Blank Durable Power of Attorney Template for Ohio State

The Ohio Durable Power of Attorney form is a crucial legal document that allows individuals to designate someone they trust to make decisions on their behalf when they are unable to do so themselves. This form is particularly important for managing financial matters, healthcare decisions, and other personal affairs. It remains effective even if the individual becomes incapacitated, ensuring that their preferences are honored and that their affairs are handled according to their wishes. The appointed agent, also known as an attorney-in-fact, gains the authority to perform a wide range of tasks, from managing bank accounts to making medical decisions. In Ohio, this form must be signed by the principal and notarized to be valid, providing a layer of protection and clarity. Additionally, the principal can specify the scope of the agent's authority, allowing for tailored arrangements that reflect their unique needs and circumstances. Understanding the nuances of this form is essential for anyone considering how to prepare for future uncertainties and safeguard their interests.

Some Other State-specific Durable Power of Attorney Templates

North Carolina Power of Attorney Requirements - A Durable Power of Attorney is a necessary planning tool to safeguard your assets and ensure your needs are met in emergencies.

When engaging in the sale or purchase of a boat in New York, it's crucial to utilize the New York Boat Bill of Sale form to ensure all aspects of the transaction are clearly documented. For those looking for a reliable template to facilitate this process, resources like NY Templates can provide valuable assistance, allowing both buyers and sellers to navigate their obligations effectively.

New York State Power of Attorney Form - Many people choose this form to avoid the complications associated with guardianship proceedings.

Common mistakes

-

Not specifying the powers granted: Many individuals fail to clearly outline the specific powers they wish to grant to their agent. This can lead to confusion or disputes later on. It is important to be as detailed as possible.

-

Choosing the wrong agent: Selecting someone who may not act in your best interest can be a significant mistake. It is crucial to choose a trustworthy person who understands your values and wishes.

-

Not signing the document properly: A Durable Power of Attorney must be signed according to Ohio law. Failing to sign in the correct location or not having the required witnesses can invalidate the document.

-

Neglecting to update the form: Life changes, such as marriage, divorce, or the death of an agent, can necessitate updates to the Durable Power of Attorney. Not revising the document when these changes occur can lead to complications.

-

Ignoring notarization requirements: While notarization is not always mandatory for a Durable Power of Attorney in Ohio, it is highly recommended. Failing to have the document notarized can create challenges in its acceptance by financial institutions or healthcare providers.

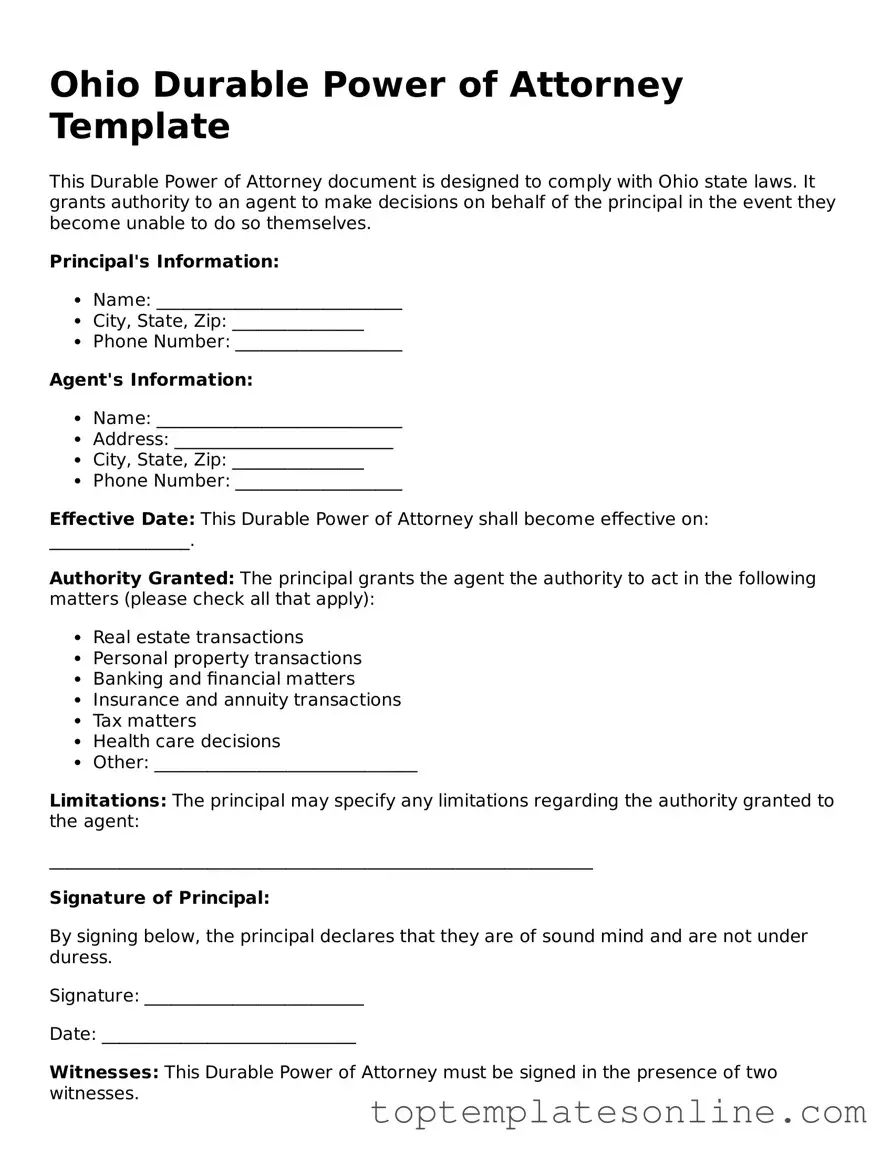

Guide to Writing Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form is an important step in ensuring that your wishes are respected if you become unable to make decisions for yourself. This form allows you to designate someone you trust to handle your financial and legal matters. Follow the steps below to complete the form accurately.

- Obtain the Ohio Durable Power of Attorney form. You can find it online or request a copy from a legal professional.

- Read through the entire form carefully to understand what information is required.

- Begin by filling in your full name and address at the top of the form. Ensure that all details are correct.

- Next, designate the person you want to act on your behalf. Provide their full name, address, and relationship to you.

- Specify the powers you are granting to your agent. You can choose to give broad powers or limit them to specific tasks.

- If you wish to include any additional instructions or limitations, write them clearly in the designated section.

- Sign and date the form at the bottom. Your signature should match the name you provided at the beginning of the form.

- Have your signature witnessed by at least one person. The witness should not be your agent or related to you.

- If required, have the document notarized to add an extra layer of authenticity.

- Keep a copy of the completed form for your records and provide a copy to your agent.

Documents used along the form

When establishing a Durable Power of Attorney in Ohio, several other forms and documents may complement it. Each of these documents serves a specific purpose and can help clarify intentions, ensure proper management of affairs, or provide additional legal authority. Below is a list of commonly used forms that often accompany the Durable Power of Attorney.

- Living Will: This document outlines a person's wishes regarding medical treatment in situations where they cannot communicate their preferences. It guides healthcare providers and loved ones in making decisions about end-of-life care.

- Healthcare Power of Attorney: Similar to a Durable Power of Attorney, this document specifically grants someone the authority to make medical decisions on your behalf if you are unable to do so. It focuses solely on healthcare matters.

- Financial Power of Attorney: This form allows you to designate someone to handle financial matters on your behalf. It can be used alongside a Durable Power of Attorney to ensure comprehensive management of both personal and financial affairs.

- Non-disclosure Agreement: To protect sensitive information, a Non-disclosure Agreement is essential for anyone sharing confidential data. For a useful resource, consider this https://newyorkform.com/free-non-disclosure-agreement-template/.

- Will: A will outlines how a person's assets should be distributed after their death. It can work in conjunction with a Durable Power of Attorney to ensure that both financial and personal wishes are respected.

- Trust Agreement: A trust can hold assets for the benefit of another person or entity. Establishing a trust can provide additional control over how and when assets are distributed, often used alongside a Durable Power of Attorney for estate planning.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance or retirement accounts, upon your death. They can simplify the transfer of assets and should be kept current alongside other estate planning documents.

- Guardianship Documents: In cases where someone may need a guardian due to incapacity, these documents establish who will take on that role. This can be important for individuals who may not have a Durable Power of Attorney in place.

- Authorization for Release of Medical Information: This document allows designated individuals to access medical records and information. It complements healthcare-related documents by ensuring that those making decisions have the necessary information.

Each of these forms plays a crucial role in comprehensive estate planning and can help ensure that your wishes are honored. By understanding and utilizing these documents alongside a Durable Power of Attorney, you can create a robust plan that addresses various aspects of your personal and financial life.