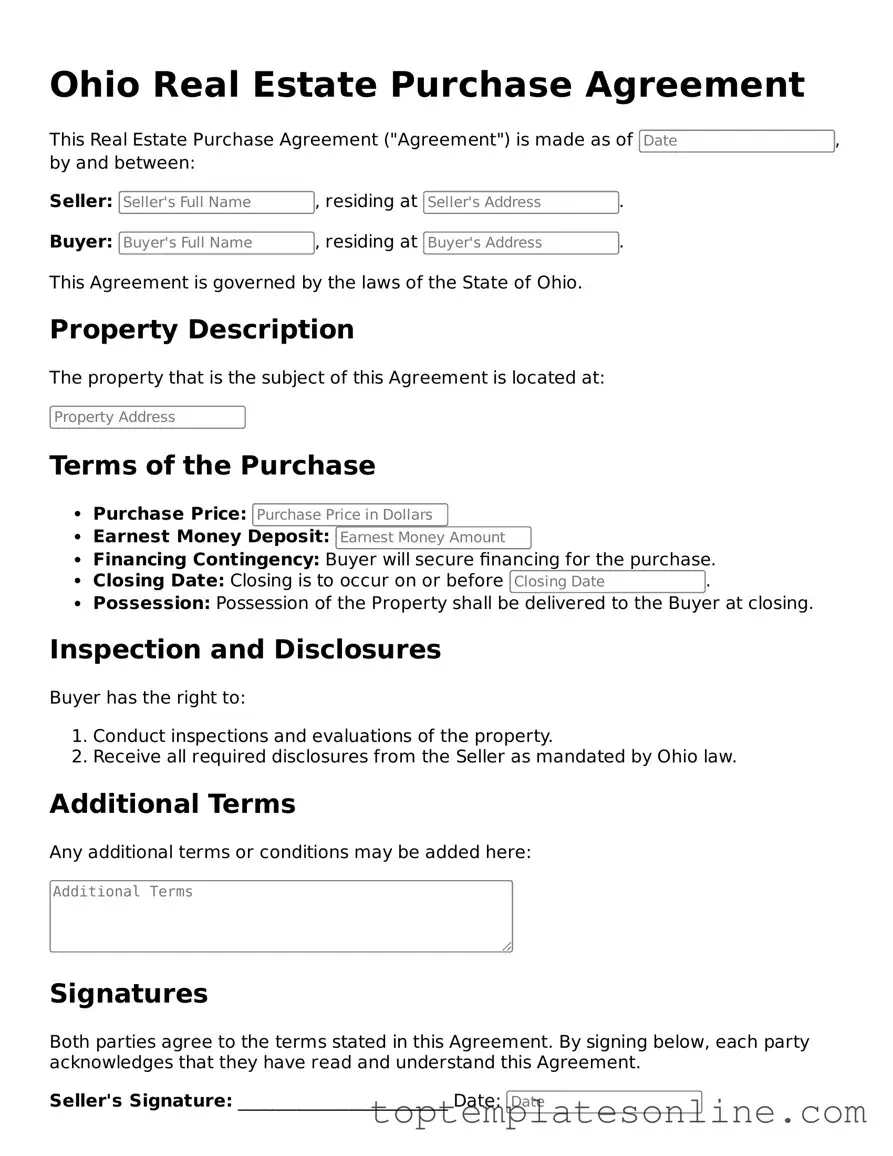

Blank Real Estate Purchase Agreement Template for Ohio State

The Ohio Real Estate Purchase Agreement form serves as a crucial document in the home buying process, outlining the terms and conditions under which a property will be sold. This form typically includes essential details such as the purchase price, the closing date, and the responsibilities of both the buyer and the seller. It also addresses important contingencies, like financing and inspections, which protect the interests of both parties. Additionally, the agreement specifies what is included in the sale, such as appliances or fixtures, and outlines the procedures for resolving disputes. By clearly defining each party's obligations, the Ohio Real Estate Purchase Agreement helps ensure a smooth transaction and provides a framework for a successful real estate deal.

Some Other State-specific Real Estate Purchase Agreement Templates

Purchasing Agreements - The agreement can indicate if the property is part of a homeowners association.

Completing the New York Articles of Incorporation form is essential for anyone looking to start a corporation in New York; for those seeking guidance, a helpful resource can be found at newyorkform.com/free-articles-of-incorporation-template/, which provides a free template to streamline the process.

Michigan Real Estate Forms - Outlines how property taxes and utilities are handled before sale completion.

How to Get a Purchase Agreement - A document outlining the terms of buying a property.

Common mistakes

-

Incomplete Information: Buyers and sellers often forget to fill out all required fields. Missing details can lead to confusion or delays in the transaction.

-

Incorrect Property Description: Accurately describing the property is crucial. Errors in the address or legal description can create legal issues down the line.

-

Failure to Specify Contingencies: Not including contingencies, such as financing or inspection, can put buyers at risk. These clauses protect both parties and clarify conditions for the sale.

-

Ignoring Deadlines: Missing important dates, like the closing date or inspection period, can derail the entire transaction. It is essential to keep track of these timelines.

-

Omitting Signatures: All necessary parties must sign the agreement. An unsigned document is not legally binding and can lead to disputes.

-

Not Reviewing Terms Thoroughly: Buyers and sellers should read the entire agreement carefully. Overlooking specific terms can result in unexpected obligations or costs.

-

Neglecting to Include Earnest Money: Failing to specify the earnest money amount can create uncertainty. This deposit shows the buyer's commitment and is often required.

-

Misunderstanding the Closing Costs: Parties may not fully grasp who is responsible for which closing costs. Clear communication about these expenses is vital to avoid surprises at closing.

Guide to Writing Ohio Real Estate Purchase Agreement

Once you have the Ohio Real Estate Purchase Agreement form in hand, it's time to fill it out carefully. This document serves as a binding contract between the buyer and seller, outlining the terms of the property sale. Accuracy is crucial, as any errors can lead to misunderstandings or legal complications down the line.

- Review the Instructions: Before filling out the form, read any accompanying instructions to ensure you understand the requirements.

- Enter the Date: Start by writing the date on which the agreement is being executed.

- Identify the Parties: Clearly state the full names and addresses of both the buyer(s) and seller(s). Make sure to include any necessary contact information.

- Describe the Property: Provide a detailed description of the property being sold, including the address, parcel number, and any relevant legal descriptions.

- Set the Purchase Price: Clearly state the total purchase price for the property. Be specific about any deposits or down payments.

- Outline Contingencies: If applicable, list any contingencies that must be met for the sale to proceed, such as financing or inspection requirements.

- Specify Closing Details: Indicate the proposed closing date and any specific terms related to the closing process.

- Include Signatures: Ensure that both parties sign and date the agreement. If there are multiple buyers or sellers, all must sign.

- Review the Completed Form: Go through the entire form to check for accuracy and completeness before submitting it.

After filling out the form, both parties should keep a copy for their records. This document will guide the transaction process and help ensure that both parties are clear on the terms agreed upon.

Documents used along the form

When engaging in a real estate transaction in Ohio, several documents often accompany the Real Estate Purchase Agreement. These forms help clarify the terms of the sale and protect the interests of all parties involved. Below is a list of commonly used documents.

- Disclosure Statement: This document provides important information about the property's condition, including any known defects or issues. Sellers are typically required to disclose material facts that could affect the buyer's decision.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about potential lead-based paint hazards. It is a federal requirement to ensure safety and awareness.

- Property Inspection Report: This report details the findings from a professional inspection of the property. It can highlight necessary repairs or maintenance issues that may need to be addressed before the sale is finalized.

- Title Report: A title report outlines the legal ownership of the property and identifies any liens or encumbrances. This document is essential for confirming that the seller has the right to sell the property.

- Residential Lease Agreement: This document is essential for anyone renting property in Florida, as it outlines the terms between landlord and tenant, ensuring clarity regarding responsibilities and payment schedules. For more details, you can refer to Florida Forms.

- Closing Statement: Also known as a HUD-1, this document itemizes all closing costs associated with the transaction. It provides a clear breakdown of fees for both the buyer and seller.

- Purchase Agreement Addendum: This is an additional document that modifies or adds to the terms of the original purchase agreement. It can cover specific contingencies or agreements between the parties.

- Escrow Agreement: This document outlines the terms under which funds will be held in escrow until the sale is complete. It ensures that both parties fulfill their obligations before the funds are released.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and asserts that there are no undisclosed liens or claims against it. It provides additional assurance to the buyer.

These documents play a vital role in the real estate transaction process. Understanding each one can help ensure a smoother experience for both buyers and sellers.