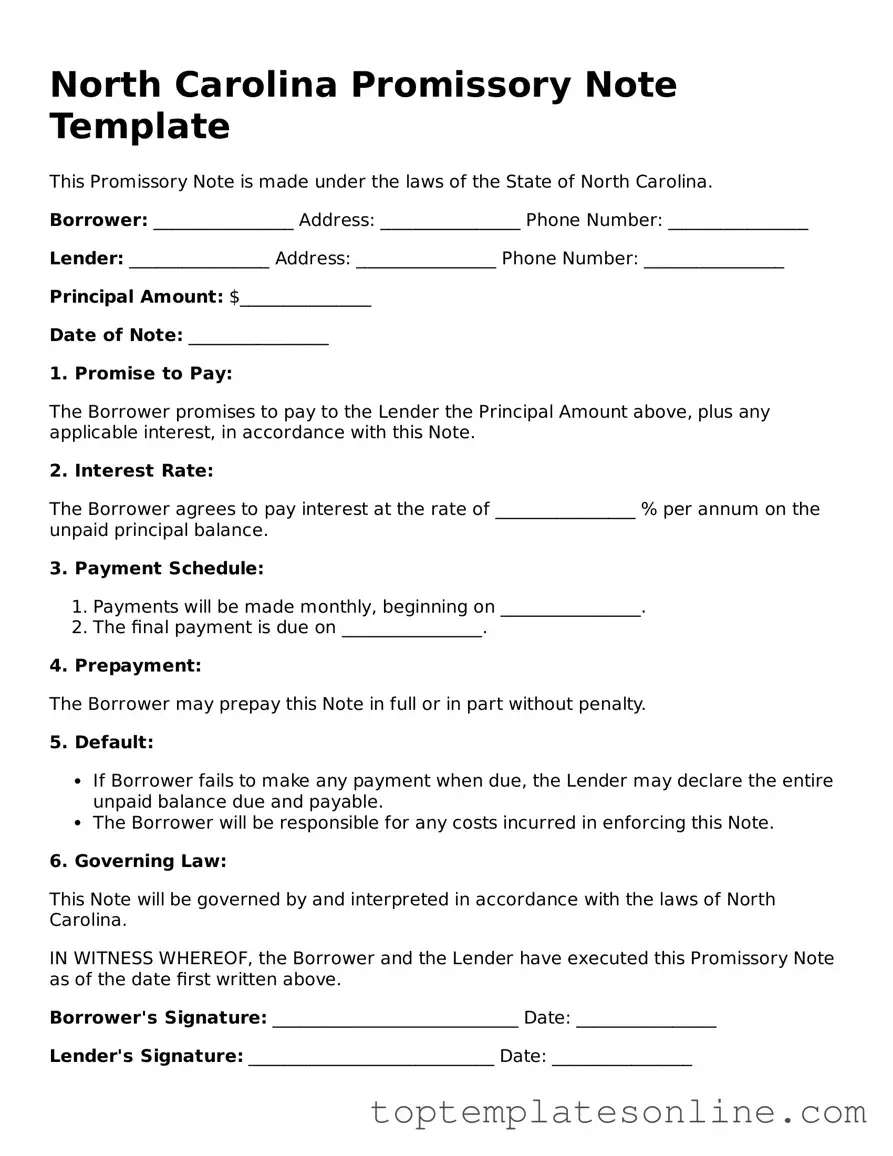

Blank Promissory Note Template for North Carolina State

In North Carolina, a promissory note serves as a vital financial instrument that outlines a borrower's commitment to repay a loan under specified terms. This legally binding document typically includes essential details such as the principal amount borrowed, the interest rate, and the repayment schedule. Additionally, it clarifies the consequences of default, ensuring that both parties understand their rights and obligations. The note may also include provisions for prepayment, allowing borrowers the flexibility to pay off their debt early without incurring penalties. By clearly defining the terms of the agreement, the North Carolina promissory note helps foster trust between lenders and borrowers, providing a structured approach to personal or business financing. Understanding the nuances of this form is crucial for anyone involved in lending or borrowing, as it lays the groundwork for a successful financial transaction.

Some Other State-specific Promissory Note Templates

Loan Agreement Template Texas - Penalties for late payments are typically included in the promissory note terms.

For those looking to create a clear and valid proof of transaction, utilizing a reliable resource can be beneficial. You can find helpful templates to guide you in completing this important documentation, such as the one offered by NY Templates.

Ohio Promissory Note Requirements - This form can be customized to fit various lending scenarios.

Michigan Promissory Note Example - A promissory note can also include default provisions and remedies for the lender.

Common mistakes

-

Incorrect Borrower Information: Failing to provide accurate names or addresses can lead to confusion. Ensure that the borrower's full legal name and current address are clearly stated.

-

Missing Lender Details: Just as with the borrower, the lender's information must be complete. Omitting the lender's name or address can cause issues in the future.

-

Improper Amount: Double-check the loan amount. Writing the wrong figure can create disputes later on. Ensure the amount is clear and correctly formatted.

-

Not Specifying Interest Rate: If the loan includes interest, the rate must be clearly stated. Leaving this blank can lead to misunderstandings about repayment terms.

-

Unclear Repayment Terms: Clearly outline when payments are due and the method of payment. Vague terms can create confusion and lead to missed payments.

-

Failure to Sign: Both parties must sign the document for it to be valid. An unsigned note is not enforceable, which can jeopardize the agreement.

-

Not Dating the Document: Forgetting to include the date can create complications. Always ensure the date of signing is included to establish a timeline.

-

Ignoring Witness or Notary Requirements: Depending on the situation, having a witness or notary may be necessary. Failing to include these can affect the note's validity.

-

Not Keeping Copies: After completing the note, both parties should retain copies. This ensures that everyone has access to the terms agreed upon.

Guide to Writing North Carolina Promissory Note

Once you have the North Carolina Promissory Note form in front of you, it's time to fill it out accurately. This document will outline the terms of the loan agreement between the borrower and the lender. Follow the steps below to complete the form correctly.

- Start by entering the date at the top of the form. Use the format month/day/year.

- Next, fill in the name and address of the borrower. This should include the full name and current address.

- Provide the name and address of the lender. Ensure that this information is complete and accurate.

- Specify the principal amount of the loan. This is the total amount borrowed and should be written in both numbers and words.

- Indicate the interest rate. Write the percentage as a number and ensure it is clear.

- State the payment terms. Specify how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments. Be specific about the conditions that apply.

- Sign and date the form at the bottom. The borrower must do this to validate the agreement.

- If required, have a witness or notary public sign the document. This step may vary based on specific needs.

After completing the form, make copies for both the borrower and lender. Store the original in a safe place. This document serves as an important record of the loan agreement.

Documents used along the form

When entering into a loan agreement in North Carolina, a Promissory Note is a key document. However, it is often accompanied by other forms and documents that help clarify the terms of the loan and protect the interests of both parties. Here are some commonly used documents alongside the North Carolina Promissory Note:

- Loan Agreement: This document outlines the specific terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any penalties for late payments. It serves as a comprehensive guide to the expectations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, a Security Agreement details what assets are being used as security. This document ensures that the lender has a legal claim to the collateral if the borrower fails to repay the loan.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and terms. It ensures that the borrower fully understands the costs associated with the loan before agreeing to the terms.

- Motorcycle Bill of Sale: For those involved in motorcycle transactions, our essential motorcycle bill of sale documentation is crucial to ensure all details are formally recorded.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from the borrower or a third party. This document holds the individual personally responsible for the loan, adding an extra layer of security for the lender.

These documents work together to create a clear and enforceable loan agreement. By understanding each component, both lenders and borrowers can navigate their financial obligations with confidence.