Blank Motor Vehicle Bill of Sale Template for Ohio State

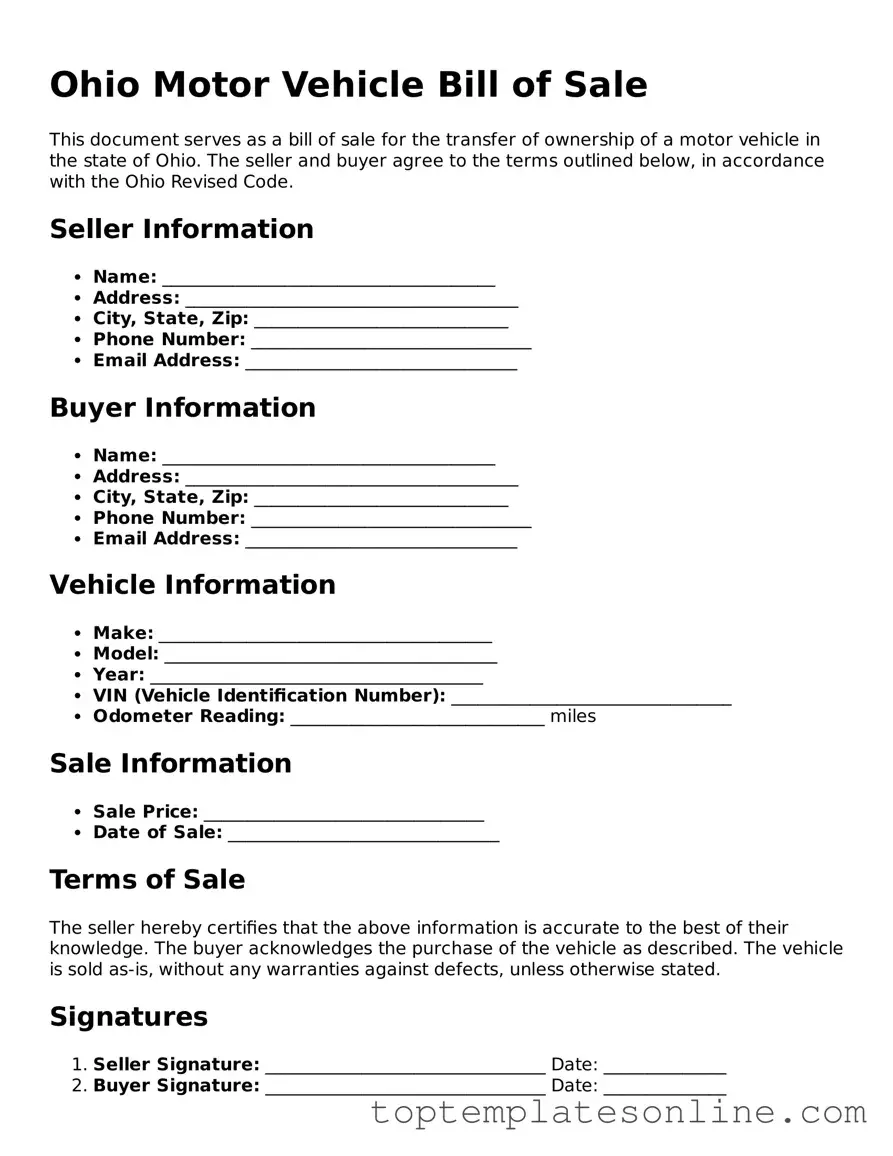

When buying or selling a vehicle in Ohio, a Motor Vehicle Bill of Sale form plays a crucial role in documenting the transaction. This form not only serves as proof of ownership transfer but also outlines essential details about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN). Both the buyer and seller must provide their names and addresses, ensuring that all parties involved are clearly identified. Additionally, the form includes space for the sale price and the date of the transaction, which are vital for record-keeping and potential tax purposes. By completing this document, both parties can protect their interests and avoid future disputes, making it an indispensable part of any vehicle sale in Ohio.

Some Other State-specific Motor Vehicle Bill of Sale Templates

Txdmv - Good for keeping a record of all vehicle sales transactions.

Nj Bill of Sale for Car - Provides a straightforward process for documenting vehicle transfers.

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. This crucial record helps employees understand their compensation, taxes withheld, and other pertinent financial information. For those looking for templates to streamline this process, resources like Fast PDF Templates can be invaluable. Familiarity with this form can empower workers to manage their finances more effectively.

Bill of Sale Nc Dmv - The form can help in tracking vehicle history for insurance purposes.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. Buyers and sellers must fill out the names, addresses, and signatures accurately. Leaving out even one piece of information can lead to confusion and potential disputes later on.

-

Incorrect Vehicle Identification Number (VIN): The VIN is crucial for identifying the vehicle. Errors in this number can result in legal complications. Double-checking the VIN against the vehicle title and registration is essential to ensure accuracy.

-

Not Including the Sale Price: Some individuals forget to state the sale price of the vehicle. This figure is important for both parties and may have implications for taxes and future transactions. Always include the agreed-upon amount clearly on the form.

-

Neglecting to Sign the Document: A bill of sale without signatures is not valid. Both the buyer and seller must sign the form to confirm the transaction. This step is often overlooked, leading to a lack of legal standing for the sale.

Guide to Writing Ohio Motor Vehicle Bill of Sale

After completing the Ohio Motor Vehicle Bill of Sale form, you will have a record of the transaction between the buyer and seller. This document serves as proof of the sale and can be important for registration and title transfer. Follow these steps to ensure you fill out the form correctly.

- Begin by entering the date of the sale in the designated space.

- Provide the seller's name and address. Ensure that the information is accurate and clearly written.

- Next, fill in the buyer's name and address. Double-check for any spelling errors.

- Write down the vehicle's details, including the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the odometer reading at the time of sale. This should reflect the actual mileage of the vehicle.

- Specify the purchase price of the vehicle. Be clear about the amount being exchanged.

- Both the seller and buyer should sign and date the form. Signatures confirm that both parties agree to the sale.

- Make a copy of the completed form for your records before handing it over to the buyer or seller.

Documents used along the form

When buying or selling a vehicle in Ohio, several documents may accompany the Motor Vehicle Bill of Sale form. These documents help ensure a smooth transaction and provide necessary information for both parties involved. Below is a list of commonly used forms and documents.

- Title Transfer Form: This document officially transfers ownership of the vehicle from the seller to the buyer. It must be signed by both parties and submitted to the Ohio Bureau of Motor Vehicles (BMV).

- Odometer Disclosure Statement: Required for vehicles less than ten years old, this form verifies the vehicle's mileage at the time of sale. It helps prevent fraud related to odometer tampering.

- Application for Certificate of Title: Buyers must complete this form to apply for a new title in their name. It includes details about the vehicle and the new owner.

- Last Will and Testament Form: To make sure your final wishes are honored, consider this essential Last Will and Testament document that provides clarity in asset distribution.

- Vehicle History Report: Although not mandatory, this report provides information about the vehicle's past, including accidents and title issues. It can help buyers make informed decisions.

- Sales Tax Form: This form is used to report the sale for tax purposes. The buyer may need to pay sales tax based on the purchase price of the vehicle.

- Affidavit of Vehicle Ownership: If the seller cannot provide a title, this affidavit can serve as a declaration of ownership. It may require notarization.

- Insurance Verification: Buyers often need to show proof of insurance before registering the vehicle. This document confirms that the buyer has an active insurance policy.

Having these documents ready can streamline the process of buying or selling a vehicle in Ohio. Ensure that all forms are completed accurately to avoid potential issues with registration or ownership transfer.