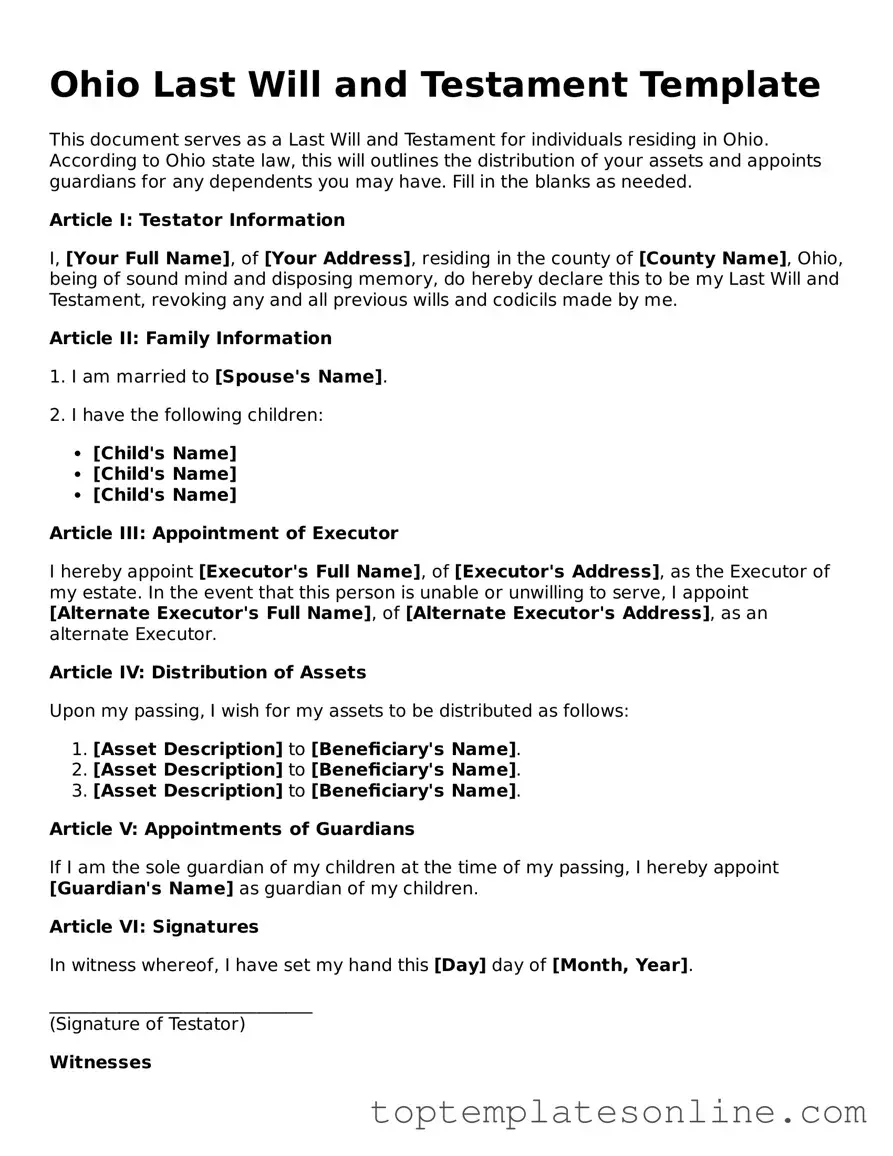

Blank Last Will and Testament Template for Ohio State

Creating a Last Will and Testament is an essential step in ensuring that an individual's wishes regarding their assets and loved ones are honored after their passing. In Ohio, this legal document outlines how a person wants their property distributed, who will care for any minor children, and who will execute their wishes. The Ohio Last Will and Testament form includes several key components, such as the testator's identity, a declaration of revocation of any previous wills, and specific instructions for the distribution of assets. Additionally, it allows for the appointment of an executor, a trusted individual responsible for carrying out the terms of the will. It is important to note that the form must be signed and witnessed according to Ohio law to ensure its validity. Understanding these elements can help individuals navigate the process of creating a will that reflects their intentions and provides clarity for their family and friends during a difficult time.

Some Other State-specific Last Will and Testament Templates

How to Make a Will in Nj - A way to express your final wishes regarding personal items.

Last Will and Testament Michigan - Intended to reflect personal values and priorities in a formalized way.

For those looking to navigate the nuances of buying or selling a motorcycle, understanding the importance of a well-documented transaction is crucial. This includes using a proper form to ensure legality and clarity. To assist in this process, a valuable resource is the comprehensive Motorcycle Bill of Sale that outlines the necessary steps and information needed for a smooth exchange.

Will Template Georgia - Can help to minimize disputes among heirs and streamline the probate process.

Last Will and Testament Template New York Pdf - May incorporate specific requests for the care of pets, reflecting compassion for animal companions.

Common mistakes

-

Not Being Specific About Assets: Many individuals fail to clearly identify their assets. It’s important to specify what you own, including property, bank accounts, and personal belongings. Vague descriptions can lead to disputes.

-

Overlooking Witness Requirements: Ohio law requires that a will be signed in the presence of two witnesses. Some people forget this step or do not choose impartial witnesses, which can invalidate the will.

-

Not Updating the Will: Life changes such as marriage, divorce, or the birth of children necessitate updates to your will. Failing to revise it can result in unintended beneficiaries or outdated information.

-

Ignoring the Executor Role: Selecting an executor is crucial. Some people either don’t appoint one or choose someone who may not be willing or able to fulfill the role. This can complicate the administration of the estate.

-

Not Including a Residual Clause: A residual clause addresses any assets not specifically mentioned in the will. Omitting this can lead to confusion about how to handle remaining assets, potentially resulting in legal challenges.

Guide to Writing Ohio Last Will and Testament

After obtaining the Ohio Last Will and Testament form, the next steps involve accurately completing the document to ensure it reflects the individual's wishes regarding the distribution of their assets. It is important to follow the instructions carefully to avoid any potential issues in the future.

- Begin by entering your full legal name at the top of the form.

- Provide your current address, including city, state, and zip code.

- Indicate the date on which the will is being created.

- Clearly state your intentions regarding the distribution of your assets. This includes naming beneficiaries and specifying what each beneficiary will receive.

- If applicable, appoint an executor who will be responsible for carrying out the terms of the will. Include their full name and contact information.

- Consider including a clause for the appointment of a guardian for any minor children, if relevant.

- Review the document for accuracy and completeness before signing.

- Sign the will in the presence of at least two witnesses. Ensure that the witnesses are not beneficiaries of the will.

- Have the witnesses sign the document, along with their full names and addresses.

- Store the completed will in a safe location, and inform your executor of its whereabouts.

Documents used along the form

When preparing an estate plan in Ohio, individuals often utilize several important documents alongside the Last Will and Testament. Each of these documents serves a unique purpose in ensuring that a person's wishes are honored and that their estate is managed according to their preferences.

- Living Will: This document outlines an individual's preferences regarding medical treatment in situations where they are unable to communicate their wishes. It typically addresses end-of-life care and life-sustaining treatments.

- Durable Power of Attorney: This form allows an individual to designate someone to make financial and legal decisions on their behalf if they become incapacitated. The authority granted can be broad or limited, depending on the individual's needs.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document specifically designates an agent to make healthcare decisions for an individual if they are unable to do so themselves.

- Revocable Living Trust: A trust allows for the management of assets during a person's lifetime and can facilitate the transfer of those assets upon death, avoiding probate. It can be altered or revoked by the creator at any time while they are alive.

- Beneficiary Designations: These forms are used for financial accounts, retirement plans, and insurance policies to specify who will receive the assets upon the account holder's death. They take precedence over wills.

- Affidavit of Heirship: This document may be used to establish the heirs of a deceased person, particularly when there is no will. It provides a legal declaration of who the rightful heirs are based on the state's intestacy laws.

- Pet Trust: This specialized trust ensures that pets are cared for after their owner's death. It provides instructions and funds for the pet's care, designating a caregiver and outlining the necessary provisions.

- Letter of Intent: While not a legally binding document, this letter can accompany a will to provide additional guidance to the executor regarding the individual's wishes, including funeral arrangements and distribution of personal items.

- Guardianship Designation: For individuals with minor children, this document allows parents to designate a guardian who will care for their children in the event of their untimely death.

- Bill of Sale: A legal document that records the transfer of ownership of personal property, ensuring clarity and protection for both parties involved. For detailed templates, visit NY Templates.

- Estate Inventory: This document lists all assets and liabilities of the deceased, providing a comprehensive overview of the estate. It assists the executor in managing the estate and fulfilling their duties.

These documents, when used in conjunction with a Last Will and Testament, help to create a comprehensive estate plan that reflects an individual's wishes and provides clarity for their loved ones. It is essential to consider each of these forms carefully, as they can significantly impact the management and distribution of an estate.