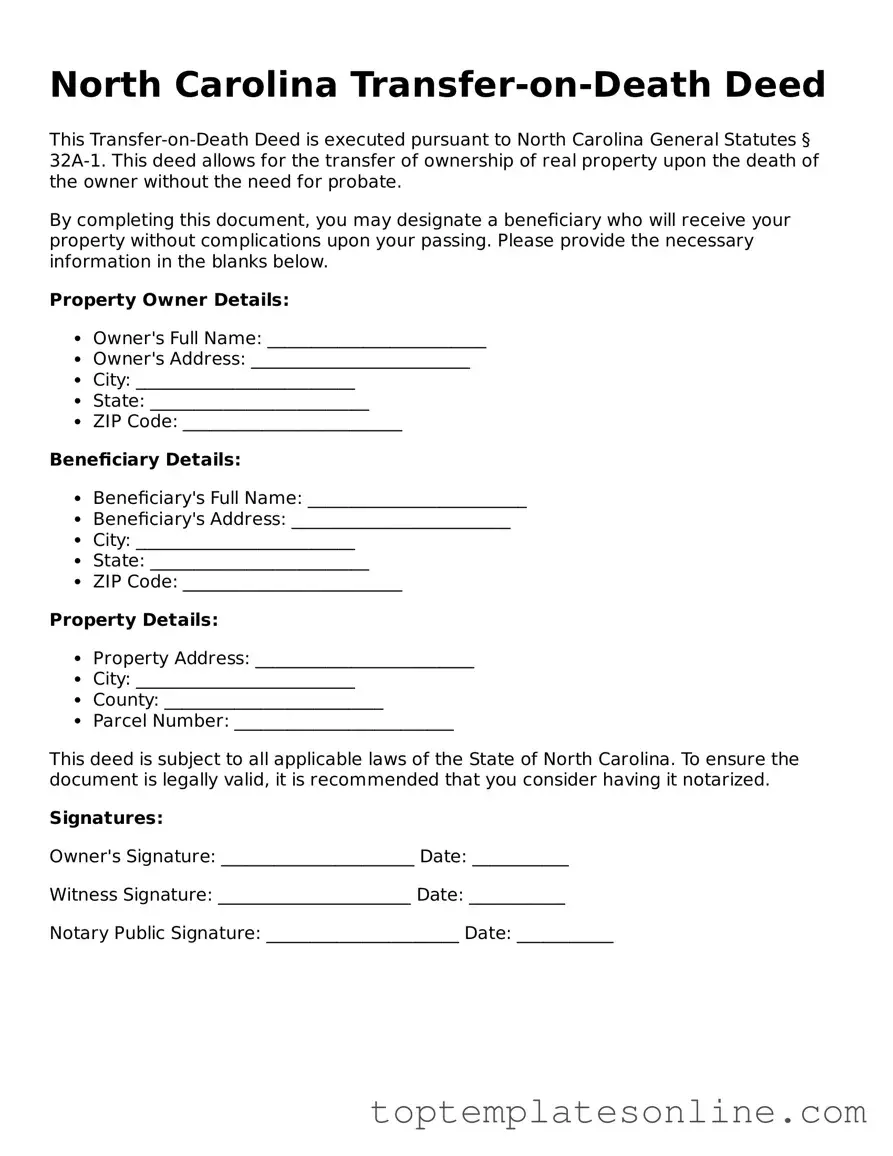

Blank Transfer-on-Death Deed Template for North Carolina State

The North Carolina Transfer-on-Death Deed form serves as a valuable tool for property owners who wish to ensure a smooth transition of their real estate assets upon their passing. This legal document allows individuals to transfer ownership of their property directly to designated beneficiaries without the need for probate, simplifying the process for heirs. By completing this form, property owners can maintain control over their assets during their lifetime while designating who will inherit the property after their death. The form requires specific information, including the property owner's details, a description of the property, and the names of the beneficiaries. Additionally, it must be signed, witnessed, and recorded in the appropriate county office to be legally effective. Understanding the nuances of this deed can provide peace of mind, knowing that one’s wishes will be honored and that loved ones will receive their intended inheritance without unnecessary delays or complications.

Some Other State-specific Transfer-on-Death Deed Templates

How to Avoid Probate in Georgia - Properly filing the deed is necessary to ensure its validity and enforceability after death.

Having a well-drafted General Power of Attorney is vital for ensuring that your affairs are managed effectively, especially in unforeseen circumstances. To empower someone through this document, it's important to understand the nuances involved, including the scope of authority granted. For those seeking a reliable template, NY Templates provides a comprehensive resource that can facilitate the process of creating this crucial legal document.

Can a Transfer on Death Account Be Contested - This deed can be recorded with other property-related documents at the local courthouse or county recorder's office.

Common mistakes

-

Not Understanding the Purpose: Many people fill out the Transfer-on-Death Deed form without fully grasping its purpose. This deed allows property owners to transfer real estate to beneficiaries upon their death, avoiding probate.

-

Incorrectly Identifying the Property: A common mistake is failing to accurately describe the property. It’s essential to include the correct legal description, not just the address, to avoid confusion.

-

Omitting Beneficiary Information: Some individuals forget to list all intended beneficiaries. This can lead to disputes or unintended consequences if the form is not completed correctly.

-

Not Signing the Deed: A Transfer-on-Death Deed must be signed by the property owner. Failing to sign the document renders it invalid.

-

Neglecting Witnesses or Notarization: In North Carolina, the deed must be either witnessed or notarized. Skipping this step can invalidate the deed.

-

Filing in the Wrong County: It’s crucial to file the deed in the correct county where the property is located. Filing it elsewhere can complicate the transfer process.

-

Failing to Record the Deed: Some people mistakenly believe that simply filling out the form is enough. The deed must be recorded with the county register of deeds to be effective.

-

Not Keeping Copies: After filing, it’s vital to keep copies of the recorded deed. This ensures that beneficiaries can access the document when needed.

-

Ignoring Changes in Circumstances: Life changes, such as divorce or the death of a beneficiary, may necessitate updates to the deed. Failing to make these changes can lead to complications.

Guide to Writing North Carolina Transfer-on-Death Deed

After obtaining the North Carolina Transfer-on-Death Deed form, you will need to complete it accurately to ensure that your property transfers as intended upon your passing. Follow these steps carefully to fill out the form correctly.

- Obtain the Form: Download the North Carolina Transfer-on-Death Deed form from a reliable source or visit your local register of deeds office.

- Fill in Your Information: Enter your full name and address in the designated section for the grantor (the person transferring the property).

- Identify the Property: Provide a complete legal description of the property you wish to transfer. This may include the parcel number and address.

- Designate the Beneficiary: Write the full name and address of the beneficiary (the person who will receive the property upon your death).

- Include Additional Beneficiaries: If you want to name more than one beneficiary, include their names and addresses in the appropriate sections.

- Sign the Form: Sign and date the form in front of a notary public. Your signature must be notarized for the deed to be valid.

- File the Deed: Submit the completed and notarized deed to the local register of deeds office in the county where the property is located. Pay any required filing fees.

Once you have submitted the deed, keep a copy for your records. It is also wise to inform your beneficiaries about the deed and its implications. This will help ensure a smooth transfer of property in the future.

Documents used along the form

When preparing a North Carolina Transfer-on-Death Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Understanding these documents can help facilitate the process and protect the interests of all parties involved.

- Property Deed: This document establishes ownership of the property. It outlines the legal description of the property and the names of the current owners.

- Affidavit of Heirship: Used to confirm the identity of heirs when a property owner passes away without a will. This document can help clarify the rightful heirs to the property.

- Last Will and Testament: If the property owner has a will, this document specifies how their assets, including real estate, should be distributed after death.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including real estate transactions, which can be crucial if the property owner is incapacitated.

- Notice of Death: This document may be required to inform interested parties and the public of the property owner's death, especially if the property is part of an estate.

- Residential Lease Agreement Form: For those renting property in New York, understanding the essential residential lease agreement terms is crucial for a smooth rental experience.

- Title Search Report: A report that verifies the ownership of the property and identifies any liens or encumbrances. This ensures that the title is clear before the transfer occurs.

Being aware of these documents can streamline the process of transferring property in North Carolina. Each document plays a vital role in ensuring that the transfer is legally sound and that the rights of all parties are respected.