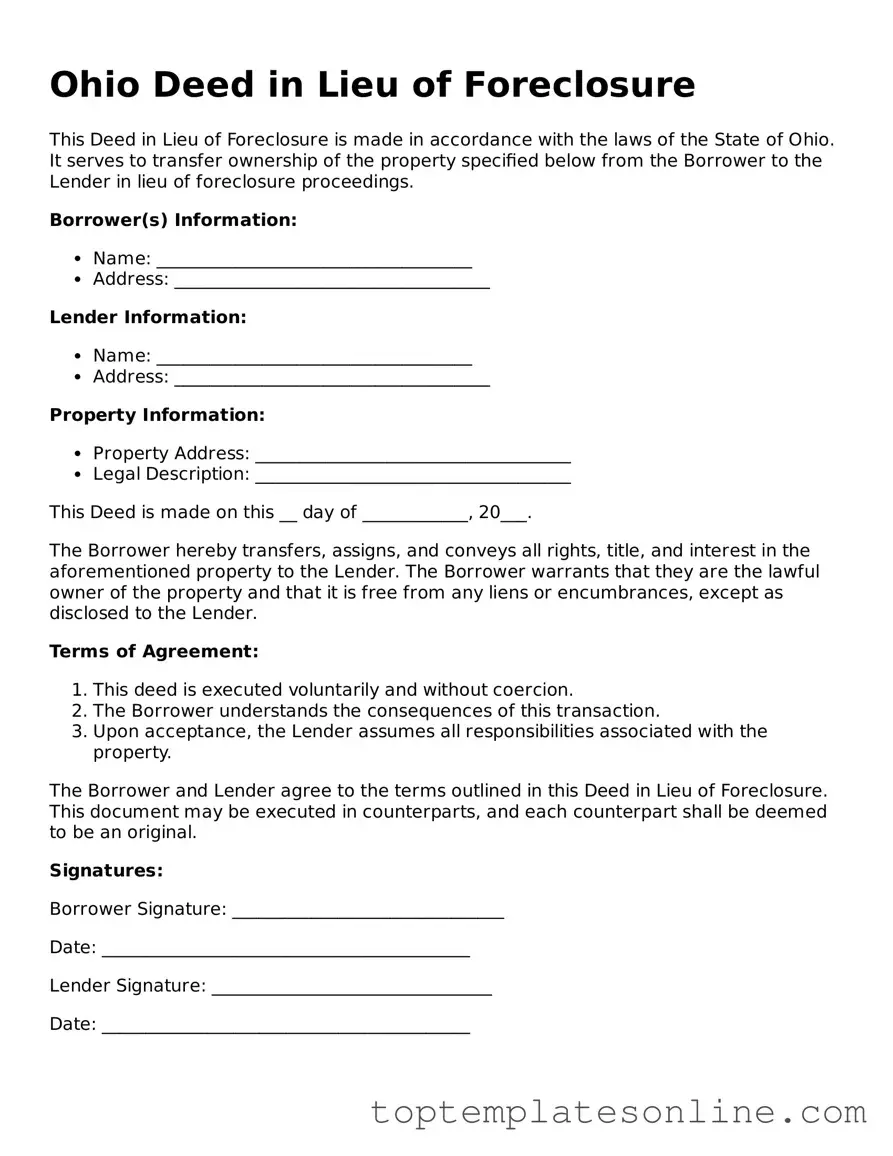

Blank Deed in Lieu of Foreclosure Template for Ohio State

In Ohio, the Deed in Lieu of Foreclosure form serves as a valuable tool for homeowners facing financial difficulties and the threat of foreclosure. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often stressful foreclosure process. Key aspects of the form include the identification of both the borrower and the lender, a clear description of the property involved, and the acknowledgment of any existing liens or encumbrances. Additionally, the form outlines the conditions under which the deed is executed, ensuring that both parties understand their rights and responsibilities. By opting for a deed in lieu, homeowners can potentially mitigate damage to their credit scores and expedite the transition out of a burdensome mortgage. This option not only benefits the homeowner but also provides lenders with a more efficient resolution to recover their investment.

Some Other State-specific Deed in Lieu of Foreclosure Templates

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - A Deed in Lieu may release homeowners from remaining mortgage debt, depending on the lender's terms.

Having a reliable plan in place is essential for every parent, and utilizing the Florida Power of Attorney for a Child form can help you achieve that peace of mind. This document empowers you to choose a trusted individual to act on your behalf when you're unable to make decisions for your child, ensuring their well-being in various situations. For those looking to navigate the process effectively, resources such as Florida Forms can provide valuable guidance and templates to assist in preparing the necessary paperwork.

Georgia Foreclosure - The borrower might be able to stay in the property until an agreement is reached, often referred to as a "cash for keys" arrangement.

Common mistakes

-

Failing to provide complete property information. It's important to include the correct address and legal description of the property. Missing details can lead to delays or complications.

-

Not signing the document. All required parties must sign the form. An unsigned document is invalid and will not be processed.

-

Incorrectly identifying the parties involved. Ensure that all names are spelled correctly and match the names on the title.

-

Omitting the date. Every deed should have a date when it is executed. Without a date, the deed may be questioned.

-

Not including a notary signature. Many jurisdictions require notarization for the deed to be legally binding. Failing to have a notary can invalidate the document.

-

Ignoring local requirements. Different counties may have specific rules regarding the deed. Always check local regulations to ensure compliance.

-

Not providing supporting documents. Sometimes, additional paperwork is needed, such as proof of ownership or a hardship letter. Be prepared to submit all required documents.

-

Submitting the form without reviewing it. Mistakes can be easily overlooked. It is advisable to review the form carefully before submission.

Guide to Writing Ohio Deed in Lieu of Foreclosure

After completing the Ohio Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties and ensuring that all requirements are met for a smooth transition. It’s important to keep copies for your records and follow up to confirm that the deed has been processed correctly.

- Begin by gathering all necessary information about the property, including the address and legal description.

- Identify the current property owner(s) and ensure their names are correctly spelled as they appear on the title.

- Fill in the date on which the deed is being executed.

- Clearly state the name of the lender or mortgage company that is accepting the deed in lieu of foreclosure.

- Provide a description of the property, including the county where it is located.

- Include any additional terms or conditions that may apply to the deed transfer.

- Ensure that all parties involved sign the document in the appropriate places. Signatures should be notarized to validate the deed.

- Make copies of the completed form for your records.

- Submit the original deed to the county recorder’s office where the property is located for official recording.

Documents used along the form

When dealing with the Ohio Deed in Lieu of Foreclosure, several other forms and documents may be necessary to ensure a smooth process. Each document serves a specific purpose and can facilitate the transaction. Below is a list of commonly used documents.

- Loan Modification Agreement: This document outlines changes to the original loan terms, potentially making repayment more manageable for the borrower.

- Notice of Default: This formal notice informs the borrower that they have defaulted on their loan obligations and outlines the consequences if the situation is not remedied.

- Statement of Fact Texas Form: Essential for certifying vehicle transaction details, the texasformspdf.com provides guidance on completing this legal document accurately to comply with Texas law.

- Release of Liability: This document releases the borrower from any further obligations related to the loan after the deed in lieu transaction is completed.

- Property Inspection Report: A report detailing the condition of the property, often required by lenders to assess its value and any necessary repairs.

- Title Report: This document provides information about the property’s ownership history, confirming that the title is clear and can be transferred without issues.

- Settlement Statement: A detailed account of all costs and fees associated with the transaction, ensuring transparency for both parties involved.

Each of these documents plays a critical role in the process surrounding a deed in lieu of foreclosure. Ensure all necessary forms are completed accurately to avoid complications.