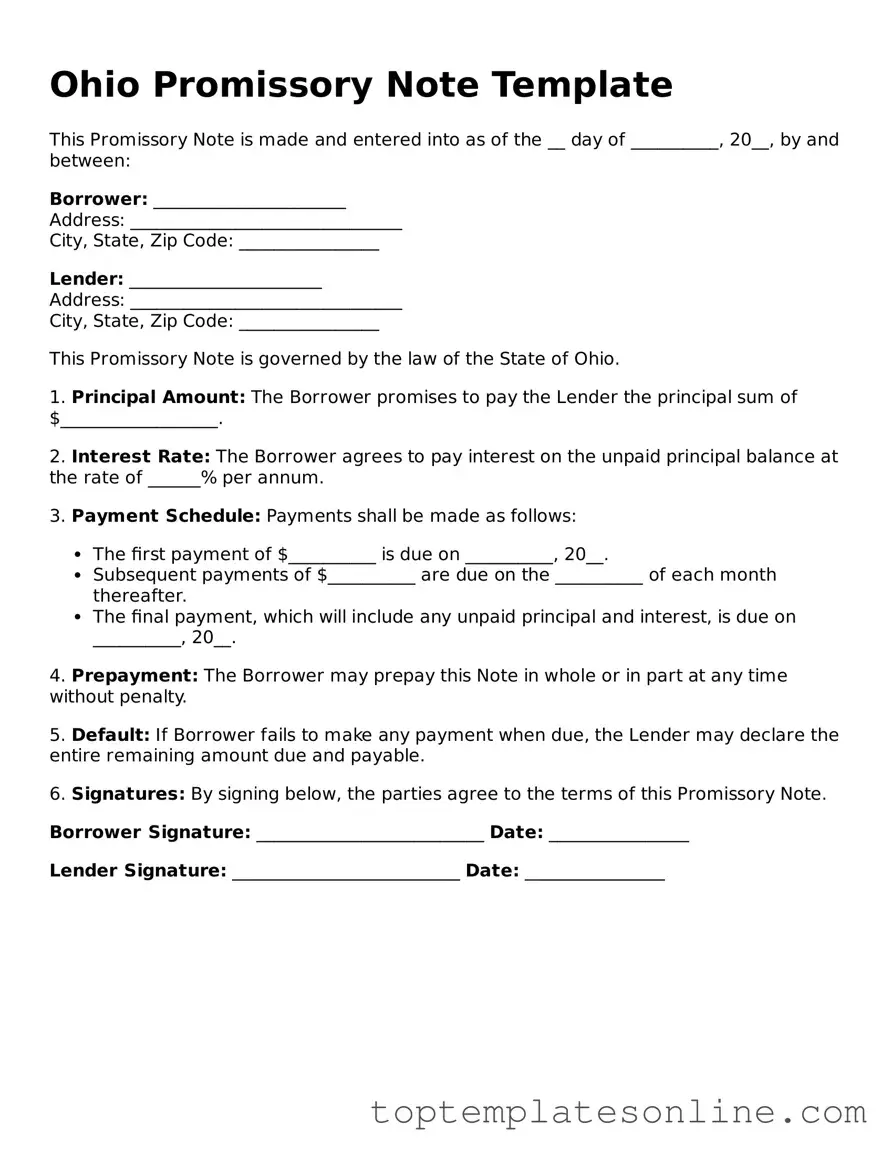

Blank Promissory Note Template for Ohio State

In the realm of financial transactions, the Ohio Promissory Note form plays a crucial role in facilitating agreements between lenders and borrowers. This legally binding document outlines the terms under which one party agrees to repay a specified amount of money to another, typically accompanied by interest. Essential components of the form include the principal amount, interest rate, repayment schedule, and the consequences of default. Additionally, it may specify whether the note is secured or unsecured, providing clarity on the collateral involved, if any. Understanding the nuances of this form is vital for both parties, as it not only protects the lender's interests but also ensures that the borrower is fully aware of their obligations. The Ohio Promissory Note serves as a safeguard, ensuring transparency and accountability in financial dealings. As such, it is imperative for individuals engaging in such agreements to familiarize themselves with the details and implications of this important legal instrument.

Some Other State-specific Promissory Note Templates

Nc Promissory Note - Ensures there is a record of the transaction for both parties involved.

Loan Agreement Template Texas - A promissory note may include a prepayment clause for early loan repayment conditions.

In addition to understanding the importance of the New York Notice to Quit form, landlords can also benefit from accessing helpful resources and templates. For instance, you can find a comprehensive template for this form at https://newyorkform.com/free-notice-to-quit-template, which ensures that the necessary legal requirements are met and that the process is handled correctly.

Loan Promissory Note - A promissory note is a written promise to pay a specific amount at a future date.

Common mistakes

-

Incorrect Date: One common mistake is failing to write the correct date on the form. The date is crucial as it marks the beginning of the loan agreement. Ensure that you enter the date clearly and accurately.

-

Missing Signatures: Both the borrower and lender must sign the promissory note. Omitting a signature can render the document invalid. Always double-check that all necessary parties have signed.

-

Ambiguous Loan Amount: Clearly state the loan amount in both numeric and written form. Ambiguity can lead to disputes later on. For instance, write "One Thousand Dollars" as well as "1,000" to avoid confusion.

-

Inadequate Payment Terms: Clearly outline the payment schedule, including the frequency of payments and the due date. Vague terms can create misunderstandings between the parties involved.

-

Ignoring Interest Rates: If the loan includes interest, specify the rate and how it will be calculated. Failing to do so can lead to unexpected costs for the borrower.

-

Neglecting to Include Collateral: If the loan is secured by collateral, it should be described in detail. Not including this information may weaken the lender's position in case of default.

-

Not Keeping Copies: After filling out the form, both parties should retain copies of the signed document. This is vital for record-keeping and can help resolve disputes if they arise.

-

Failing to Review the Document: Rushing through the form can lead to errors. Take the time to review the entire document before signing. This ensures that all information is accurate and complete.

Guide to Writing Ohio Promissory Note

Once you have the Ohio Promissory Note form in hand, it's time to fill it out carefully. Each section requires specific information to ensure clarity and legality. Follow these steps to complete the form accurately.

- Title the Document: At the top of the form, write "Promissory Note" to clearly indicate the nature of the document.

- Identify the Borrower: Enter the full name and address of the borrower. This is the person or entity receiving the loan.

- Identify the Lender: Next, provide the full name and address of the lender. This is the individual or organization providing the loan.

- Loan Amount: Specify the total amount of money being borrowed. Be clear and precise with the figures.

- Interest Rate: Indicate the interest rate applicable to the loan. Make sure to specify whether it is a fixed or variable rate.

- Payment Terms: Describe how and when the borrower will repay the loan. Include details about the payment schedule and any grace periods.

- Maturity Date: State the date when the loan will be fully repaid. This is crucial for both parties to understand.

- Signatures: Finally, both the borrower and lender should sign and date the document. This signifies agreement to the terms outlined in the note.

After completing the form, review all entries for accuracy. Ensure that all necessary signatures are present. Once finalized, keep a copy for your records and provide one to the other party. This ensures that both sides have a clear understanding of the agreement.

Documents used along the form

When working with an Ohio Promissory Note, several other forms and documents may be necessary to ensure clarity and legal compliance. Each document serves a specific purpose in the lending process. Below are six commonly used documents that often accompany a Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It provides a comprehensive overview of the obligations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged as security. It protects the lender's interests in case of default.

- Operating Agreement: The Florida Operating Agreement form is essential for LLCs, as it defines the management structure and responsibilities, helping to prevent misunderstandings. For more details, visit Florida Forms.

- Disclosure Statement: This document informs the borrower about the total cost of the loan, including interest and fees. It ensures transparency and helps the borrower understand their financial commitment.

- Payment Schedule: A detailed breakdown of when payments are due, the amount of each payment, and how they will be applied. This helps borrowers plan their finances accordingly.

- Default Notice: In the event of a missed payment, this document serves as a formal notice to the borrower. It outlines the consequences of default and the steps the lender may take to recover the owed amount.

- Amendment Agreement: If any terms of the original Promissory Note need to be changed, this document outlines those modifications. It requires the agreement of both parties and ensures that any changes are legally binding.

Understanding these documents is crucial for both lenders and borrowers. They provide a framework that helps manage expectations and responsibilities throughout the lending process.