Blank Articles of Incorporation Template for Ohio State

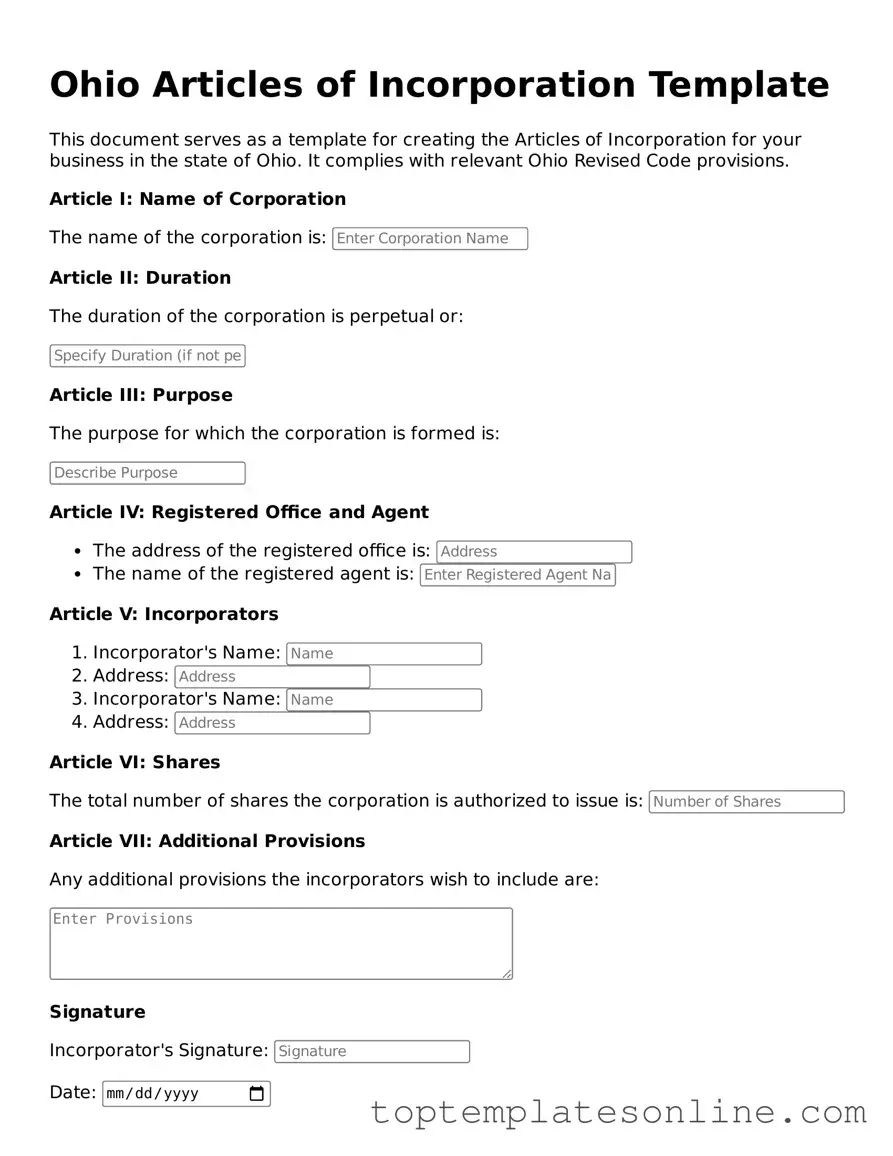

When starting a business in Ohio, one of the first steps is to complete the Articles of Incorporation form. This essential document serves as the foundation for establishing a corporation in the state. It outlines key information about the business, including its name, principal address, and the purpose for which it is being formed. Additionally, the form requires details about the corporation's shares, including the number of shares authorized and their par value. Incorporators must also provide information about the registered agent, a designated individual or entity responsible for receiving legal documents on behalf of the corporation. By carefully filling out this form, entrepreneurs can ensure compliance with state regulations and lay the groundwork for their new venture. Understanding the intricacies of the Articles of Incorporation is crucial for anyone looking to navigate the process of forming a corporation in Ohio successfully.

Some Other State-specific Articles of Incorporation Templates

Document Retrieval Center - Identifies the corporation's name and address.

Georgia Incorporation - The form aims to provide transparency about corporate intentions to stakeholders and the public.

Having a reliable legal Power of Attorney document in place is vital for individuals wishing to ensure that their financial and medical decisions are handled according to their desires. This form grants specific powers to another person, enabling them to act responsibly on your behalf when needed.

Lara Llc - The Articles of Incorporation can help clarify ownership and management roles.

Common mistakes

-

Not providing a clear business name. The name must be unique and not too similar to existing businesses.

-

Failing to include the correct registered agent information. This person or business must be authorized to receive legal documents on behalf of the corporation.

-

Leaving out the purpose of the corporation. A brief description of the business activities is required.

-

Incorrectly listing the initial directors. The names and addresses of the initial directors must be accurate.

-

Not specifying the number of shares the corporation is authorized to issue. This detail is crucial for stock corporations.

-

Forgetting to sign the form. The Articles of Incorporation must be signed by the incorporators.

-

Not including the filing fee. Payment is necessary for the form to be processed.

-

Failing to check for typos or errors. Small mistakes can lead to delays or rejections of the application.

Guide to Writing Ohio Articles of Incorporation

After completing the Ohio Articles of Incorporation form, you will need to submit it to the appropriate state office along with the required fee. Ensure that all information is accurate to avoid delays in processing your application.

- Obtain the Ohio Articles of Incorporation form from the Ohio Secretary of State's website or your local office.

- Fill in the name of your corporation. Ensure it is unique and meets state requirements.

- Provide the purpose of your corporation. Be clear and concise about what your business will do.

- List the address of the principal office. This must be a physical address in Ohio.

- Designate a registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Include the names and addresses of the initial directors. You typically need at least one director.

- State the number of shares the corporation is authorized to issue. Specify any classes of shares if applicable.

- Sign and date the form. The incorporator must sign the document.

- Review the completed form for accuracy. Ensure all fields are filled out correctly.

- Prepare the payment for the filing fee. Check the current fee amount on the Ohio Secretary of State's website.

- Submit the form and payment to the Ohio Secretary of State's office. You can do this by mail or online, depending on your preference.

Documents used along the form

When forming a corporation in Ohio, the Articles of Incorporation is a crucial document. However, several other forms and documents are often needed to complete the incorporation process. These documents serve various purposes, from establishing governance to ensuring compliance with state regulations. Below is a list of commonly used forms that accompany the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for the corporation. Bylaws detail how the corporation will be governed, including the roles of directors and officers, meeting procedures, and voting rights of shareholders.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report typically includes basic information about the corporation, such as its address, officers, and registered agent, ensuring that the state has up-to-date contact information.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes. This unique number, issued by the IRS, allows the corporation to hire employees, open bank accounts, and file tax returns.

- Operating Agreement: While more common for LLCs, some corporations may choose to draft an operating agreement. This document defines the management structure and operational procedures, helping to prevent disputes among owners.

- General Power of Attorney: A NY Templates form allows an individual to designate another person to handle their affairs, crucial when they cannot manage their responsibilities personally.

- State Business Licenses: Depending on the nature of the business, specific licenses or permits may be required at the local, state, or federal level. These licenses ensure that the corporation complies with industry regulations and local laws.

In summary, while the Articles of Incorporation is a foundational document for starting a corporation in Ohio, it is essential to consider these additional forms and documents. Each serves a specific purpose that contributes to the successful establishment and operation of your corporation. Ensuring that all necessary paperwork is completed can help pave the way for a smooth business journey.