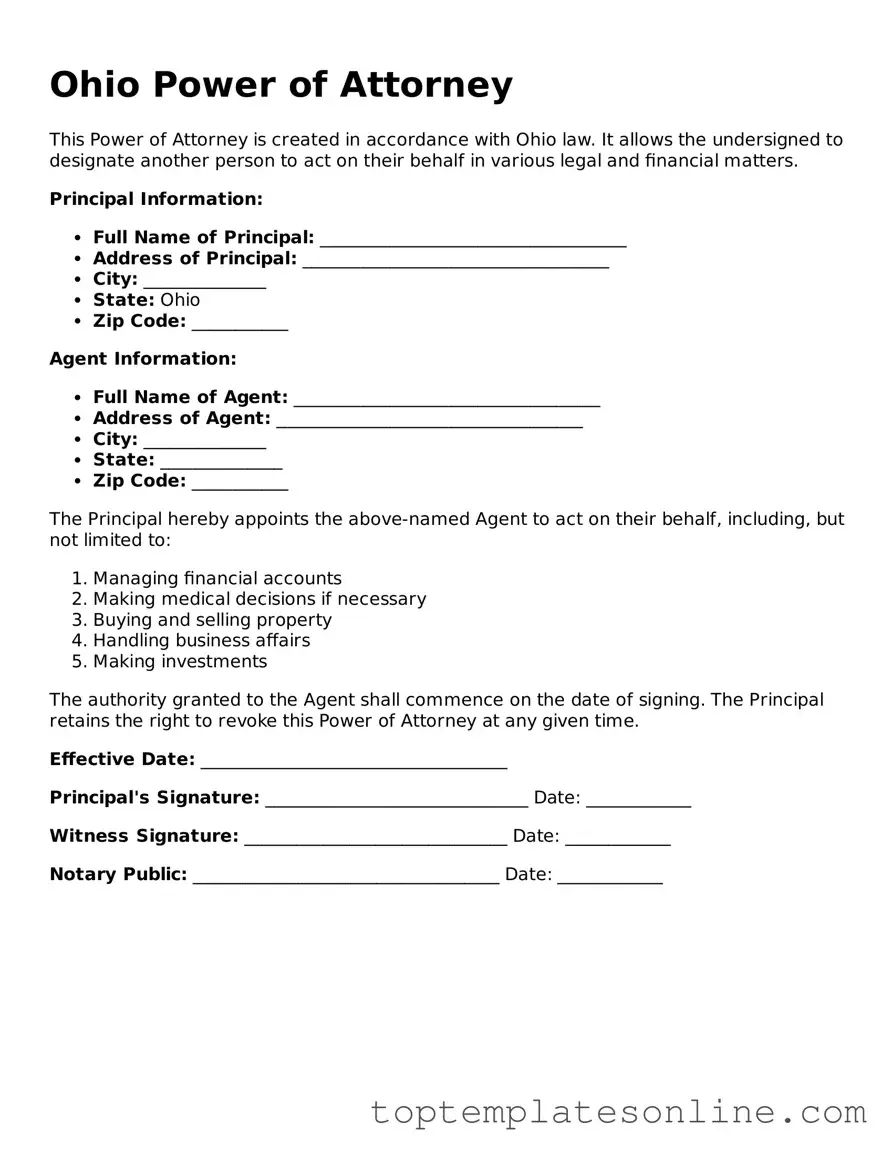

Blank Power of Attorney Template for Ohio State

The Ohio Power of Attorney form is a crucial legal document that allows individuals to appoint someone they trust to make decisions on their behalf, especially in matters related to financial and healthcare issues. This form can be particularly beneficial in situations where a person may become incapacitated or unable to manage their affairs. By designating an agent, you ensure that your wishes are honored, whether it involves paying bills, handling investments, or making medical decisions. Ohio offers different types of Power of Attorney forms, including durable and non-durable options, each serving unique purposes based on the needs of the principal. Understanding the nuances of these forms is essential, as they can vary in authority and duration. Additionally, the Ohio Power of Attorney form requires specific signatures and notarization to be legally valid, emphasizing the importance of following the correct procedures. With the right information and guidance, anyone can navigate the process of creating a Power of Attorney that aligns with their personal and financial goals.

Some Other State-specific Power of Attorney Templates

Ga Power of Attorney - Beneficiaries should be aware of who holds Power of Attorney to avoid confusion later.

When dealing with the purchase or sale of an all-terrain vehicle, it's essential to have the correct documentation in place, such as the New York ATV Bill of Sale. This form not only captures important information about the transaction but also ensures protection for both buyer and seller. For those looking for a reliable template to facilitate this process, you can check out NY Templates, which offers easy-to-use solutions.

How to Get Power of Attorney in North Carolina - Acts as a safeguard for managing assets during unforeseen circumstances.

Common mistakes

-

Not Specifying Powers Clearly: Individuals often fail to clearly outline the specific powers they wish to grant. A vague description can lead to confusion and misinterpretation. It is essential to be explicit about what decisions your agent can make on your behalf.

-

Forgetting to Sign and Date: One common mistake is neglecting to sign and date the form. Without your signature, the document is not legally binding. Always ensure that you complete this crucial step to validate your Power of Attorney.

-

Not Having Witnesses or Notarization: Some people overlook the requirement for witnesses or notarization. In Ohio, certain types of Power of Attorney must be signed in front of a notary public or witnesses to be enforceable. Failing to do so can render the document invalid.

-

Choosing the Wrong Agent: Selecting an agent without careful consideration is a frequent error. It is vital to choose someone trustworthy and capable of handling your affairs. Think about their ability to make decisions in your best interest.

Guide to Writing Ohio Power of Attorney

Filling out the Ohio Power of Attorney form is an important task that requires careful attention to detail. Once you have the form ready, follow these steps to ensure it is completed accurately.

- Obtain the Ohio Power of Attorney form. You can find it online or request a copy from a legal office.

- Begin by entering the name and address of the person who will be granting the authority (the principal).

- Next, fill in the name and address of the person who will be receiving the authority (the agent or attorney-in-fact).

- Specify the powers you wish to grant to the agent. This may include financial decisions, property management, or health care decisions.

- Clearly indicate any limitations or specific instructions regarding the powers granted.

- Sign and date the form in the designated area. Ensure that your signature matches the name on the form.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Provide copies of the completed form to your agent and any relevant institutions or individuals.

After completing these steps, the Power of Attorney form is ready for use. Make sure to keep the original in a safe place and share copies with those who may need it.

Documents used along the form

In addition to the Ohio Power of Attorney form, several other documents are commonly used to complement or enhance the authority granted to an agent. These documents can help clarify intentions, provide additional legal authority, or address specific needs. Below are four forms that are often associated with the Power of Attorney in Ohio.

- Living Will: This document outlines an individual's wishes regarding medical treatment in the event they become incapacitated. It specifies the types of medical interventions one does or does not want, providing guidance to healthcare providers and loved ones.

- Motor Vehicle Bill of Sale: For those involved in vehicle transactions, the necessary Motor Vehicle Bill of Sale documentation is crucial for a smooth ownership transfer.

- Healthcare Power of Attorney: Similar to the general Power of Attorney, this form specifically designates an agent to make healthcare decisions on behalf of an individual if they are unable to do so. This document focuses solely on medical matters.

- Durable Power of Attorney: This version of the Power of Attorney remains effective even if the individual becomes incapacitated. It is essential for ensuring that the designated agent can continue to act on behalf of the individual during periods of diminished capacity.

- Financial Power of Attorney: This document grants an agent the authority to manage financial matters, such as paying bills, managing investments, and handling property transactions. It can be tailored to specific financial tasks or be broad in scope.

These documents serve important roles in ensuring that an individual's wishes are respected and that their affairs are managed effectively, particularly during times of incapacity or crisis. It is advisable to consider these forms in conjunction with a Power of Attorney to create a comprehensive plan for managing personal and financial matters.