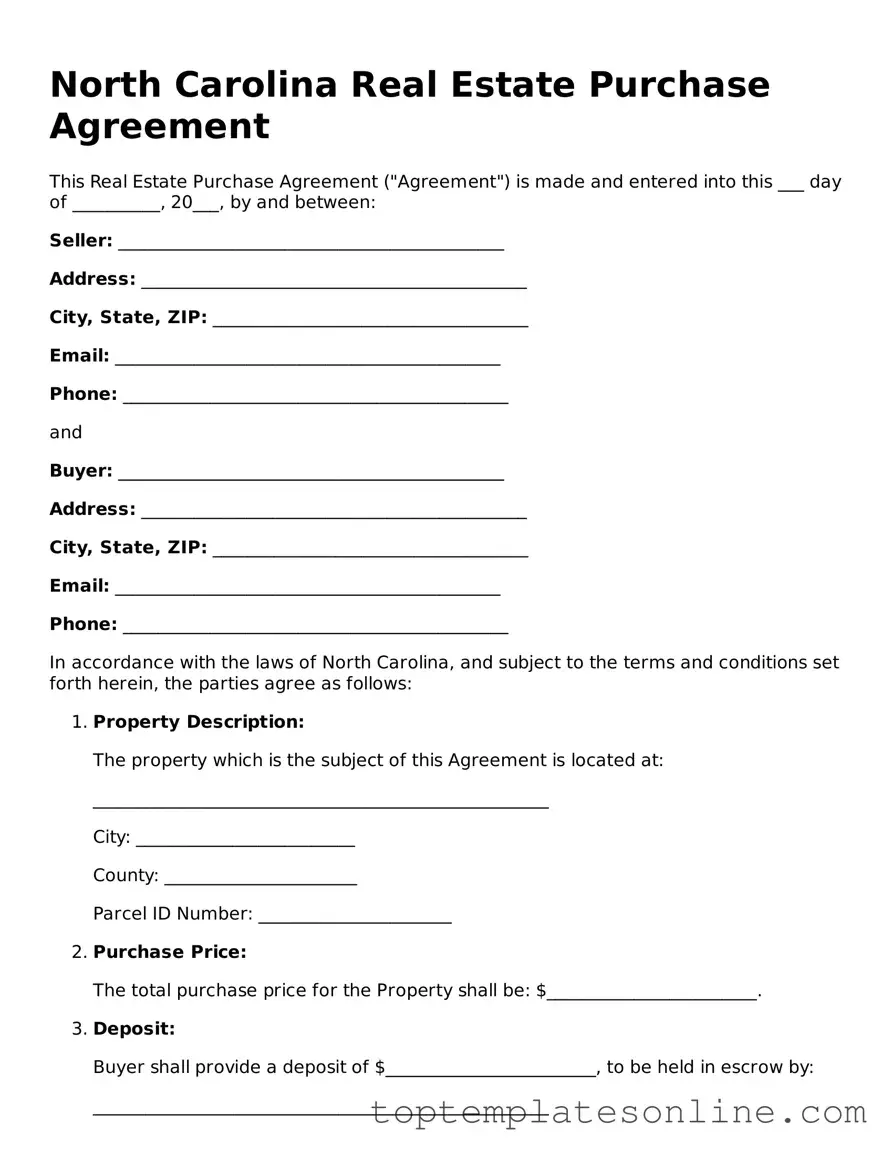

Blank Real Estate Purchase Agreement Template for North Carolina State

When navigating the world of real estate transactions in North Carolina, understanding the Real Estate Purchase Agreement form is crucial for both buyers and sellers. This document serves as a binding contract that outlines the terms of the sale, ensuring that both parties are on the same page. Key aspects of the form include the purchase price, the property description, and the closing date, which are essential for establishing the framework of the agreement. Additionally, it addresses contingencies such as financing and inspections, providing a safety net for buyers. The form also details the responsibilities of both parties, including disclosures and any repairs that may need to be addressed before closing. By clearly laying out these elements, the Real Estate Purchase Agreement helps to minimize misunderstandings and protects the interests of everyone involved in the transaction.

Some Other State-specific Real Estate Purchase Agreement Templates

Purchasing Agreements - It can specify how the possession of the property will be transferred.

For individuals looking to navigate the nuances of mobile home transactions, a thorough understanding of the "New York Mobile Home Bill of Sale" is crucial. By utilizing a detailed mobile home bill of sale, you can ensure a legally binding agreement that protects both the buyer and seller. For more insights, refer to the important mobile home bill of sale documentation.

How to Get a Purchase Agreement - Identifies any inspection and repair responsibilities.

Common mistakes

-

Incomplete Information: Many people forget to fill in all required fields. Missing details can delay the process or even lead to the rejection of the agreement.

-

Incorrect Dates: It's crucial to ensure that all dates are accurate. Errors in the closing date or deadlines can create confusion and complications.

-

Omitting Contingencies: Buyers often neglect to include important contingencies, such as financing or inspection clauses. This can leave them vulnerable to unforeseen issues.

-

Wrong Property Description: Providing an inaccurate description of the property can lead to legal disputes. Always double-check the address and any additional identifying details.

-

Ignoring Seller Disclosures: Sellers must disclose certain information about the property. Buyers should ensure these disclosures are included and reviewed carefully.

-

Not Specifying Earnest Money: Failing to clearly state the amount of earnest money can create misunderstandings. This deposit shows the buyer's serious intent and should be defined in the agreement.

-

Missing Signatures: It's easy to overlook signatures, but without them, the agreement is not legally binding. Ensure all parties sign the document.

-

Neglecting Legal Review: Skipping a review by a real estate attorney can be a costly mistake. Legal professionals can spot issues that might be overlooked by individuals.

Guide to Writing North Carolina Real Estate Purchase Agreement

Filling out the North Carolina Real Estate Purchase Agreement form is an essential step in the home buying process. Once completed, this form will serve as a binding contract between the buyer and seller, outlining the terms of the sale. To ensure accuracy and clarity, follow these detailed steps to fill out the form correctly.

- Obtain the Form: Start by acquiring the North Carolina Real Estate Purchase Agreement form from a reliable source, such as a real estate agent or a legal website.

- Fill in the Date: At the top of the form, write the date on which you are completing the agreement.

- Identify the Parties: Enter the full names and addresses of both the buyer(s) and seller(s). Ensure that all names are spelled correctly.

- Property Description: Provide a detailed description of the property being sold, including the address and any relevant identification numbers, such as the parcel number.

- Purchase Price: Clearly state the total purchase price of the property. This amount should reflect the agreed-upon price between the buyer and seller.

- Deposit Information: Indicate the amount of earnest money deposit and specify how it will be held (e.g., in an escrow account).

- Financing Terms: If applicable, outline the financing terms, including the type of loan and any contingencies related to financing.

- Closing Date: Specify the proposed closing date, when the transfer of ownership is expected to occur.

- Contingencies: List any contingencies that must be met before the sale can proceed, such as home inspections or financing approval.

- Signatures: Ensure that all parties sign and date the agreement at the end of the document. This includes both the buyers and sellers.

With the form filled out, it's important to review it carefully for any errors or omissions. After confirming that all information is accurate, the next step involves sharing the completed agreement with all parties involved, including real estate agents and attorneys, to facilitate the transaction process.

Documents used along the form

When engaging in real estate transactions in North Carolina, several documents accompany the Real Estate Purchase Agreement. These documents help clarify terms, protect parties' interests, and ensure compliance with state regulations. Below is a list of commonly used forms and documents in conjunction with the purchase agreement.

- Due Diligence Agreement: This document outlines the buyer's right to inspect the property and conduct necessary investigations before finalizing the purchase. It typically includes a specified period during which the buyer can back out without penalty.

- Seller Disclosure Statement: Sellers must provide this statement, which details known issues with the property. It covers aspects like structural problems, environmental hazards, and past repairs, ensuring buyers are fully informed.

- Property Inspection Report: After an inspection, this report summarizes the condition of the property. It highlights any repairs needed and can influence the buyer's decision or negotiation terms.

- Financing Addendum: If the buyer is obtaining a mortgage, this addendum specifies the terms of financing, including loan amount, interest rate, and any contingencies related to the loan approval.

- Title Search Report: This document confirms the legal ownership of the property and identifies any liens or encumbrances. A clear title is essential for a smooth transaction.

- Closing Disclosure: Provided at least three days before closing, this document outlines the final terms of the loan, including all costs associated with the transaction. It ensures transparency in financial obligations.

- Classic Vehicle Registration: Vehicle owners interested in obtaining classic license plates should utilize the Texas VTR-850 form, which outlines the necessary criteria and fees for registering vehicles over 25 years old. For more details, visit texasformspdf.com.

- Settlement Statement (HUD-1): This statement details all costs and credits involved in the transaction. It is typically reviewed at closing to ensure all parties agree on the financial aspects.

- Power of Attorney: In some cases, a buyer or seller may authorize another person to act on their behalf in the transaction. This document grants that authority and must be executed properly.

Understanding these documents can help facilitate a smoother real estate transaction. Each plays a vital role in ensuring that both buyers and sellers are protected and informed throughout the process.