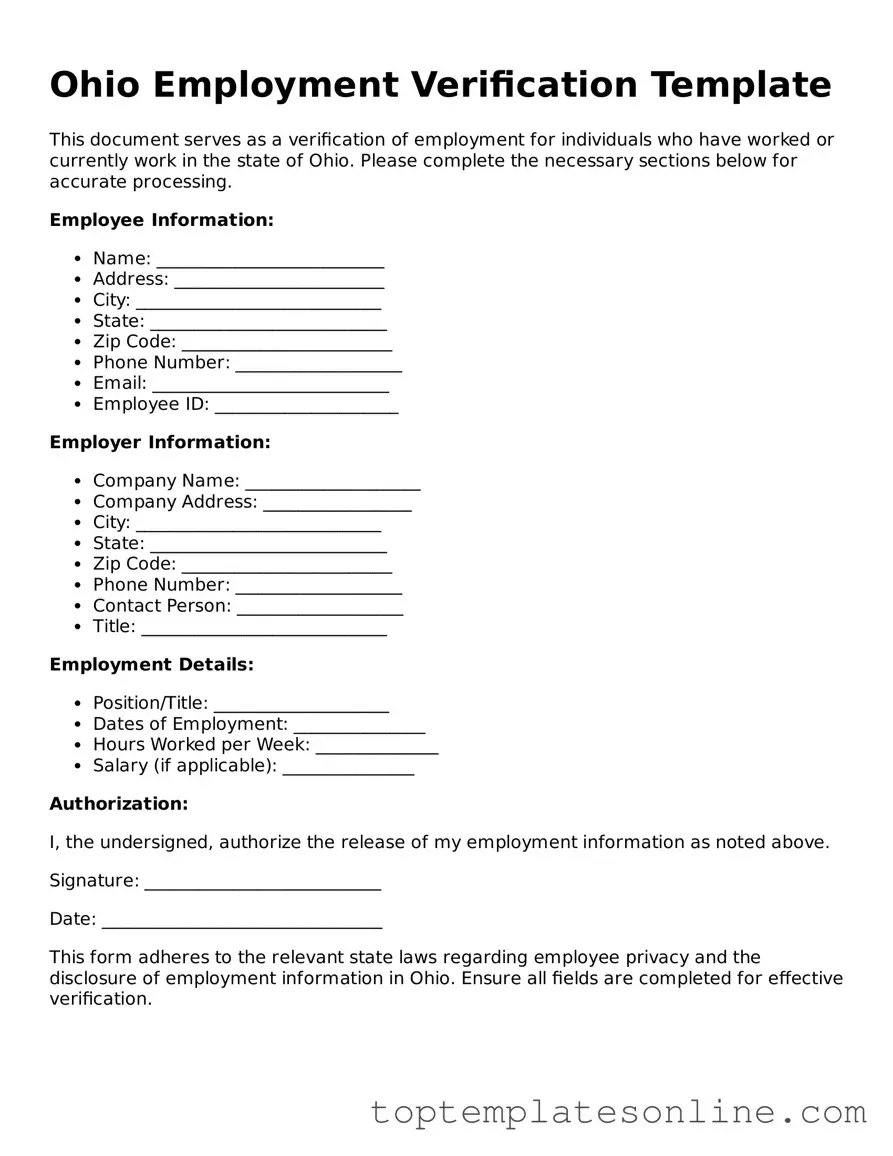

Blank Employment Verification Template for Ohio State

When navigating the employment landscape in Ohio, understanding the Employment Verification form is essential for both employers and employees. This form serves as a crucial tool for confirming an individual's employment status, including details such as job title, duration of employment, and salary information. Employers often use it during the hiring process or when verifying a current employee’s credentials for loans, housing applications, or other purposes. For employees, this form can be a vital document when seeking new opportunities or fulfilling various personal needs. Completing the form accurately is important, as it not only reflects the employee's work history but also ensures compliance with any legal requirements. Additionally, understanding who needs to fill out the form and how it should be submitted can streamline the verification process, making it easier for everyone involved. Overall, the Ohio Employment Verification form plays a significant role in fostering transparency and trust in the employer-employee relationship.

Some Other State-specific Employment Verification Templates

Letter for Employment - It acts as an objective verification of claims made by potential employees.

To further assist employers in fulfilling their responsibilities regarding employee verification, resources are available online, including the option to access the Texas Employment Verification form directly at texasformspdf.com, which simplifies the process of ensuring that all necessary information is provided accurately and efficiently.

Texas Income Comfirmation Letter - Acts as evidence in disputes regarding employment status or discrepancies.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays. Ensure every section is addressed fully.

-

Incorrect Dates: Entering wrong employment dates can cause confusion. Double-check the start and end dates.

-

Wrong Job Title: Using an inaccurate job title may misrepresent the role. Verify the title with the employer before submission.

-

Missing Signature: Omitting the required signature can invalidate the form. Always sign where indicated.

-

Inaccurate Employer Information: Providing incorrect contact details for the employer can hinder verification. Confirm the employer's name and contact information.

-

Not Using Official Letterhead: Submitting the form without the employer's official letterhead may raise questions about its authenticity. Always use the proper format.

-

Neglecting to Include Additional Documentation: Failing to attach necessary supporting documents can lead to incomplete verification. Include any requested paperwork.

-

Ignoring Instructions: Not following the specific instructions provided can result in errors. Read the guidelines carefully before filling out the form.

-

Using Abbreviations: Abbreviating terms can cause misunderstandings. Write out all terms clearly to avoid confusion.

-

Submitting Late: Delaying the submission can lead to missed deadlines. Aim to submit the form as soon as possible.

Guide to Writing Ohio Employment Verification

Once you have the Ohio Employment Verification form in front of you, it's time to fill it out carefully. Ensure that all required fields are completed accurately to avoid any delays in processing.

- Begin by entering the employee's full name in the designated space.

- Provide the employee's Social Security number. Make sure this is accurate to prevent any issues.

- Fill in the employee's job title and the department they work in.

- Indicate the start date of the employee's employment. This is crucial for verification purposes.

- Include the employee's current salary or hourly wage. Be precise with the figures.

- Complete the employer's name and contact information, including the address and phone number.

- Sign and date the form at the bottom to validate the information provided.

After filling out the form, review all entries for accuracy. Once confirmed, submit it as directed, whether by mail, fax, or electronically, depending on the requirements.

Documents used along the form

When completing the Ohio Employment Verification process, several other forms and documents may be required to support the verification. Each of these documents serves a specific purpose and can help ensure a smooth and accurate verification process.

- W-2 Form: This form provides information about an employee's annual wages and the taxes withheld from their paycheck. It is often used to verify income.

- Pay Stubs: Recent pay stubs show an employee's earnings over a specified period. They can help confirm employment status and income levels.

- Employment Offer Letter: This letter outlines the terms of employment, including position, salary, and start date. It serves as proof of employment and the agreed-upon conditions.

- Power of Attorney: A legal document that allows an individual to designate another person to make decisions on their behalf. Understanding its importance is crucial, and you can find more about Florida Forms for this purpose.

- Tax Returns: Personal tax returns can provide a comprehensive view of an individual's income over the years. They may be requested to verify long-term employment and income stability.

- Social Security Card: This card verifies an employee's Social Security number, which is essential for tax reporting and employment eligibility.

- Driver's License or State ID: A government-issued ID confirms the identity of the employee and may be necessary for background checks.

- Background Check Authorization: This document allows the employer to conduct a background check, which may include verifying previous employment history.

- Direct Deposit Authorization Form: This form provides the necessary banking information for an employee's paychecks to be deposited directly into their bank account, confirming employment and payment details.

Gathering these documents can streamline the verification process and ensure that all necessary information is readily available. Being prepared with the right paperwork can help avoid delays and complications.