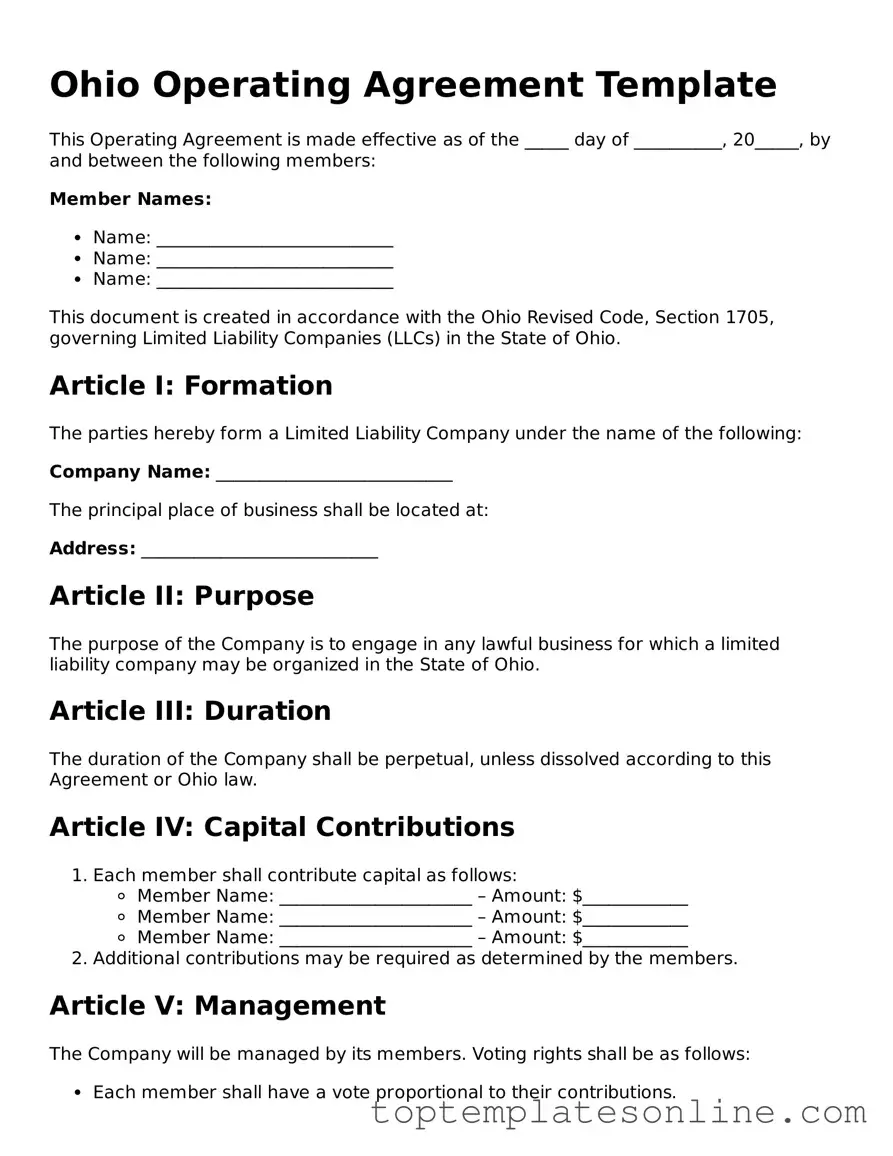

Blank Operating Agreement Template for Ohio State

The Ohio Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal structure and management of the LLC, detailing the roles and responsibilities of its members. It typically includes provisions regarding profit distribution, decision-making processes, and the procedures for adding or removing members. By establishing clear guidelines, the Operating Agreement helps to prevent disputes among members and ensures that the company operates smoothly. Additionally, it may address issues such as capital contributions and the process for amending the agreement in the future. Having a well-drafted Operating Agreement is not only a best practice but also a vital step in protecting the interests of all members involved.

Some Other State-specific Operating Agreement Templates

How to Make an Operating Agreement - It includes provisions for adding new members to the business.

For those seeking to complete a Recommendation Letter form, it is important to understand that this document serves as a crucial endorsement of an individual's qualifications, skills, and character. Often used in the context of job applications or academic admissions, it highlights the strengths of the candidate from the viewpoint of someone who has a deep understanding of their capabilities. To streamline this process, the form is available here, ensuring that all necessary information can be gathered efficiently.

Nys Llc - An Operating Agreement outlines the management structure of a limited liability company (LLC).

Common mistakes

-

Incomplete Information: Individuals often leave sections blank or fail to provide necessary details about the members of the LLC. This can lead to confusion and potential legal issues down the line.

-

Incorrect Member Designation: Some people mistakenly classify members as managers or vice versa. Understanding the roles within the LLC is crucial for proper governance.

-

Failure to Specify Profit Distribution: Not clearly outlining how profits and losses will be shared among members can result in disputes later. Clear terms should be established to avoid misunderstandings.

-

Omitting Voting Rights: Many overlook detailing the voting rights of members. This is essential for decision-making processes and can affect the operation of the LLC.

-

Not Including an Amendment Clause: A common mistake is to forget to add a clause that allows for future amendments to the agreement. Flexibility is important as business needs evolve.

-

Neglecting State-Specific Requirements: Each state has unique regulations. Failing to comply with Ohio's specific requirements can lead to complications or invalidation of the agreement.

Guide to Writing Ohio Operating Agreement

Once you have the Ohio Operating Agreement form, you can begin the process of completing it. This document is essential for outlining the management structure and operational procedures of your business. Follow the steps below to fill it out correctly.

- Start with the title of the agreement at the top of the form. Clearly label it as "Operating Agreement."

- Enter the name of your business. This should be the official name registered with the state of Ohio.

- Provide the principal office address of your business. This should be a physical address, not a P.O. Box.

- List the members of the business. Include their full names and addresses.

- Specify the ownership percentages for each member. Clearly indicate how much of the business each member owns.

- Outline the management structure. Decide if the business will be member-managed or manager-managed and indicate this on the form.

- Detail the voting rights of each member. Clearly state how decisions will be made within the business.

- Include provisions for profit and loss distribution. Specify how profits and losses will be allocated among members.

- Address the process for adding new members. Include any requirements or procedures that must be followed.

- Sign and date the agreement. All members should sign the document to indicate their agreement to the terms outlined.

After completing the form, review it for accuracy. Ensure all members have copies for their records. Consider consulting a professional for any specific concerns or questions regarding the agreement.

Documents used along the form

When forming a Limited Liability Company (LLC) in Ohio, several documents may accompany the Ohio Operating Agreement. Each of these documents serves a specific purpose in the establishment and operation of the business. Below is a list of common forms and documents often used alongside the Operating Agreement.

- Articles of Organization: This document is filed with the Ohio Secretary of State to officially create the LLC. It includes basic information such as the company name, address, and the names of the members.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes. This application can be submitted to the IRS to obtain a unique identification number for the business.

- Member Resolution: This document outlines decisions made by the members of the LLC, such as the appointment of managers or approval of major business transactions.

- Bylaws: While not required for LLCs, bylaws can provide additional governance rules, including procedures for meetings and member responsibilities.

- Vehicle Purchase Agreement: This form is crucial when buying or selling a vehicle in Texas, ensuring all transaction details are documented. For more information, visit https://texasformspdf.com/.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They can help formalize the ownership structure and rights of each member.

- Operating Procedures: This document details the day-to-day operational procedures of the LLC, including roles and responsibilities of members and managers.

- Financial Statements: Regular financial statements, such as balance sheets and income statements, are important for tracking the financial health of the LLC and ensuring transparency among members.

These documents collectively support the formation and ongoing management of an LLC in Ohio. Properly preparing and maintaining these forms can help ensure compliance with state regulations and facilitate smooth operations within the business.