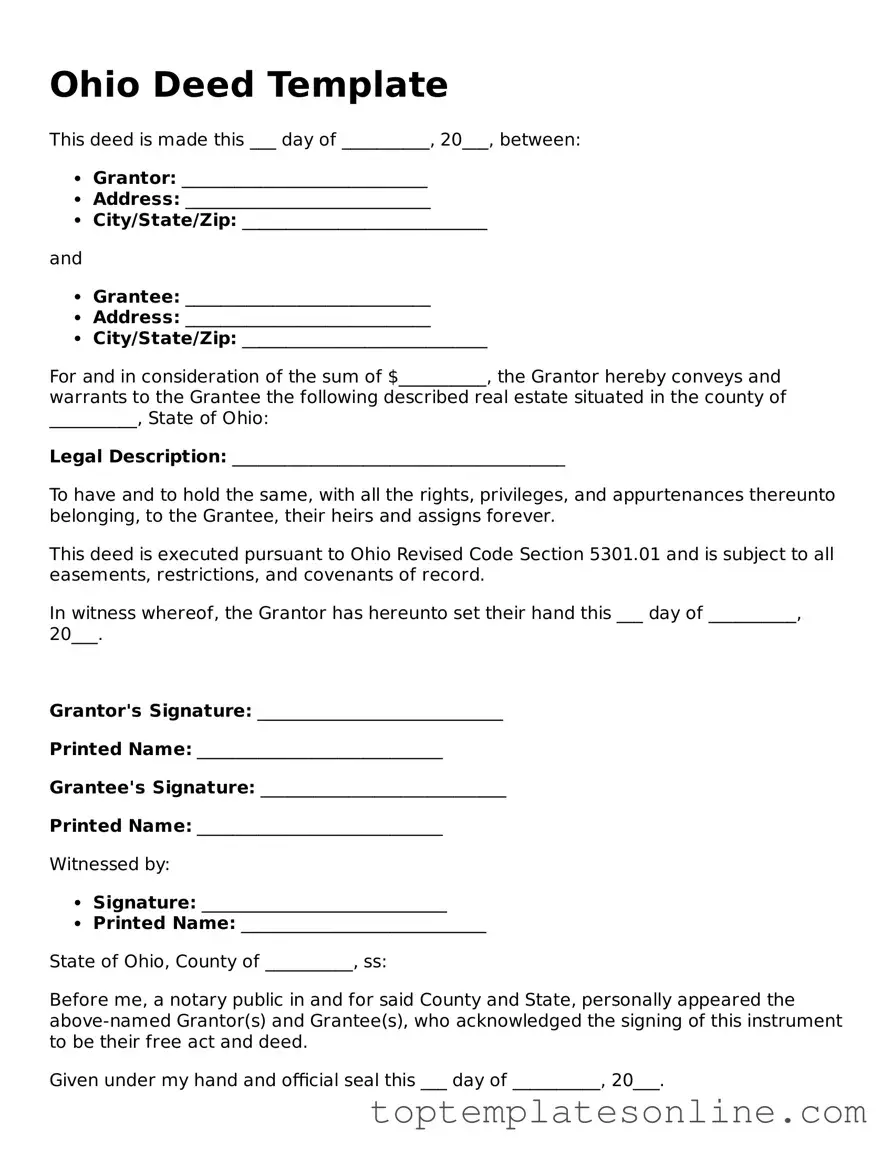

Blank Deed Template for Ohio State

The Ohio Deed form serves as a crucial document in the realm of real estate transactions, facilitating the transfer of property ownership from one party to another. This form encompasses essential elements such as the names of the grantor and grantee, a clear description of the property, and the legal language necessary to execute the transfer. It is important to note that the deed must be signed by the grantor, and in some cases, it may require notarization to ensure its validity. Different types of deeds exist within Ohio, including warranty deeds and quitclaim deeds, each serving specific purposes and offering varying levels of protection to the grantee. Additionally, the form must be properly recorded with the county recorder's office to provide public notice of the ownership change. Understanding these components is vital for anyone involved in a property transaction in Ohio, as they lay the foundation for a legally binding agreement and safeguard the rights of all parties involved.

Some Other State-specific Deed Templates

Property Transfer Form - In certain circumstances, such as divorce, a Deed may be used to transfer property between parties.

For further information and resources regarding the Texas Employment Verification form, employers can visit texasformspdf.com, which provides guidance on how to effectively fill out and submit this essential document to the Texas Health and Human Services Commission.

Nj House Deed - Helps to formalize verbal agreements regarding property transactions.

Legal House Deed Document - The grantee often should verify the details of the Deed before finalizing a purchase.

Common mistakes

-

Incorrect Property Description: People often fail to provide a clear and accurate description of the property. This includes not including the correct parcel number or legal description. Such errors can lead to confusion and disputes later.

-

Omitting Signatures: A common mistake is not obtaining all necessary signatures. All parties involved in the transaction must sign the deed. Without the required signatures, the deed may not be valid.

-

Improper Notarization: Some individuals overlook the need for notarization. A deed must be notarized to be legally binding. Failing to have a notary public witness the signing can invalidate the document.

-

Incorrect Grantee Information: Errors often occur when entering the name of the grantee. It is essential to ensure that the name is spelled correctly and that it matches the name on the identification. Mistakes here can complicate ownership transfer.

-

Neglecting to Record the Deed: After filling out the deed form, some forget to record it with the county recorder’s office. Recording the deed is crucial as it provides public notice of the ownership change and protects the grantee’s rights.

Guide to Writing Ohio Deed

Once you have the Ohio Deed form in hand, it's time to fill it out accurately. This is a straightforward process, but attention to detail is essential to ensure everything is correct. Follow the steps below to complete the form properly.

- Start by entering the date at the top of the form. Use the format MM/DD/YYYY.

- In the "Grantor" section, write the full name of the person or entity transferring the property. Include their address.

- Next, in the "Grantee" section, provide the full name of the person or entity receiving the property. Again, include their address.

- Fill in the "Consideration" section. This is typically the amount paid for the property. Write the amount in both numerical and written form.

- Describe the property being transferred. Include the address and any legal descriptions required.

- If applicable, add any restrictions or conditions related to the property transfer.

- Sign the form where indicated. Ensure that the signature matches the name of the grantor.

- Have the deed notarized. A notary public must witness the signature to validate the document.

- Finally, submit the completed deed to the appropriate county recorder's office for filing.

After filling out the form, ensure that all information is accurate and legible. Once submitted, the deed will be recorded, making the transfer official. Keep a copy for your records.

Documents used along the form

In real estate transactions in Ohio, various forms and documents accompany the Ohio Deed form. Each of these documents serves a specific purpose and plays a vital role in ensuring the legality and clarity of property transfers. Below is a list of commonly used forms and documents in conjunction with the Ohio Deed form.

- Title Search Report: This document outlines the history of ownership of the property, revealing any liens, encumbrances, or claims against it. A title search is crucial for ensuring clear ownership.

- Property Disclosure Statement: Sellers provide this document to inform potential buyers of any known issues with the property. It covers aspects such as structural problems, environmental hazards, and other significant concerns.

- Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller. It includes the purchase price, financing details, and any contingencies that must be met before the sale is finalized.

- Affidavit of Title: This sworn statement, usually from the seller, confirms their ownership of the property and discloses any claims or liens. It helps protect the buyer from potential disputes over ownership.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document itemizes all the financial transactions involved in the sale, including fees, taxes, and adjustments. It is presented at the closing of the sale.

- Transfer Tax Affidavit: This form is required to report the transfer of property and calculate any applicable transfer taxes. It must be filed with the county auditor's office.

- Recommendation Letter: A vital document that evaluates an individual’s skills and character, enhancing their application for various opportunities. To understand its significance in property transactions, read more about the document.

- Mortgage Documents: If financing is involved, various mortgage documents will be necessary. These include the mortgage agreement and promissory note, outlining the terms of the loan.

- Power of Attorney: In some cases, a seller may appoint someone else to act on their behalf in the transaction. This document grants that person the authority to sign documents related to the sale.

- IRS Form 1099-S: This tax form reports the sale of real estate to the IRS. It is typically filed by the closing agent and is important for tax reporting purposes.

Understanding these documents and their purposes can facilitate a smoother real estate transaction in Ohio. Each plays a crucial role in ensuring that the rights and responsibilities of all parties involved are clearly defined and legally protected.